Aerospace and defense company Cadre (NYSE:CDRE) reported results for the second quarter of calendar year 2024 that beat Wall Street analysts’ expectations. Revenue rose 19.2% year over year to $144.3 million. The company’s full-year revenue forecast of $576.5 million was also 1.2% above analyst estimates. The company posted GAAP earnings of $0.31 per share, improving from earnings of $0.29 per share in the same quarter last year.

Is now the right time to buy Cadre? Find out in our full research report.

Highlights of Cadre (CDRE) Q2 CY2024:

-

Revenue: $144.3 million versus analyst estimates of $142.1 million (up 1.6%)

-

EPS: $0.31 versus analyst estimates of $0.27 (15.4%)

-

EBITDA forecast for the full year is on average 106 million US dollars, below analyst estimates of 106.6 million US dollars

-

Gross margin (GAAP): 40.6%, compared to 41.9% in the same quarter last year

-

EBITDA margin: 19.6%, corresponding to the same quarter last year

-

Free cash flow of $9.12 million, an increase from $794,000 in the previous quarter

-

Market capitalization: 1.39 billion US dollars

“Cadre delivered strong results in the second quarter driven by outstanding execution in line with our strategic objectives as well as significant demand for our mission-critical safety equipment,” said Warren Kanders, CEO and Chairman of the Board.

Cadre (NYSE:CDRE), originally known as Safariland, specializes in the manufacture and distribution of safety and survival equipment for first responders.

Suppliers to law enforcement agencies

Many law enforcement supplier companies require licenses and permits to manufacture products such as firearms. These companies can enter into long-term contracts with law enforcement and correctional agencies, resulting in more predictable revenues. It is still unclear how the recent focus on excessive force and police accountability will affect long-term demand. On the one hand, products that use lethal force may become less popular. On the other hand, products such as body cameras that contribute to transparency in policing may become standard. In general, the fate of the sector will also depend on state or local budgets, and there is a high reputational risk, as one mishap or bad headline can change a company’s fate.

Sales growth

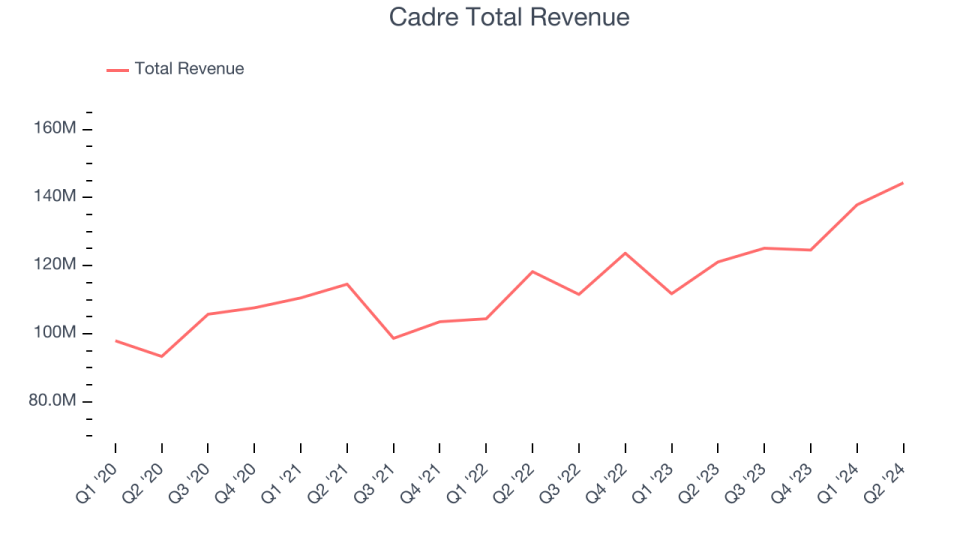

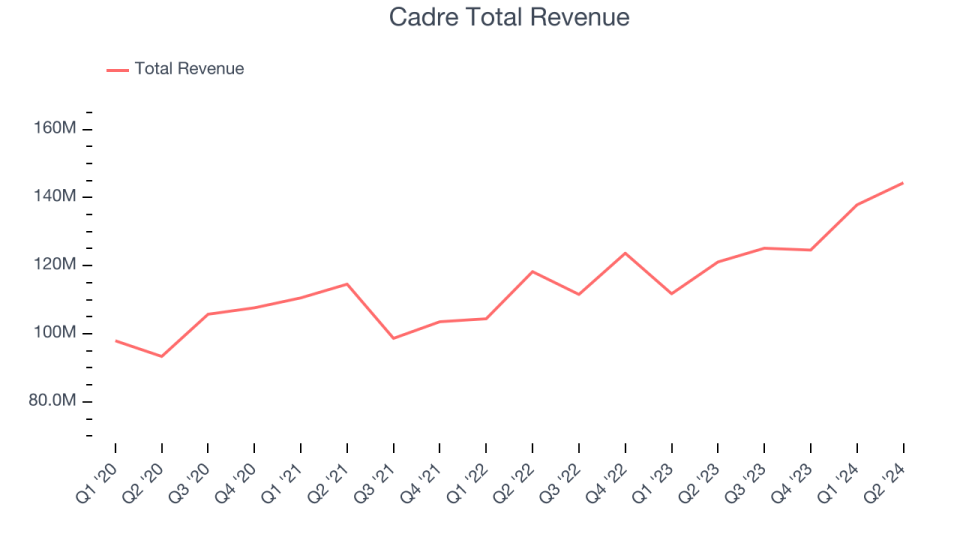

Looking at a company’s long-term performance can provide insight into its business quality. Any company can be successful in the short term, but a top company tends to sustain its growth over the years. Over the past four years, Cadre grew its revenue at a solid compound annual growth rate of 10.2%. This shows that the company was expanding successfully, a good starting point for our analysis.

At StockStory, we place the most emphasis on long-term growth, but with industrials, too broad a historical view can miss cycles, industry trends, or a company benefiting from catalysts like a new contract win or successful product line. Cadre’s 11.9% annualized revenue growth over the past two years is above its four-year trend, suggesting demand has been strong and has accelerated recently.

We can better understand the company’s sales dynamics by analyzing its most important segment, products. Over the past two years, Cadre’s sales of products (body armor, correction tools, sensors) have grown by an average of 14% year-on-year.

This quarter, Cadre reported robust year-over-year revenue growth of 19.2%, beating Wall Street estimates by 1.6% on revenue of $144.3 million. For the next 12 months, Wall Street expects revenue growth of 10.4%, a slowdown from this quarter.

Here at StockStory, we understand the potential of thematic investing. Various winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving growth. With that in mind, we’ve identified a relatively low-profile, profitable growth stock that’s benefiting from the rise of AI, and it’s available to you for FREE via this link.

Operating margin

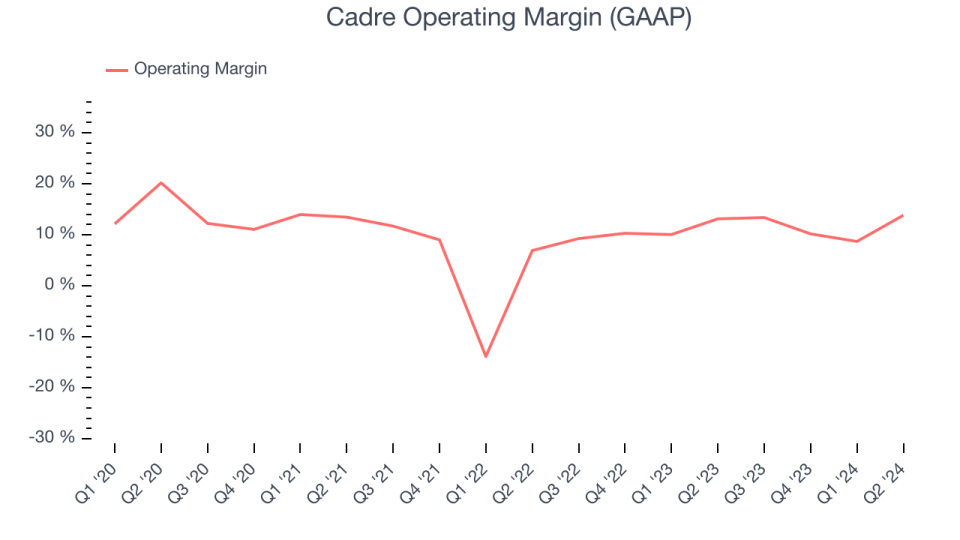

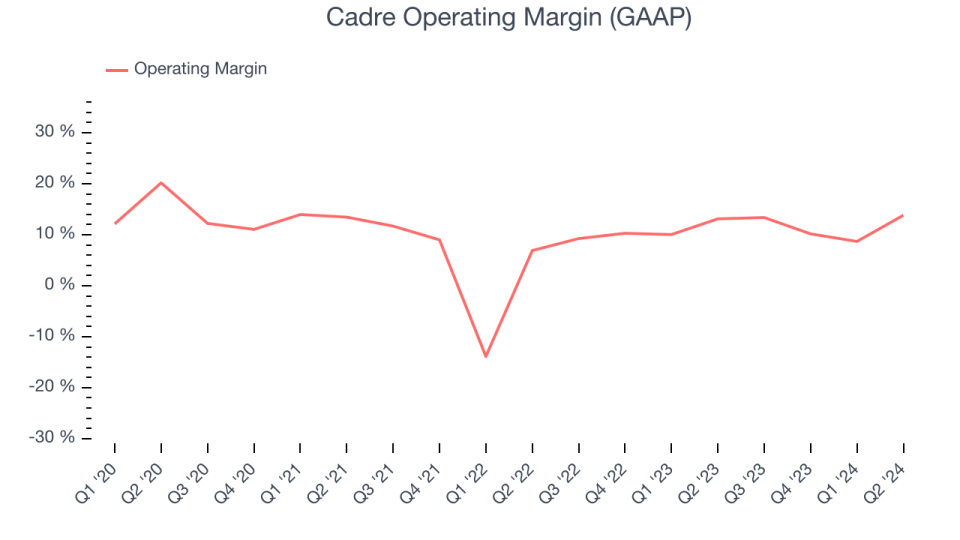

Cadre has managed its expenses well over the past five years and has demonstrated solid profitability for an industrial company, achieving an average operating margin of 10.3%.

Looking at the evolution of profitability, Cadre’s annual operating margin has declined by 4.7 percentage points over the past five years. Even though the margin is still high, shareholders will want Cadre to become more profitable in the future.

During the quarter, Cadre generated an operating profit margin of 13.8%, consistent with the year-ago quarter, indicating that the company’s overall cost structure remained relatively stable.

EPS

We track long-term earnings per share (EPS) growth for the same reason we track long-term revenue growth. However, when compared to revenue, EPS shows whether a company’s growth was profitable.

Unfortunately, Cadre’s earnings per share have declined 4.5% annually over the past four years while revenue has grown 10.2%, meaning that as the company has expanded, it has become less profitable per share.

As with revenue, we also analyze earnings per share over a shorter period of time to see if we’re missing a change in the business. At Cadre, its two-year annual earnings growth of 151% was higher than the four-year trend. This acceleration made it one of the fastest-growing industrial companies in recent history.

In the second quarter, Cadre reported earnings per share of $0.31, compared to $0.29 in the same quarter last year. This figure easily beat analysts’ estimates, and shareholders should be pleased with the results. Over the next 12 months, Wall Street expects Cadre to increase its earnings. Analysts forecast earnings per share to rise 22.6% to $1.26 from $1.03 last year.

Key takeaways from Cadre’s Q2 results

We were impressed by how significantly Cadre beat analysts’ revenue expectations this quarter, driven by the outperformance of its product segment. We were also excited to see its earnings per share beat Wall Street estimates. Overall, we believe this was a good quarter with some important upside. The stock rose 2.2% to $34.60 immediately after the reports were released.

Cadre may have had a good quarter, but does that mean you should invest now? When making this decision, it’s important to consider valuation, business qualities, as well as what happened last quarter. We cover that in our actionable full research report, which you can read for free here.