OTRS AG (FRA:TR9) Shareholders who had been waiting for something were treated to a 25% drop in the share price over the past month. The drop in the share price over the last 30 days capped off a tough year for shareholders, with the share price falling 41% during that time.

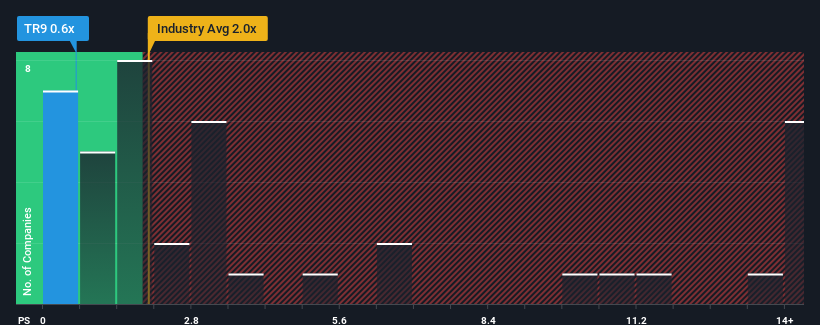

After such a sharp price drop, OTRS’s price-to-sales (or “P/S”) ratio of 0.6 may currently be sending buy signals, considering that almost half of all companies in the software industry in Germany have a P/S ratio of over 2x, and even P/S ratios of over 10x are not uncommon. However, it is not advisable to simply take the P/S at face value, as there may be an explanation as to why it is capped.

Check out our latest analysis for OTRS

What does OTRS’s P/S mean for shareholders?

While the industry has seen revenue growth recently, OTRS’s revenue has gone into reverse, which is not good. The P/S ratio is likely low because investors believe this poor revenue performance will not improve. If it does, existing shareholders are unlikely to be enthusiastic about the stock price’s future trajectory.

Would you like to know how analysts assess the future of OTRS compared to the industry? Then our free Report is a good starting point.

Is sales growth forecast for OTRS?

A P/S ratio as low as OTRS’s would only be truly comfortable if the company’s growth lagged behind that of the industry.

First, if we look back, the company’s revenue growth last year was not exactly exciting as it posted a disappointing 2.9% decline. This marred the good performance the company had been showing over the long term as the three-year revenue growth is still a respectable 12%. Although it has been a bumpy ride, it is still fair to say that the company’s revenue growth has been mostly respectable recently.

As for the outlook, growth of 4.4% per year is expected over the next three years, according to the only analyst covering the company. With the industry forecast to grow at 12% per year, the company will have to expect a weaker top-line result.

With that in mind, it’s clear why OTRS’s P/S lags behind its industry peers. Apparently, many shareholders were uncomfortable holding onto the company despite its potentially less successful future.

What can we learn from the P/S of OTRS?

The southward price movements of OTRS shares mean that the price-to-sales ratio is currently at a fairly low level. While the price-to-sales ratio should not be the deciding factor in whether or not you buy a stock, it is a fairly useful indicator of sales expectations.

As we suspected, our study of OTRS’s analyst forecasts found that the weaker revenue outlook is contributing to the low P/S ratio. For now, shareholders are accepting the low P/S ratio because they acknowledge that future revenue is unlikely to hold any pleasant surprises. Under these circumstances, it is difficult to imagine the share price rising much in the near future.

Before you form an opinion, we found out 2 warning signals for OTRS that you should know.

If this Risks make you rethink your opinion on OTRSexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.