Sometimes the macro picture doesn’t tell the whole story. When it comes to furniture stocks, the very high-end names like RH (RH) don’t seem to be doing nearly as well as the slightly more upscale Williams-Sonoma (WSM). The latter retailer has clearly made great strides toward the upscale market in recent quarters. While it hasn’t come close to capturing the incredibly affluent home and furniture market (that’s RH’s turf), it doesn’t need to to keep driving its share price higher.

In fact, Williams-Sonoma shows us that you can get solid results by buying stocks, even when macroeconomic headwinds are weighing heavily on the industry. Over the past year, WSM stock has risen more than 103%, while RH stock has fallen about 35%. That’s a stark difference in performance that could cause investors in the former name to switch to the latter.

With recession risks back on investors’ radar following the last two jobs reports (the first sparked a sell-off, the second a rebound), the battle for consumers’ money could get even more fierce. So let’s check out TipRanks’ comparison tool to rank the top two home furnishings stocks and see where analysts stand.

The luxury furniture market has been rough in recent years, with RH down 10% over the past two years. Currently, RH stock is about 67% below its 2021 all-time high as it navigates what management recently called “the most difficult real estate market in three decades.” In any case, RH has a plan to orchestrate a comeback despite headwinds, and with CEO Gary Friedman recently buying shares on weakness, I’m inclined to be bullish on the stock as well.

There’s no doubt that weakness in the housing market is partly to blame for RH’s sales woes. But that doesn’t explain why Williams-Sonoma is coming off one of its best annual runs. Perhaps being at the most expensive end of an already expensive consumer goods category isn’t the right thing to do right now, not while consumers are still in value-maximization mode on virtually everything after the last few years of inflation.

The company has now missed its earnings targets for three quarters in a row. The perfect storm of headwinds in the housing market and its aggressive investments to expand are one reason why. Such long-term bets on growth could make short-term results look much worse. With the next economic expansion, however, such short-term pain could be worth the long-term gain.

In some ways, RH’s cyclicality takes things to another level. While the RH brand is synonymous with luxury and incredibly high quality, consumers should be absolutely confident in their economic standing to splurge on a trendy, new RH Cloud sofa set, which can easily fetch six figures.

As a retailer of high-end consumer goods, you can’t avoid a bad economy. While it’s difficult to pinpoint when a cyclical increase in demand will boost RH stock again, long-term investors have plenty of reasons to hold while shares remain stagnant.

Zachary Fadem, an analyst at Wells Fargo (WFC), sees RH as still in the “early stages” of a “long-term growth story” that is “among the most exciting in our Hardlines coverage universe.” I couldn’t agree more. It’s also impressive how much brand power the company has, despite being a mid-cap valued at $4.7 billion.

If you want to capitalize on a real return on consumer spending and perhaps the resumption of the Roaring Twenties, RH stock seems like a good option. However, with a P/E ratio of 28.7, the premium furniture retailer’s shares are significantly more expensive than WSM’s.

What is the price target for RH shares?

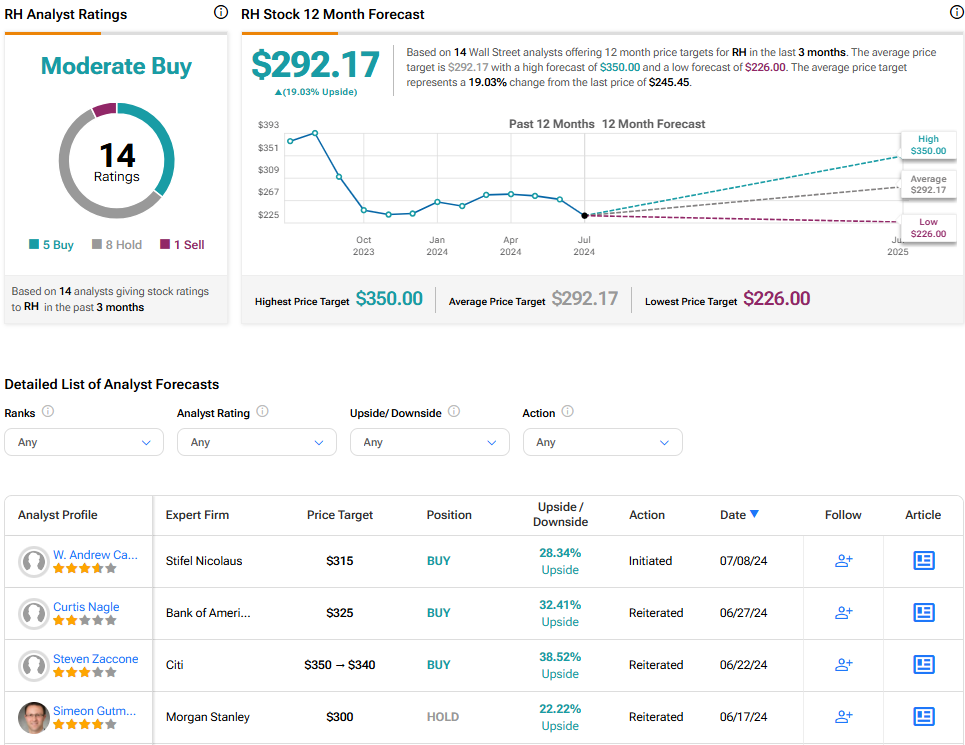

According to analysts, RH stock is a moderate buy, with five buy recommendations, eight hold recommendations, and one sell recommendation in the past three months. RH stock’s average price target of $292.17 implies an upside potential of 19%.

View more RH analyst ratings

Williams Sonoma (WSM)

Williams-Sonoma, the company behind brands like West Elm and Pottery Barn, has navigated this difficult real estate market like a true champ. CEO Laura Alber recently highlighted “easy upgrades” (home improvements that don’t require moving or major renovations) as part of the company’s secret sauce for doing well in today’s mixed consumer climate. With the stock more than doubling in value over the past year, the results really speak for themselves. All in all, I remain bullish on the stock despite the potentially worrisome “quadruple top” technical pattern that may be emerging.

The company has really capitalized on a price-conscious consumer who is still willing to pay a little more for quality. Still, while Pottery Barn furniture isn’t as expensive as some of RH’s newer offerings, it’s not cheap either. And unless the sofa is saggy or falling apart, there’s really no reason to make such an expensive purchase in this environment. With the sluggish housing market weighed down by higher interest rates, there just aren’t that many people looking to “fill” their new, larger homes with home goods and furniture.

With a diverse offering of kitchenware, home accessories, kids’ items and fine seasonal items, Williams Sonoma stands out as more than just a furniture retailer, especially when compared to RH. And as “simple upgrades” continue to be top sellers in this brutal housing climate, Williams-Sonoma will continue to have the upper hand over its biggest competitor.

And when the tide turns and low interest rates pave the way for a housing market recovery, Williams-Sonoma should also do well as more people move from “simple upgrades” to expensive home furnishing purchases. With a P/E ratio of just 17.9, WSM is a far cheaper stock than RH.

What is the price target for WSM shares?

According to analysts, WSM stock is a hold, with four buy recommendations, eleven hold recommendations, and one sell recommendation in the last three months. The average price target of WSM stock of $152.04 implies an upside potential of 9.5%.

View more WSM analyst ratings

The conclusion

Williams-Sonoma is better equipped to handle the difficult housing situation with its diverse line of “Easy Update” products that allow you to update your existing home without breaking the bank. Although RH has the better brand, its inventory (and the goods it sells) are much more expensive.

So unless you’re betting on a sudden rebound in housing, consumers and the economy, WSM seems like a far better bet. The company has performed better, its shares are still cheaper, and it may have less to lose if a recession does indeed happen next year.

notice