Those who hold Litian Pictures Holdings Limited (HKG:9958) shares would be relieved that the share price has risen 56% in the last thirty days, but it needs to continue rising to repair the recent damage it has done to investors’ portfolios. The year-to-date gain is 180% after the recent rise, which has investors sitting up.

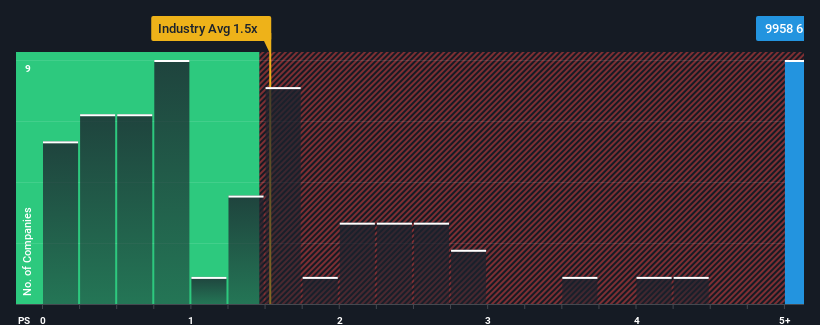

After such a big jump in share price, one might think that Litian Pictures Holdings, with a price-to-sales ratio (or “P/S”) of 6.5x, should be avoided considering that almost half of the companies in Hong Kong’s entertainment industry have a P/S ratio of under 1.5x. However, the P/S might be quite high for a reason and further research is needed to determine if it is justified.

Check out our latest analysis for Litian Pictures Holdings

How Litian Pictures Holdings has developed

With exceptionally strong revenue growth recently, Litian Pictures Holdings has been doing very well. It seems that many expect the strong revenue performance to outperform most other companies in the coming period, which has increased investors’ willingness to pay more for the stock. That’s one thing you really hope, otherwise you’re paying a pretty high price for no particular reason.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Litian Pictures Holdings will help you shed light on the historical performance of this company.

Is sufficient revenue growth forecast for Litian Pictures Holdings?

A P/S ratio as high as Litian Pictures Holdings’ would only be truly comfortable if the company’s growth is on track to significantly outpace the industry.

Looking back, last year saw an explosive increase in sales for the company. However, this was not enough as the company suffered a 75% decline in sales over the last three years overall. So it is fair to say that the recent sales growth has been unwelcome for the company.

In contrast to the Group, the rest of the industry is expected to grow by 21% next year, which puts the company’s recent medium-term sales decline into perspective.

With this in mind, we find it troubling that Litian Pictures Holdings’ P/S exceeds that of its industry peers. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. There’s a very good chance that existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent negative growth rates.

The last word

Litian Pictures Holdings shares have been on a strong upward trend recently, which has really helped the price-to-sales ratio. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

We have noted that Litian Pictures Holdings is currently trading at a significantly higher price-to-earnings ratio than expected, given that recent revenues have been declining over the medium term. Given the revenue declines that investors are worried about, the likelihood of a deterioration in sentiment is quite high, which could bring the price-to-earnings ratio back to the levels we expect. Unless recent medium-term conditions improve significantly, investors will find it difficult to accept the share price as fair value.

You should always think about the risks. A typical example: We have 2 warning signs for Litian Pictures Holdings You should be aware.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.