Daechang Forging Co., Ltd. (KRX:015230) Shareholders might be concerned after the stock price fell 22% last quarter. But that hardly takes away from the truly solid long-term returns the company has generated over five years. In fact, the share price is 104% higher today. For some, the recent decline after such a rapid rise would come as no surprise. Of course, that doesn’t necessarily mean the stock is cheap now.

After last week’s strong gains, it is worth examining whether longer-term returns are due to improving fundamentals.

Check out our latest analysis for Daechang Forging

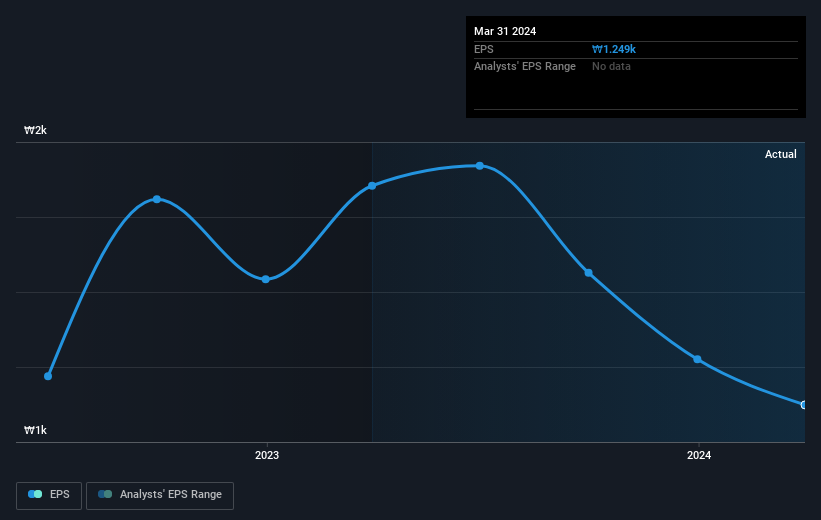

To quote Buffett, “Ships will sail around the world, but the Flat Earth Society will flourish. There will continue to be large discrepancies between price and value in the marketplace…” An imperfect but simple way to examine how the market perception of a company has changed is to compare the change in earnings per share (EPS) to the share price movement.

During the five years of share price growth, Daechang Forging achieved a compounded earnings per share (EPS) growth of 22% per year. This EPS growth is higher than the average annual share price increase of 15%. Therefore, the market seems to have become relatively pessimistic about the company. The relatively low P/E ratio of 4.34 also indicates market fears.

The image below shows how EPS has evolved over time (if you click on the image you can see greater detail).

It might be worth taking a look at our free Daechang Forging earnings, revenue and cash flow report.

What about dividends?

It is important to consider the total return to shareholders as well as the share price return for any given stock. While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It is fair to say that the TSR gives a more comprehensive picture of the return generated by a stock. We note that the TSR for Daechang Forging over the last 5 years was 138%, which is better than the share price return mentioned above. Thus, the dividends paid by the company have in total shareholder return.

A different perspective

While the broader market lost about 0.6% over the twelve months, Daechang Forging shareholders fared even worse, losing 20% (even including dividends). However, it could also simply be that the share price has been affected by general market fluctuations. It might be worth keeping an eye on the fundamentals in case a good opportunity arises. On the positive side, long-term shareholders have made money, with a gain of 19% per year over half a decade. If the fundamentals continue to point to long-term, sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at the share price over the long term as an indicator of company performance. But to really gain insights, we need to consider other information as well. For example, we found that 1 warning sign for Daechang Forging that you should know before investing here.

If you are like me, you will not don’t want to miss this free List of undervalued small caps that are being bought by insiders.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.