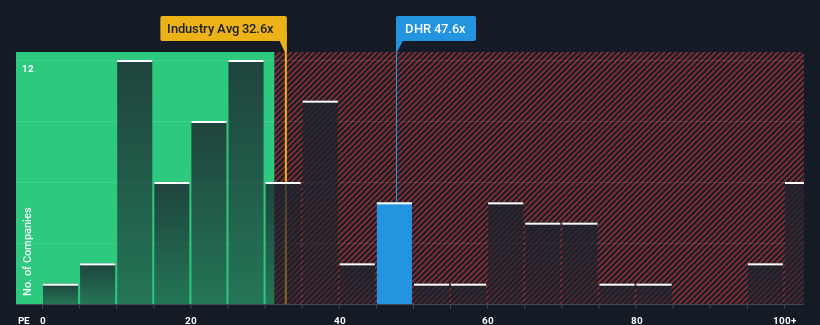

When nearly half of the companies in the United States have a price-to-earnings (P/E) ratio of less than 17x, you may consider Danaher Corporation (NYSE:DHR) is a stock to avoid completely with its P/E ratio of 47.6. However, the P/E ratio might be quite high for a reason and further research is needed to determine if it is justified.

Danaher has seen earnings decline more than the market recently and has been very sluggish as a result. One possibility is that the P/E ratio is high because investors believe the company will completely turn things around and overtake most others in the market. You really should hope so, otherwise you’re paying a pretty high price for no particular reason.

Check out our latest analysis for Danaher

Do you want the full picture of analyst estimates for the company? Then our free The Danaher report will help you find out what’s on the horizon.

Is the growth appropriate for the high P/E ratio?

Danaher’s P/E ratio would be typical of a company expected to have very strong growth and, importantly, significantly outperform the market.

First, if we look back, the company’s earnings per share growth last year was not exactly exciting, as it posted a disappointing 20% decline. As a result, earnings from three years ago also fell by a total of 25%. Accordingly, shareholders were sobered about medium-term earnings growth rates.

As for the outlook, the next three years are expected to bring growth of 17% per year, according to analysts who cover the company. This is likely to be significantly higher than the 11% growth per year forecast for the overall market.

With this in mind, it is understandable that Danaher’s P/E ratio is higher than most other companies. It seems that most investors expect this strong future growth and are willing to pay more for the stock.

The most important things to take away

It is argued that the price-to-earnings ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

As we suspected, our study of Danaher’s analyst forecasts found that its above-average earnings outlook is contributing to its high P/E ratio. Currently, shareholders are comfortable with the P/E ratio as they are fairly confident that future earnings are not at risk. Unless these conditions change, they will continue to provide strong support to the share price.

Don’t forget that there may be other risks as well. For example, we have found 1 warning sign for Danaher that you should know.

If you uncertain about the strength of Danaher’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.