In this article, I evaluated two fast food stocks, McDonald’s (MCD) and Restaurant Brands International (QSR). Upon closer inspection, the assessment of McDonald’s is bullish and that of Restaurant Brands is neutral.

Known for its golden arches signs, McDonald’s is one of the most recognizable fast-food chains in the world. The company operates and franchises more than 30,000 restaurants in over 100 countries around the world. Restaurant Brands International operates several fast-food chains, including Burger King, Popeye’s and Tim Horton’s.

McDonald’s shares have fallen 8 percent since the beginning of the year and have lost 4 percent over the past year. Restaurant Brands shares have also lost 8 percent since the beginning of the year but have remained roughly flat over the past 12 months.

Although both stocks have fallen by the same percentages since the beginning of the year, there is a significant gap in their valuations. We compare their price-to-earnings (P/E) ratios to compare their valuations.

The overall valuation of the restaurant industry is skewed due to extreme P/E ratios for names like Cava Group (CAVA), which trades at a P/E ratio of around 223.2. So a comparison with the rest of the industry isn’t really helpful, as both companies are established operators rather than rising stars in the market.

McDonald’s

With a P/E ratio of 23.6, McDonald’s is trading at a premium to Restaurant Brands. However, since the company is trading at the lower end of its usual valuation range and has experienced long-term share price gains, a long-term bullish view seems appropriate.

McDonald’s average P/E has been 28.4 since October 2019, but that includes some ups and downs related to the pandemic. More recently, the fast-food giant appears to have bottomed out in early July with a P/E of around 21, and since the August 2021 plunge, the range has been between 21 and around 35.

Moreover, McDonald’s seems to be a safe investment in times of economic weakness, with shares up 39% over the past five years and 269% over the past decade. Typically, consumers look for inexpensive restaurants when their wallets are tight, and McDonald’s definitely fits the bill.

That’s why there’s been a lot of talk about the chain’s new $5 menu, which franchisees told in a memo that it would reverse the customer slump. They reported a “remarkable” increase in customer numbers and said the $5 menu was luring customers away from rival chains.

McDonald’s reported an “incremental increase” of nearly 3% in guest numbers during the promotion. In fact, management said more guests tried the offer than originally expected.

Although this is only a short-term solution to the problem, the consumer confidence index fell to 100.4 in June from 101.3 in May as Americans became concerned about their prospects in the near future. It is noteworthy that the $5 promotion only began in late June.

In addition, the indicator for income, economic and labor market expectations fell from 74.9 in May to 73 in June. Anything below 80 suggests that a recession could be imminent.

So McDonald’s appears to be prepared to weather another economic downturn, and the current collapse in share price and valuation provides an opportunity to buy on dips.

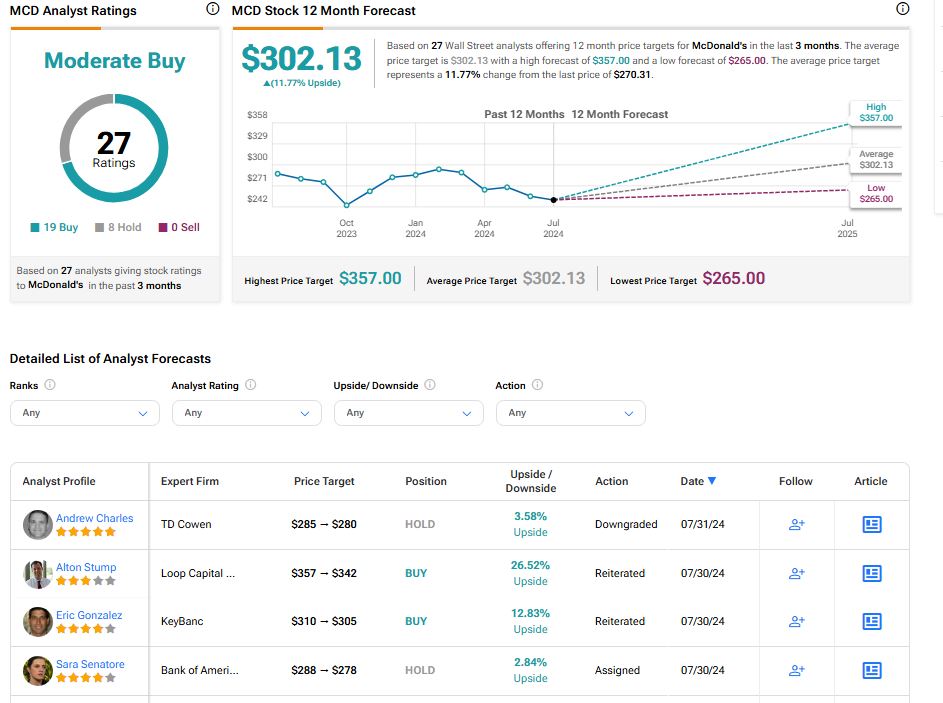

What is the price target for MCD shares?

McDonald’s has a Moderate Buy consensus rating based on 19 Buy recommendations, eight Hold recommendations, and no Sell recommendations over the past three months. The average price target for McDonald’s shares is $302.13, implying an upside potential of 11.77%.

Restaurant Brands International

With a P/E ratio of around 17.4, Restaurant Brands International shares tend to be less volatile than McDonald’s shares. Additionally, they have been trading at the lower end of their range since August 2021, so a neutral rating seems appropriate.

During that time period, Restaurant Brands shares have typically traded between 17.4 and about 23.8 times, with the exception of a spike that took them to about 30 times in January. Some investors might consider taking a bullish stance on the stock because there is significant upside potential here, but another consideration is that the company’s long-term share price gains are far smaller than McDonald’s.

Restaurant Brands stock has risen just 13% over the past five years and 149% over the past decade, so the long-term upside potential of this stock may be lower compared to McDonald’s stock.

If McDonald’s continues to steal customers from Restaurant Brands chains with its $5 menu, it could be damaging in the short term. Restaurant Brands’ Burger King was one of the first to offer a $5 menu this summer.

However, comparable-store sales in the U.S. remained more or less flat during the summer quarter, suggesting that consumers consider McDonald’s $5 meal to be more valuable.

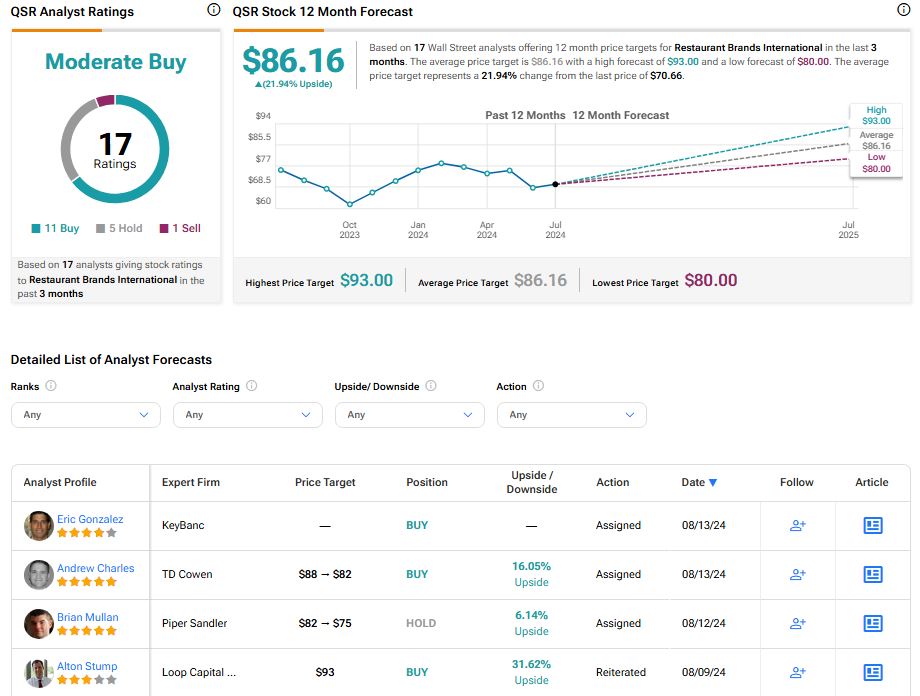

What is the price target for QSR shares?

Restaurant Brands International has a Moderate Buy consensus rating based on 11 Buy, five Hold, and one Sell ratings over the past three months. The average price target for Restaurant Brands stock is $86.16, implying an upside potential of 21.94%.

Conclusion: Bullish for MCD, neutral for QSR

Although both McDonald’s and Restaurant Brands International have shown signs of stability during times of economic weakness, McDonald’s simply seems to be the better player in the fast-food sector. Its shares have more upside potential just by looking at the trading range, and they have gained more than Restaurant Brands shares over the long term.

notice