Sandbox (SAND) price rose to $0.27 in early trading today. However, with 98% of holders currently in losses, the token could see another price drop.

Year-to-date (YTD), the price of SAND has fallen by 56.22%. If this decline continues, the cryptocurrency could reach its lowest price during the 2022 bear market.

The Sandbox continues to face difficult times

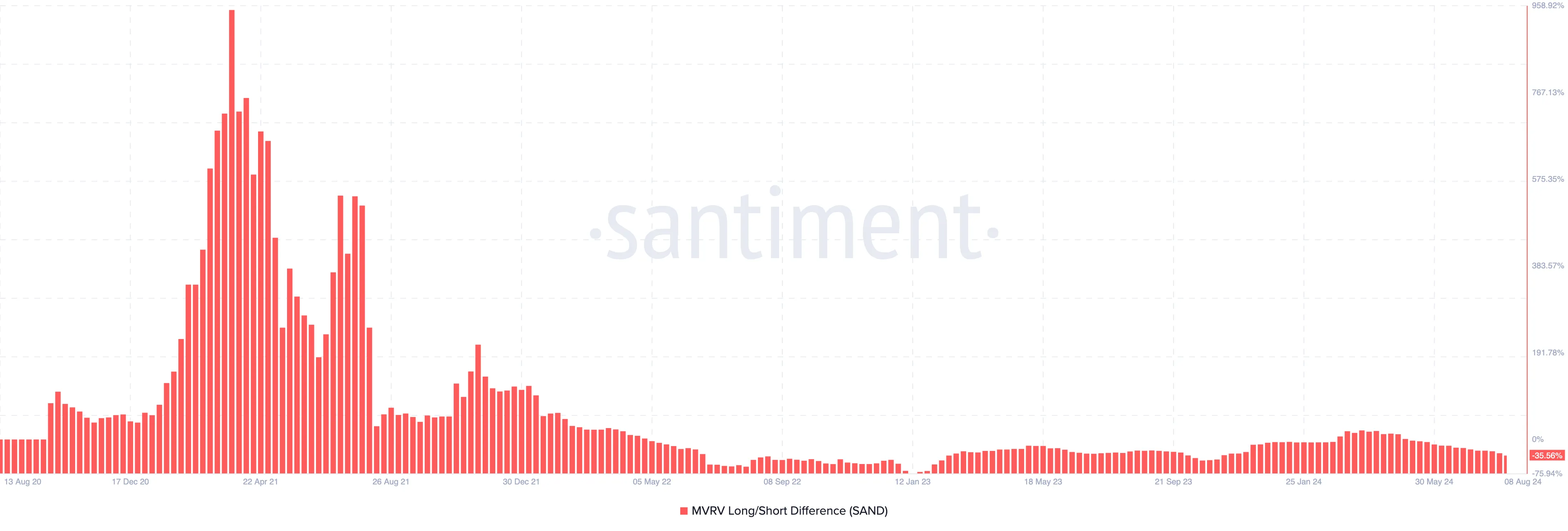

The Sandbox price has increased by about 6% in the last seven days. However, on-chain data shows that the difference between market value and realized value (MVRV) for long/short is -35.56%. This metric, which tracks market profitability, is crucial for identifying bear and bull phases.

Negative values mean that short-term holders would make more profit than long-term holders if they sold at the current price. Conversely, positive values mean that long-term holders would make more profit if they sold.

Considering the above, the MVRV long/short difference also captures the peak of a bull market and when a cryptocurrency is heading towards a bear market. Historically, SAND enters a bear market cycle when the value is between -40.74% and -75.26%.

Read more: What is the Sandbox (SAND)?

This conclusion is based on the metric’s behavior during the 2022 bull market, which eventually led to a crash in crypto prices. If the price of SAND does not make a significant jump, profitability will decline, which could potentially push the token into a bear phase.

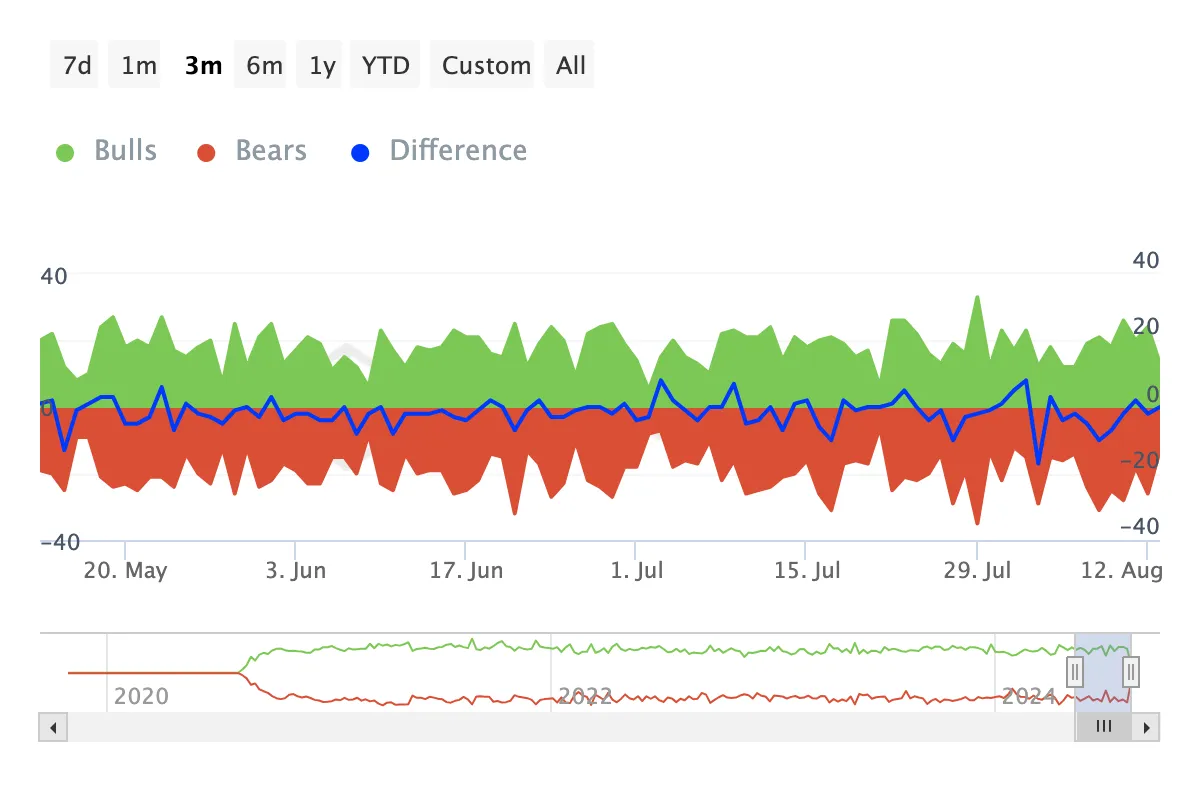

Another indicator that supports this forecast is the Bulls and Bears Indicator. This tool tracks whether the participants with the highest trading volume are buying or selling.

Bulls are buying 1% of the trading volume while bears are selling the same volume. An increase in bulls compared to bears is a positive sign that could push the price higher.

Over the past seven days, SAND has seen 28 more bears than bulls, indicating that the majority of traders lack confidence in the token’s prospects.

SAND price prediction: Relief brings bigger problems

Technical analysis, supported by clues on the daily chart of SAND, also agrees with the on-chain signs. For example, the Balance of Power (BoP) has fallen to -0.64. This price-based indicator evaluates the overall strength of buyers and sellers in the market.

When the Balance of Power (BoP) fluctuates above the zero line, it indicates that buyers are stronger than sellers, but since it is currently below the zero line, it suggests that the cryptocurrency is dominated by a bear market.

Should sellers remain in control, SAND’s recent rally could be short-lived. In the meantime, Fibonacci retracement levels offer insights into possible price points the token could reach.

Read more: The Sandbox (SAND) Price Prediction 2024/2025/2030

If the selling pressure increases, the SAND price could drop to $0.20. On the other hand, if there is a strong bullish move, the token could attempt to retest the $0.30 level.

Disclaimer

Per the Trust Project’s guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions can change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.