Santander Bank Poland SA (WSE:SPL) shareholders might be concerned after the share price fell 13% in the last month. But that doesn’t change the fact that returns over the past three years have been pleasing, with the share price up 80% in that time, outperforming the market.

Last week was a lucrative one for Santander Bank Polska investors, so let’s see if fundamentals drove the company’s three-year performance.

Check out our latest analysis for Santander Bank Polska

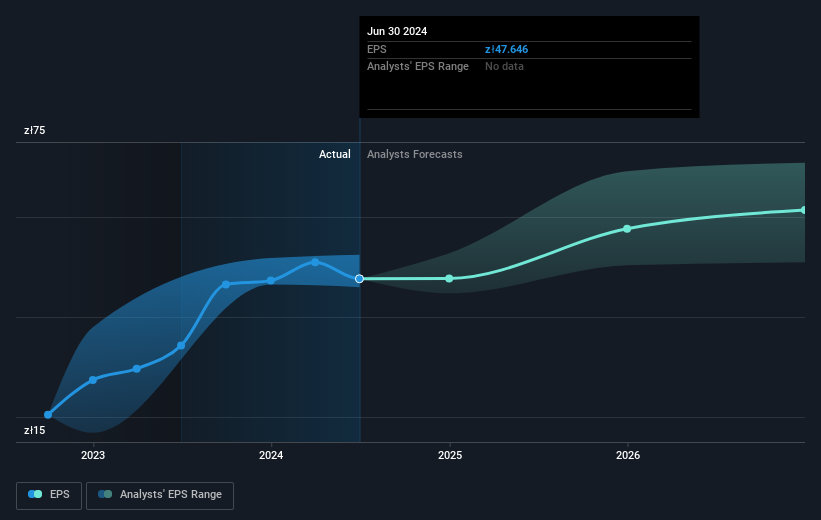

While markets are a powerful pricing mechanism, stock prices reflect not only underlying corporate performance but also investor sentiment. One way to examine how market sentiment has changed over time is to examine the interaction between a company’s stock price and its earnings per share (EPS).

During the three-year share price increase, Santander Bank Polska achieved a compounded earnings per share growth of 73% per year. The average annual share price increase of 22% is actually lower than the EPS growth. Therefore, the market seems to have somewhat tempered its growth expectations. This cautious mood is reflected in its (fairly low) P/E ratio of 10.40.

The image below shows how EPS has evolved over time (if you click on the image you can see greater detail).

It is probably worth noting that the CEO earns less than the average in similarly sized companies. But while CEO compensation should always be reviewed, the really important question is whether the company can grow its profits in the future. This free The interactive Santander Bank Polska earnings, revenue and cash flow report is a good place to start if you want to investigate the stock in more detail.

What about dividends?

When considering investment returns, the difference must be taken into account between Total return for shareholders (TSR) and Share price return. The TSR is a return calculation that takes into account the value of cash dividends (assuming that any dividends received were reinvested) and the calculated value of any discounted capital raisings and spin-offs. It’s fair to say that the TSR gives a more complete picture for dividend paying stocks. We note that for Santander Bank Polska the TSR for the last 3 years was 108%, which is better than the share price return mentioned above. And there’s no prize for guessing that dividend payments largely explain the divergence!

A different perspective

We’re pleased to report that Santander Bank Polska shareholders have received a total return of 50% over one year. And that includes the dividend. Given that the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it seems that the stock’s performance has improved in recent times. With momentum in the share price still strong, it might be worth taking a closer look at the stock so you don’t miss out on an opportunity. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the following: 2 warning signs we discovered it at Santander Bank Polska.

If you like buying stocks along with management, you might like this free List of companies. (Note: many of them go unnoticed AND have an attractive valuation).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish stock exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.