“Our signals are created through macro valuation, trend analysis and careful backtesting. This combination ensures a comprehensive assessment of an asset’s value, market conditions and historical performance.” EyeQ

block

Trading signal: long-term strategic model

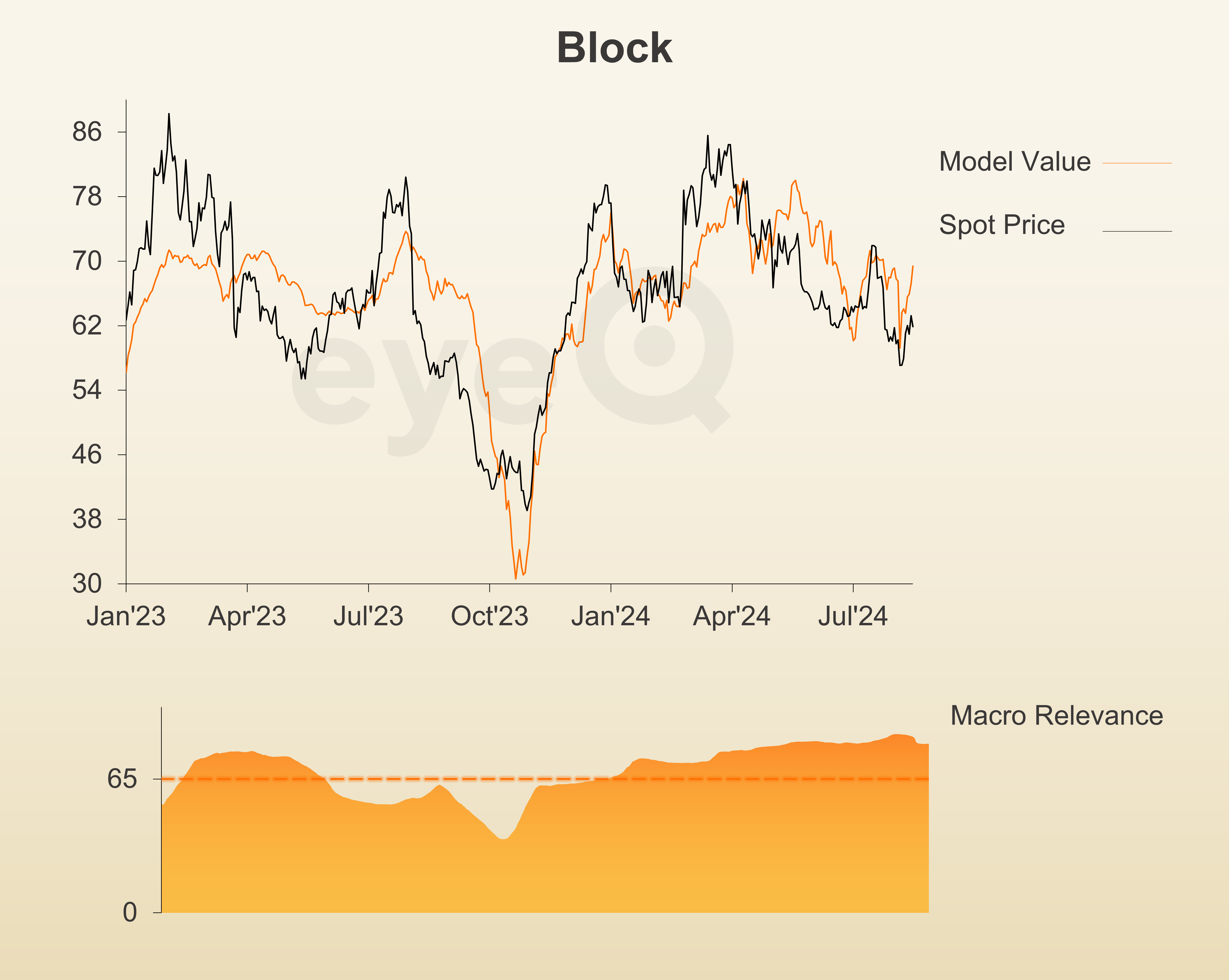

Model value: $69.83

Fair value gap: -12.26% discount on the model value

Model relevance: 82%

Data correct as of August 15, 2024. Please click on the glossary for an explanation of the terms.

Block Inc Class A (NYSE:SQ) is a financial services company that is often associated with Bitcoin. Its Square Cash app helps people manage money and make payments, including buying stocks and cryptocurrencies. It has also developed a crypto mining division and buys Bitcoin to boost its own balance sheet. Therefore, it is often used by investors as a proxy method to get invested in Bitcoin.

It is now 12.26% cheap under macro conditions. These are extreme levels. It has rarely been this cheap under macro conditions (ie our macro relevance number is greater than 65%). That suggests these levels are worth paying attention to.

The stock hasn’t performed particularly well recently. While it didn’t suffer much from the “flash crash” in early August, it hasn’t benefited from the recent stock market recovery either. For some reason, the stock just isn’t getting much attention from investors right now.

Meanwhile, macroeconomic conditions are improving. The value of the eyeQ model has increased by 17.6 percent since the lows of August 5.

For those who want to invest in Bitcoin without having to own their own crypto wallet, Block looks interesting.

Source: eyeQ. Past performance is not an indicator of future performance.

Useful terminology:

Model value

Our intelligent machine calculates how the price (fair value) of each stock index, individual stock or exchange-traded fund (ETF) should be set given the general macroeconomic environment.

Model relevance (macro)

How confident we are in the model value. The higher the number, the better! Above 65% means the macro environment is critical, so all valuation signals carry a lot of weight. Below 65%, we believe something other than the macro environment is driving the price.

Fair value gap (FVG)

The difference between our model value (fair value) and the current price. A positive fair value gap means the security is above the model value, which we call “high.” A negative FVG means it is cheap. The larger the FVG, the bigger the shift and therefore a better entry level to trade.

Long-term model

This model looks at stock prices over the last 12 months, captures the company’s relationship to growth, inflation, currency fluctuations, central bank policy, etc., and calculates our key outcomes – model value, model relevance, fair value gap.

These third party research articles are provided by eyeQ (Quant Insight). interactive investor makes no representations as to the completeness, accuracy or timeliness of the information provided nor accepts any liability for any loss, cost, liability or expense arising directly or indirectly from your use of or reliance on the information (except where we have acted negligently, fraudulently or intentionally in connection with the creation or dissemination of the information).

The value of your investments can go down as well as up. You may not get back all the money you invested.

The stock analysis is for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have taken your personal circumstances into account and the information provided should not be considered as a personal recommendation. If you are unsure about what action you should take, please consult an authorized financial advisor.R.

notice

We use a combination of fundamental and technical analysis to form our opinion on the valuation and prospects of an investment. Where relevant, we have set out the particular aspects we consider important in the article above, but further details can be found here.

Please note that our article on this investment should not be considered a regular publication.

Details of all recommendations made by ii over the last 12 months can be found here.

ii adheres to a strict code of conduct. Authors may hold shares or other interests in companies included in these portfolios, which may lead to conflicts of interest. Authors who wish to write about financial instruments in which they are interested must disclose these interests to ii and in the article itself. ii will at all times check whether these interests compromise the objectivity of the recommendation.

In addition, individuals involved in the creation of investment articles are subject to a personal account trading restriction that prevents them from conducting any transaction in the specified instruments for a period prior to and for five business days following publication, in order to avoid personal interests conflicting with the interests of the recipients of these investment articles.