Source: Clive Maund 08/13/2024

Technical analyst Clive Maund explains why he thinks Interra Copper is worth overweight.

Interra Copper Corp. Company Profile IMIMF is a company that is extremely undervalued From a fundamental and technical perspective, the stock is currently doing very well and is therefore rated as an “Instant Buy”. Before we review the latest stock charts, we will look at what the company fundamentally has to offer.

Although an early stage exploration company, Interra has two highly prospective copper-gold deposits in British Columbia. Its flagship Thane project is located in the prolific Quesnel Terrane. Following the recent completion of successful financings, the Company is fully funded for upcoming drilling and exploration programs later this year and into 2025.

Here is a one-page investor presentation summarizing what the company has to offer.

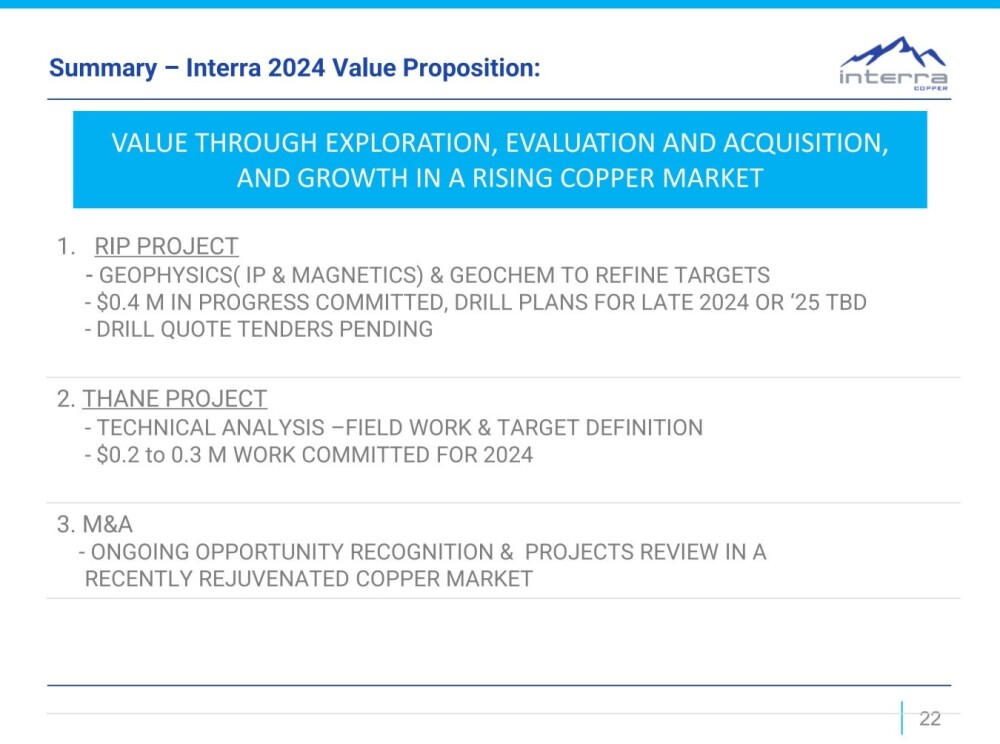

The company’s priorities for 2024 are as follows:

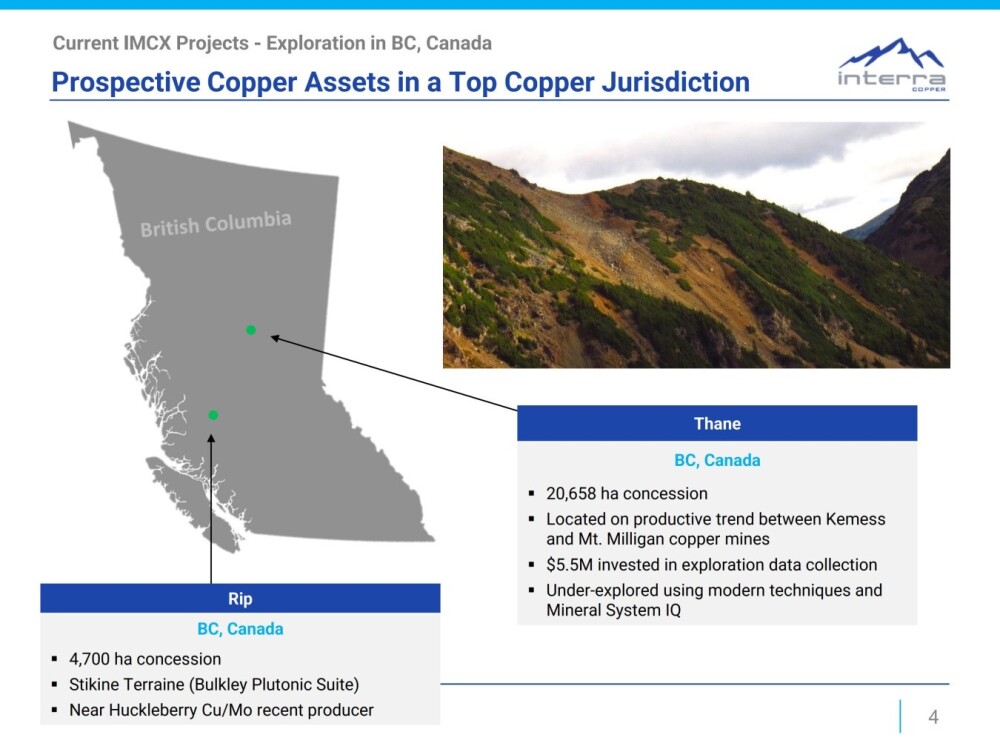

This slide shows the location of the Company’s two properties in British Columbia and provides a brief overview of their characteristics.

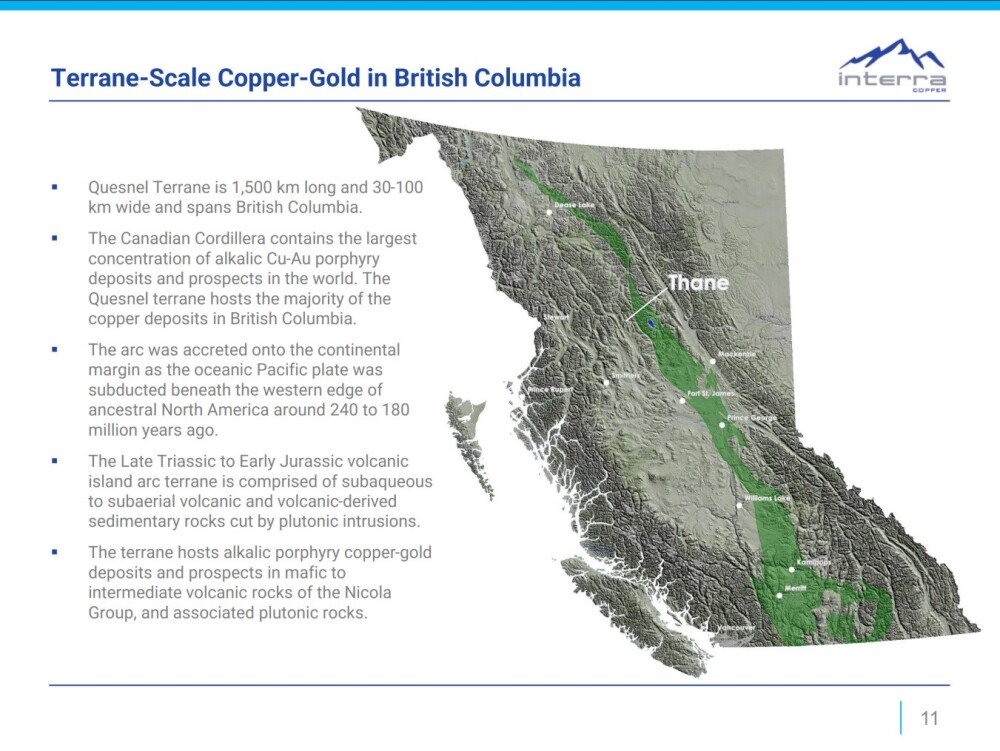

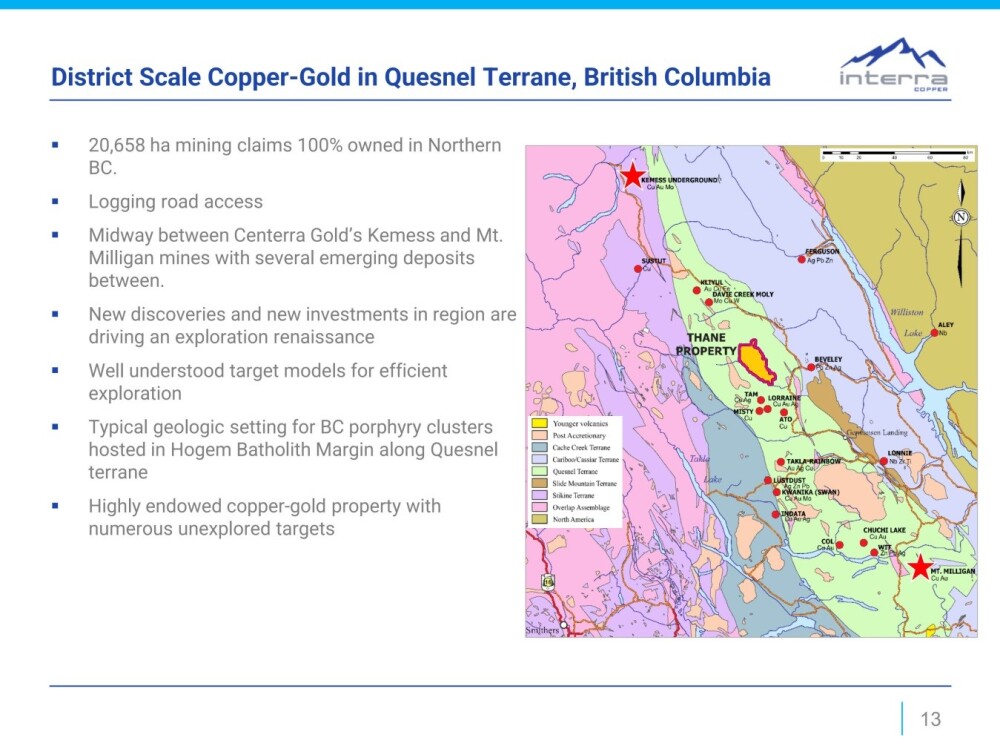

The larger Thane property is located in the prolific Quesnel Terrane, which stretches almost the entire length of British Columbia.

The 100% owned Thane district scale land parcel covers an area of over 20,000 hectares.

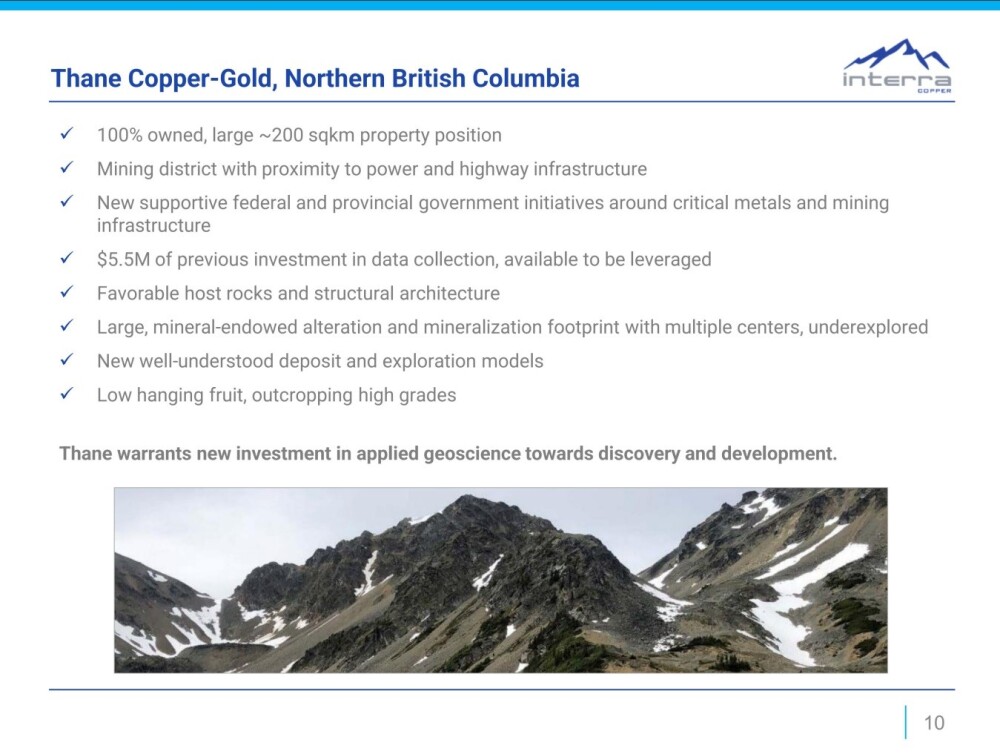

This slide shows the key features of Thane Estate.

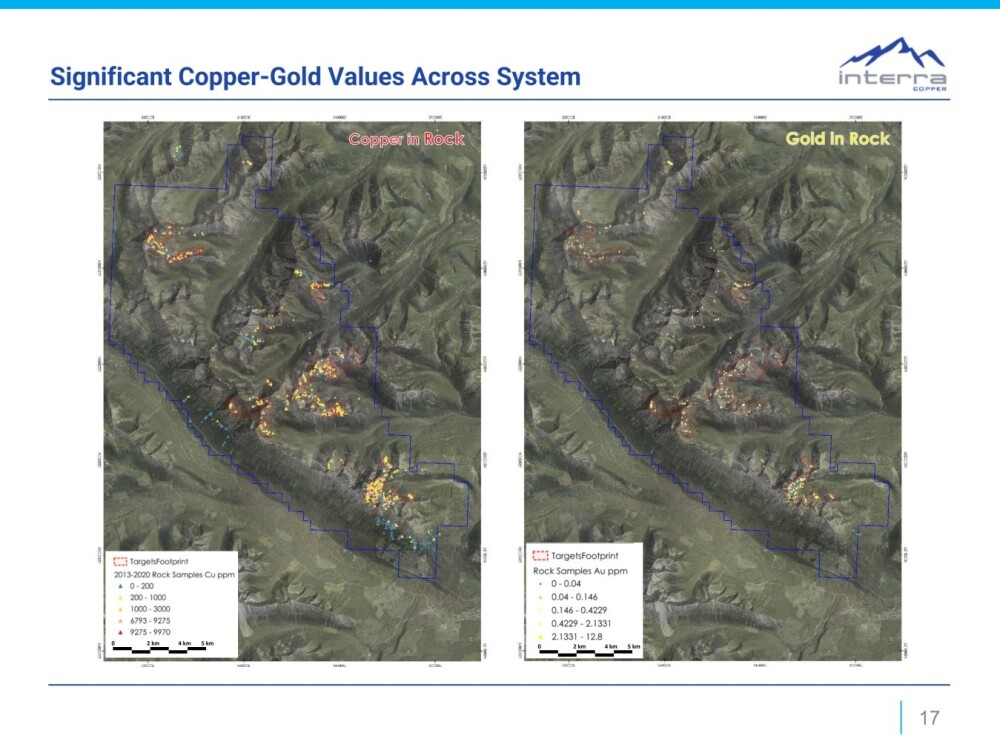

Thane has significant copper-gold deposits throughout the system.

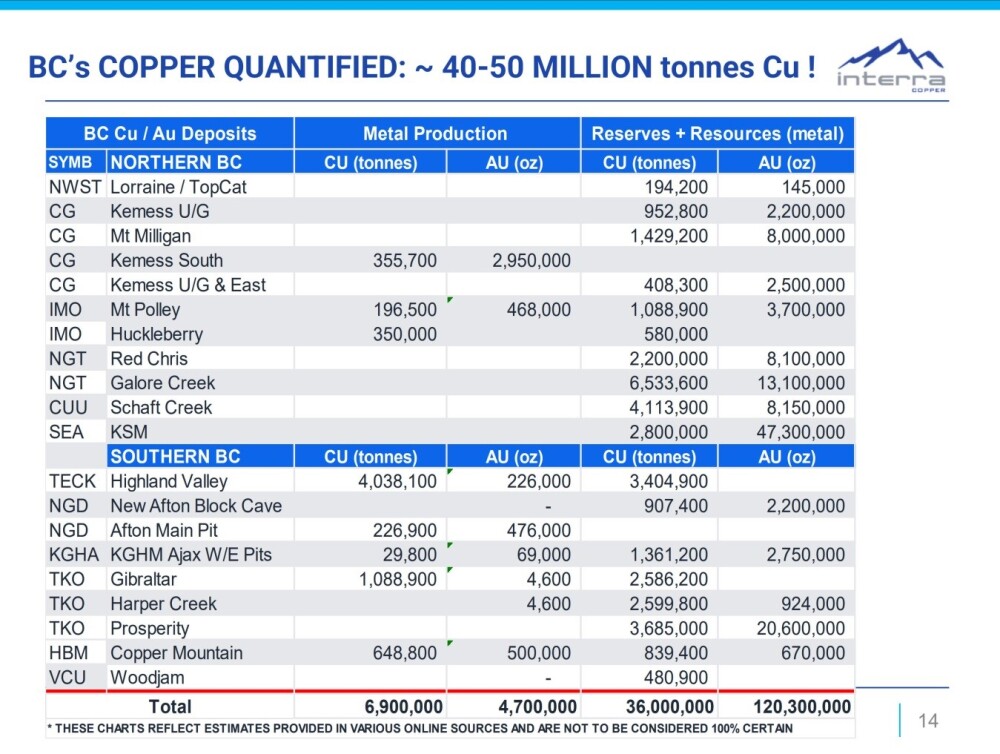

BC is home to large copper deposits, which bodes well for exploration on the Company’s properties, particularly given Thane’s location in the Quesnel Terrane.

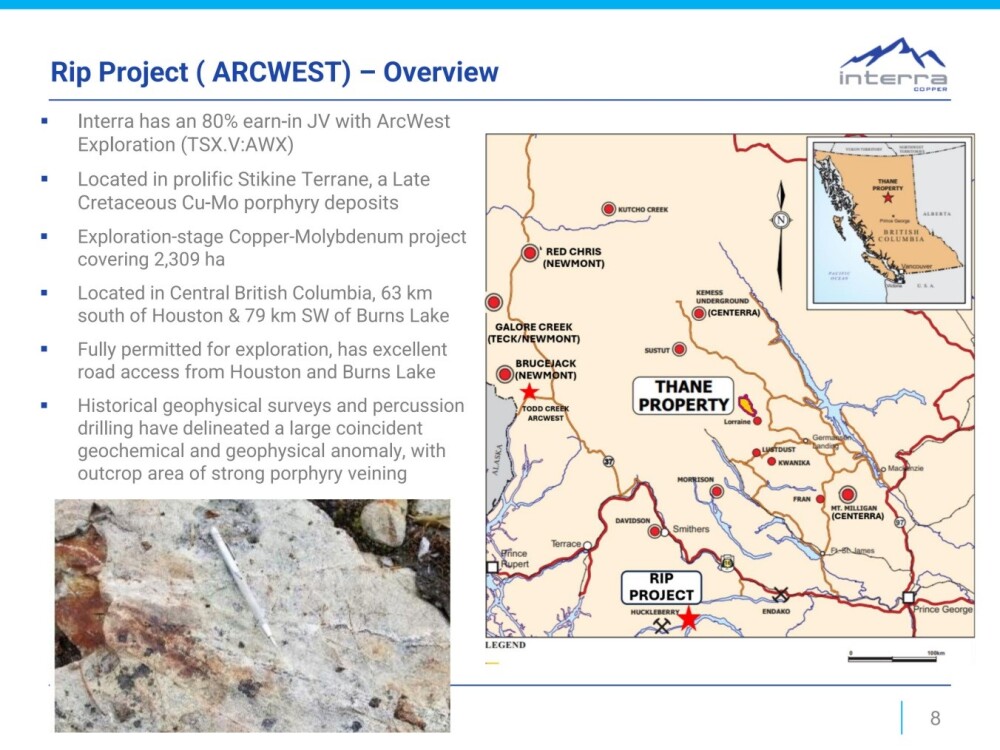

This slide provides an overview of the smaller Rip property to the southwest.

Here’s what’s planned for this year through 2025.

Finally, this slide shows the capital structure. It is noteworthy that of the modest 29.5 million shares issued, only a third, or less than 10 million, are in circulation.

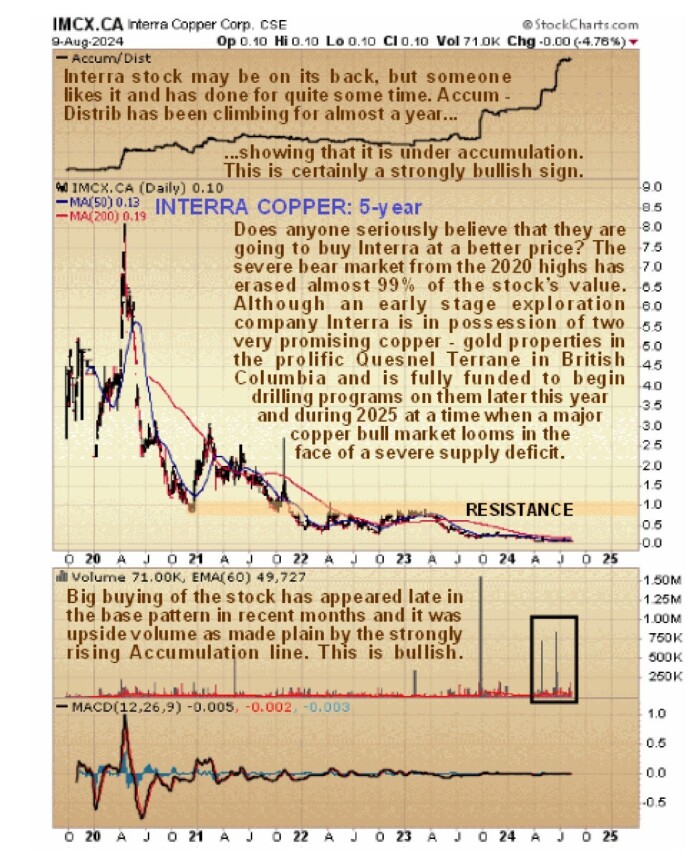

Now let’s look at the charts for Interra Copper. Given the company’s positive fundamentals described above, it quickly becomes clear that this is a rare and unusual situation where there is enormous upside potential, especially in percentage terms, and downside potential is virtually nonexistent. In other words, the risk-reward ratio here is massively skewed in favor of buyers of the stock.

Let’s start with the long-term 5-year chart. We can see that Interra has lost almost 99% of its value at current prices since its (admittedly short-lived) peak of over CA$8.00 in mid-2020 following a long and particularly severe bear market. However, when we consider the now favorable outlook for both the company following successful financings and the prices of the metals it plans to produce, primarily copper and gold, it quickly becomes clear that there is plenty of upside and no downside for the stock.

Also, on this long-term chart, you can see that there are some smart money investors who also hold this view, as their accumulation of the stock over the past year, as evidenced by the heavy buying, especially in the last few months, has pushed the accumulation line sharply higher, which is very bullish.

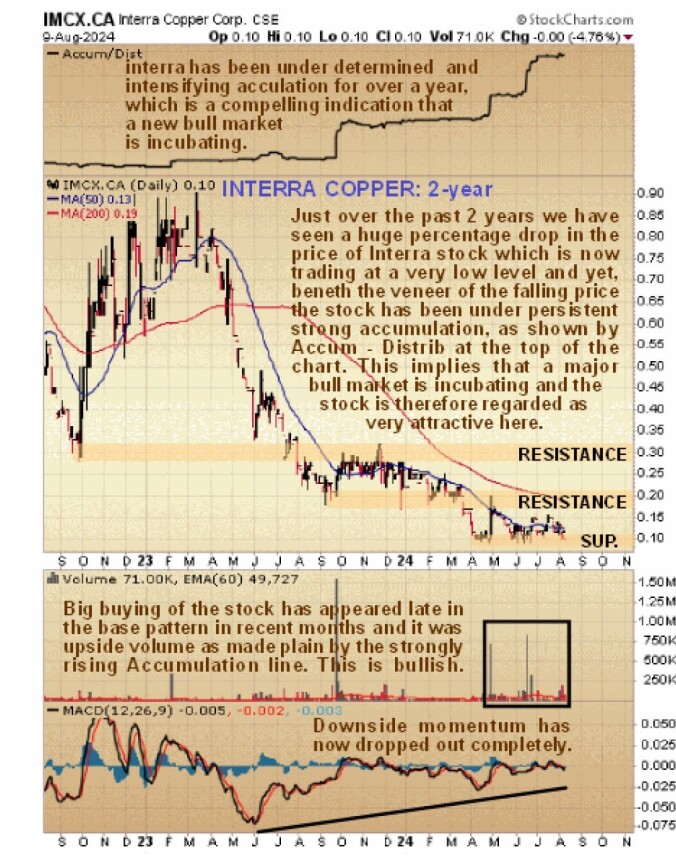

Moving on to the 2-year chart, which captures the last part of the bear market and extends it so we can see more clearly what has been going on. Here we see that after the last sharp downturn in the spring, the stock has been trading in a different range that on the surface looks like it could lead to another downturn, but where exactly?

It is already at just 10 cents, so there is hardly any downward potential.

It is therefore very interesting to observe that as this trading range expanded, upside volume increased significantly and buyers became more aggressive, driving the accumulation line steeper. This is a strong indication of buying by those who foresee better times ahead and believe the stock is severely undervalued, and it implies that this trading range is indeed a basing pattern.

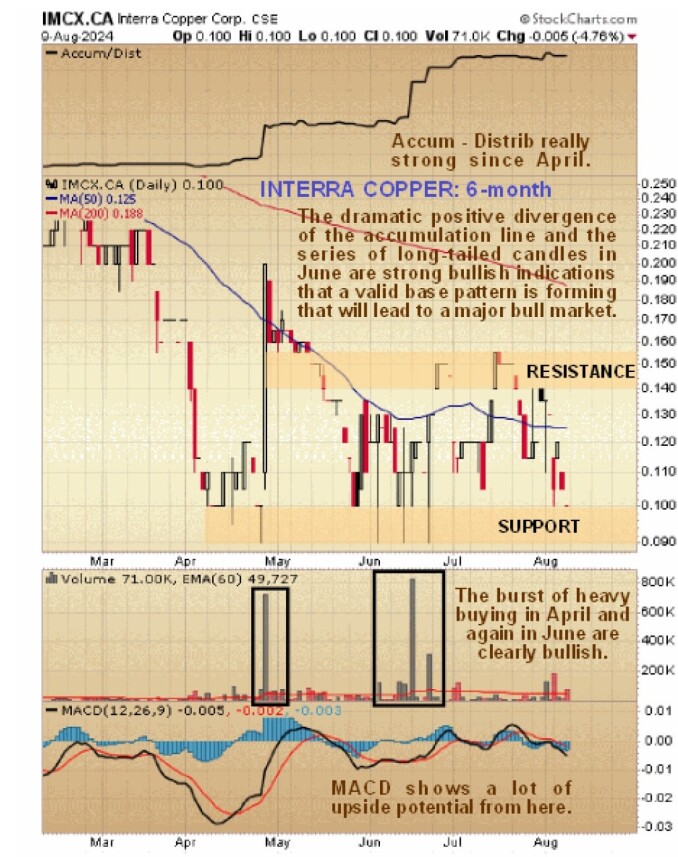

The 6-month chart allows us to examine in detail the suspected base pattern that formed from the April lows. Here we can clearly see the strong buying that set a floor under the 9 cent price. The majority of this upside volume is clearly visible from the volume pattern, the strong rising accumulation line and the long-tailed candles in June when there was strong buying.

This is all very bullish, and the icing on the cake for buyers of this stock is that after the reaction of the last two weeks or so, which saw it fall to just 10 cents, it is now (at the time of writing) at a great price.

Finally, it is worth taking a quick look at the copper price chart, as this is an important background factor.

Looking at the most recent 3-year chart, we can see that the price has undergone a fairly strong correction since mid-May. However, since it has reached a zone of fairly strong support where it is now oversold, this is a good time for a reversal to the upside soon, which would be positive for copper stocks in general.

In conclusion, while Interra Copper has to be classified as speculative as it is a junior exploration stock at a very low price, the risk/reward ratio is as good as it gets. Given this, the stock is rated as an immediate strong buy and worth overweighting.

Interra Copper Corp. Company Profile closed for trading at CA$0.10, US$0.099 on August 12, 2024

Important information:

- Interra Copper Corp. maintains a consulting relationship with Street Smart, an affiliate of Streetwise Reports. Street Smart clients pay a monthly consulting fee ranging from $8,000 to $20,000.

-

The company paid Street Smart, a partner of Streetwise Reports, $2,500 for this article.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their households) own securities of Interra Copper Corp.

- Author Certification and Compensation: (Clive Maund of clivemaund.com) was hired and compensated by Street Smart as an independent contractor to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his British Diploma as a Technical Analyst in 1989. The recommendations and opinions expressed in this content reflect the personal, independent and objective views of the author with respect to any companies discussed. No part of the compensation received by the author was, is or will be tied, directly or indirectly, to the specific recommendations or views expressed.

- The statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart or their officers. The author is fully responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any ownership interests or economic relationships with companies they write about. All author disclosures are provided below. Streetwise Reports relies on authors to provide this information accurately and Streetwise Reports has no way of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation of an investment. Streetwise Reports does not provide general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult his or her personal financial advisor and conduct his or her own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ Terms of Use and Full Disclaimer. Streetwise Reports does not endorse or recommend any company’s business, products, services or securities.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund based on data available to him at the time of writing. Mr. Maund’s opinions are his own and do not constitute a recommendation or an offer to buy or sell any securities. Because trading and investing in financial markets can involve serious risk of loss, Mr. Maund recommends that you consult a qualified investment advisor licensed by the appropriate regulatory authorities in your jurisdiction and that you perform your own due diligence and research when entering into any transactions with financial implications. Although Clive Maund is a qualified and experienced stock market analyst, he is not a registered securities advisor. Therefore, Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell any securities.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.