In a highly volatile and slightly bearish market, BTC price is trading at $58,275 today, with an intraday gain of 1.25%. Despite the recent recovery, the crypto market leader is trading below its 200-day EMA. Moreover, the 20-day EMA is approaching a bearish crossover with the 200-day EMA.

Still, bullish demand at lower levels is sparking potential as fundamental gears shift to the bullish trend. With the previous candle indicating a lower price rejection with a long tail formation from the $56,000 support level, BTC price is not ready to give up.

Trading View

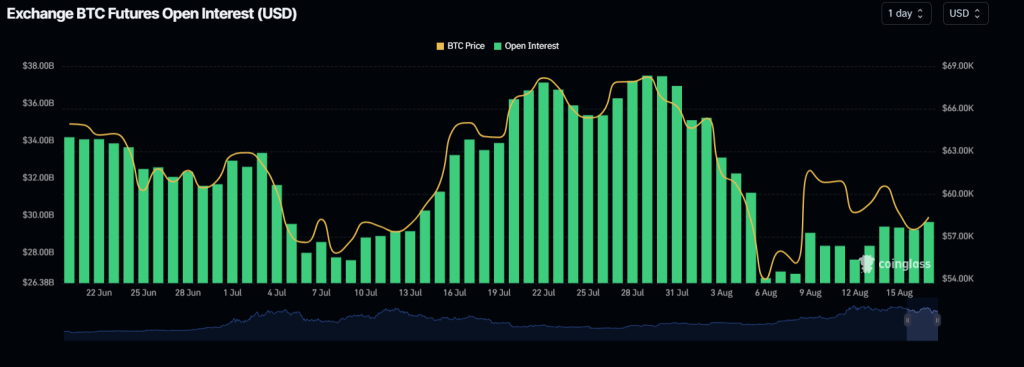

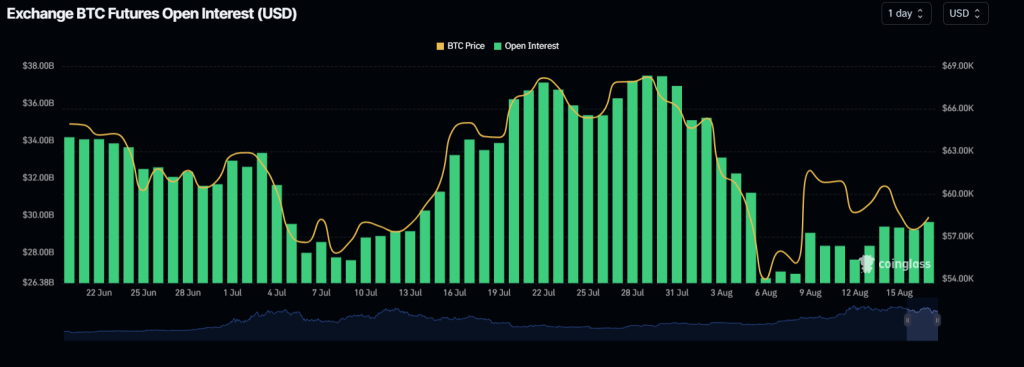

As the underlying bullish sentiment increases, the derivatives market supports the uptrend in BTC price. This is indicated by the rising open interest in Bitcoin, which has increased from $26.65 billion to $29.35 billion in 10 days.

Coin jar

As OI increases, so does the interest of large traders on multiple exchanges as they anticipate further price jumps.

However, the market remains volatile, as evidenced by the total liquidations of $208.88 million in the last 24 hours. Of this, long positions worth $159.91 million were liquidated while short positions worth $48.97 million were closed.

Central banks turn on the liquidity tap

According to a recent tweet by James Coutt, the broader macroeconomic situation is developing positively and points to a bull run in the BTC price and the crypto market in general.

Central banks, notably the Bank of Japan (BoJ) and the People’s Bank of China (PBoC), have pumped over $400 billion and $97 billion respectively into the global monetary base (credit). This massive increase in global monetary liquidity is part of a $1.2 trillion expansion of the global money supply.

The positive turnaround in global money supply comes on the back of a sharp decline in the US dollar. In the past, such developments have led to an increase in BTC prices.

Based on Coutts analysis, the last time we saw a similarly high liquidity phase, BTC price rose 19x in 2017 and 6x in 2020. And with history repeating itself and central banks around the world coming together as the US dollar weakens, Bitcoin could see a massive surge, potentially breaking the $100,000 mark.

The global liquidity momentum model (MSI) just sent its first bullish signal since November 2023. Back then, Bitcoin rallied 75% before the regime turned bearish.

Will the BTC price increase by two to three times?

From a bullish perspective, we have to ignore the recent rumors that Bitcoin has hit the $50,000 mark due to increasing FUD. The strong hands and increasing ETF inflows as BTC price falls indicate a possible rally in Bitcoin. Hence, the Bitcoin price prediction of a 2-3x increase is rising among traders.

Based on Coutts’ assumption, a further correction in the DXY is necessary to provide enough tailwind for the bull market. If this continues, the global monetary base will be expanded, starting with the central banks.