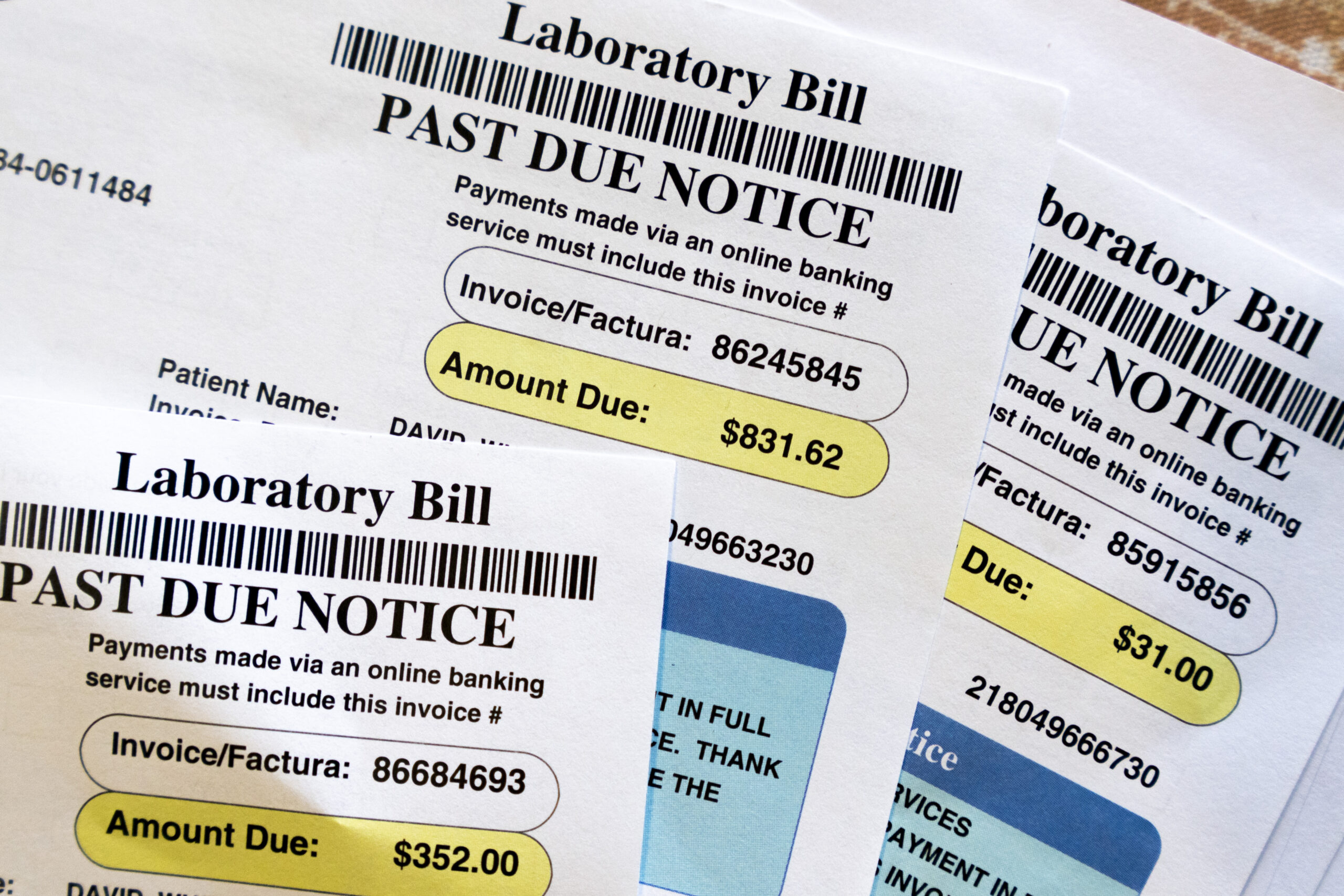

Medical bills are seen on June 26, 2023 in Temple Hills, Maryland.

(AP Photo/Jacquelyn Martin, File)

By Cora Lewis

ASSOCIATED PRESS

NEW YORK — Unexpectedly high medical bills are not uncommon in the United States, but there are ways to reduce the burden. According to the Consumer Financial Protection Bureau, one in five Americans is affected by outstanding medical bills, which amount to a total cost of $88 billion.

In a 2022 study, the bureau found that about 20% of U.S. households report having medical debt, with collections appearing on 43 million credit reports. In the second quarter of 2021, 58% of all bills in collections on credit reports were medical bills.

Medical debt also affects households unevenly, the agency said. Overdue bills are more common among blacks and Hispanics than whites and Asians, and medical debt is more prevalent in the U.S. South, in part because states in that region have not expanded Medicaid coverage.

Although battling high medical bills can be time-consuming and frustrating, advocates stress that patients should not be intimidated by the system. If you’ve received a surprise medical bill, here’s what you should know:

Always check whether you are entitled to charitable care

When 33-year-old Luisa received a medical bill for $1,000 following an emergency hospital stay for a viral infection, she was able to have the hospital cover the entire amount after taking advantage of its financial assistance policies.

“At first I thought it was just a cold, but it turned out I needed special medication for it,” said Luisa, who asked to be identified only by her first name for privacy reasons. “When I went to the emergency room, it was really bad.”

Luisa had heard about the patient advocacy organization Dollar For through a viral video and filled out the nonprofit’s online form after receiving her surprise bill. The organization contacted the Central Florida hospital. Eventually, the hospital contacted Luisa directly to let her know that she was indeed eligible for financial assistance. Although she had already paid some of the costs with a credit card, Dollar For was able to refund those payments.

Laws governing charity care hospitals require nonprofit hospitals to reduce or write off bills for individuals based on household income. To determine if you qualify, you can simply Google the hospital along with the terms “charity care” or “financial assistance policy.” Dollar For also offers patients a simplified online tool to help them determine if they qualify.

“Federal law requires hospitals to implement these programs to maintain their tax-exempt status,” said Jared Walker, CEO of Dollar For. “If you are within their income range, they will write off, forgive, waive or reduce your bills.”

Even if you have already paid off medical bills, the hospital is obligated to reimburse you for the payments you have already made, he said.

“This is the first time I’ve experienced something like this,” said Luisa. “I tried to do my research and ask about the costs at the hospital, but of course it’s hard when you’re sick in the emergency room.”

Invoking the No Surprises Act

While Medicare, Medicaid and Tricare policyholders have long had protection from surprise bills, laws now also apply to people with private or publicly traded health insurance plans.

The federal No Surprises Act applies to people who have insurance through their employer, the Marketplace or individual plans. It states that insurance companies must adequately cover all out-of-network services related to emergency care and some non-emergency medical services. This means that if you are charged more than you are used to or expect for in-network services, a bill may be illegal.

To dispute a bill covered by this law, you can use the Centers for Medicare and Medicaid Services’ toll-free help desk and hotline.

Many states also have free consumer assistance programs to help with disputes and insurance questions. You can always write to a hospital’s medical billing department and say that you believe a bill violates the No Surprises Act and ask the hospital to contact your insurance company directly.

“The complexity of the system itself is as big a problem as affordability,” says Kaye Pastaina, who leads patient protection research at KFF, a nonprofit health organization. “A lot of it is due to the fragmented system and complex rules, but also a lack of awareness of existing protections that are part of federal law and could help.”

Request a detailed invoice

Even if you don’t qualify for charity care or aren’t sure if your bills are covered by the No Surprises Act, you may be able to reduce costs.

Billing for medical services is notoriously complicated and fraught with errors. When you receive a bill, always ask the hospital or healthcare provider for a detailed invoice that includes the billing codes for all the services you received. The Health Insurance Portability and Accountability Act (HIPAA) requires providers to share this information.

Next, check to see if the billing codes are correct. Again, simply Googling the codes using the term “medical billing code” can help. If something isn’t right, disputing your bill with your doctor or medical office can result in changes.

Another approach: Compare the bill to insurance companies’ estimates of reasonable fees for services. If the price you’re charged is higher than average, you can get your costs reduced. You could even take the provider to small claims court over the discrepancy (or let them know you have a claim).

Finally, compare your health insurance company’s “explanation of benefits” with the bill. This explanation of covered and non-covered costs must match the hospital’s bill. If this is not the case, you have another reason not to pay the costs and to ask the service provider to continue to work with your health insurance company for the time being.

Remember that the process requires perseverance

Despite the hassle, these steps can save you significant amounts of money. Even after you take these steps, you can still appeal health claims with your insurance company if you believe there is reason to cover the bills in full or more than the company originally determined. You can also contact your state insurance commissioner for assistance.

“What we have seen in our research and from the data is that those who appeal – and there are few of them – have their convictions overturned to a high degree,” Pastaina said.

The Associated Press receives support from the Charles Schwab Foundation for its educational and explanatory reporting that improves financial literacy. The foundation is independent of Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.