Veracyte, Inc. (NASDAQ:VCYT) shareholders have been rewarded for their patience with a 42% jump in the stock over the past month. Looking back a little further, it’s encouraging to see that the stock is up 33% over the past year.

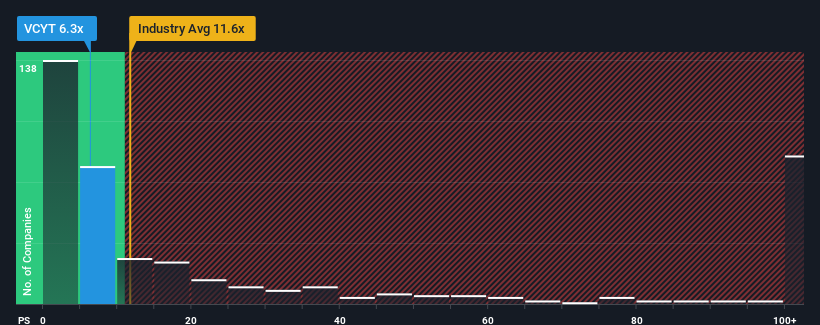

Despite the significant price increase, Veracyte’s price-to-sales (or “P/S”) ratio of 6.3 may still be sending buy signals right now, considering that nearly half of all biotech companies in the U.S. have P/S ratios above 11.6x, and even P/Ss above 63x are not uncommon. However, the P/S could be low for a reason, and further research is needed to determine if it is justified.

Check out our latest analysis for Veracyte

How has Veracyte developed recently?

The last few years have not been particularly good for Veracyte, as its revenue has grown more slowly than most other companies. Many seem to expect the uninspiring revenue performance that has been holding back growth in the P/S ratio to continue. If that is the case, existing shareholders are unlikely to be very enthusiastic about the future direction of the share price.

If you want to know what analysts are predicting for the future, you should check out our free Report on Veracyte.

What do the revenue growth metrics tell us about the low P/S?

To justify its P/S ratio, Veracyte would have to show sluggish growth that lags behind the industry.

If we look at the revenue growth over the last year, the company has seen a fantastic increase of 22%. The strong recent performance means that it has been able to achieve a total revenue increase of 154% over the last three years. So, first of all, we can say that the company has done a great job of increasing revenue during this time.

As for the outlook, the nine analysts who cover the company estimate that next year will bring growth of 15%. The rest of the industry, on the other hand, is forecast to grow by 134%, which is much more attractive.

When you take this into account, it’s clear why Veracyte’s P/S is lagging behind its industry peers. It seems that most investors expect limited future growth and are only willing to pay a lower amount for the stock.

The last word

Although Veracyte’s share price has risen recently, its price-to-sales ratio still lags behind most other companies. Generally, we prefer to use the price-to-sales ratio only to determine what the market thinks about the overall health of a company.

As we suspected, our study of Veracyte’s analyst forecasts found that its weaker revenue outlook is contributing to its low P/S ratio. At this point, investors believe that the potential for revenue growth is not large enough to justify a higher P/S ratio. Under these circumstances, it’s hard to imagine the stock price rising much in the near future.

And what about other risks? Every company has them, and we have 2 warning signs for Veracyte You should know about this.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.