Recent research conducted in Japan suggests that XRP could be heading for a period of increased volatility in the fourth quarter of 2024.

XRP community figure Eri in the spotlight the report on X confirmed that it came from blockchain firm HashHub. Data from the research, based on historical market behavior, suggests that this increased volatility could lead to a significant price increase.

Stability in 2023 and 2024

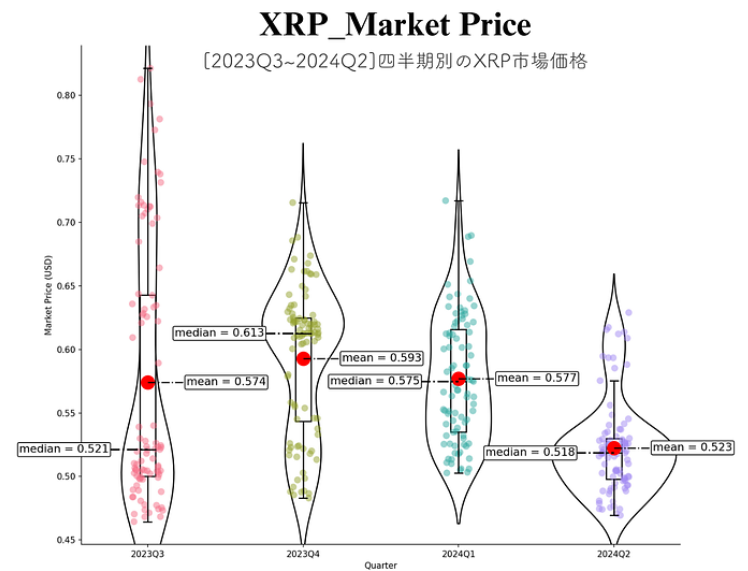

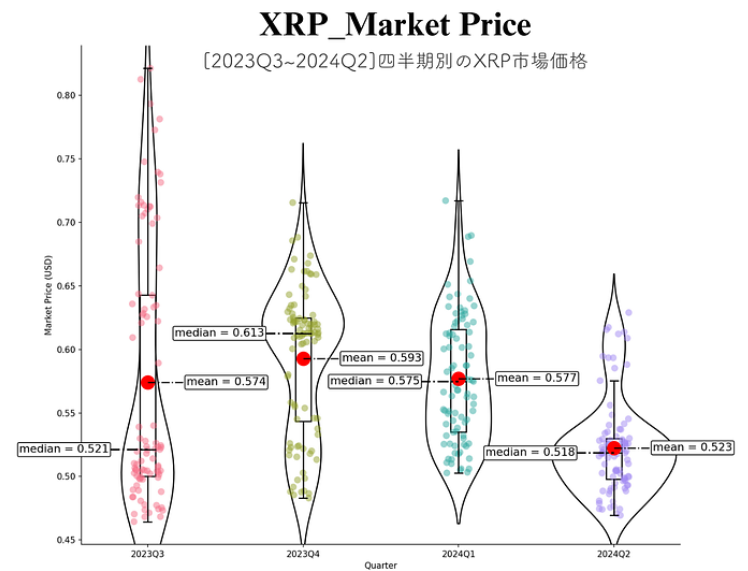

The study highlights the relative stability of XRP throughout 2023 and the first half of 2024. The violin charts used in the study show that the market price of XRP maintained strong support levels during this period, especially around 0.52 USD.

Despite fluctuations, the cryptocurrency has proven resilient, with prices remaining stable above these key levels. In Q3 2023, XRP had an average price of $0.574 and a median price of $0.521.

However, the mean rose to $0.593, while the median reached $0.613 in the fourth quarter of 2023, indicating a stronger uptrend. This marked a period of increased volatility for XRPwhich leads to rapid price spikes.

Meanwhile, in the first quarter of 2024, the average and median prices adjusted slightly to $0.577 and $0.575, respectively, amid consolidation. In the second quarter of 2024, a downward trend emerged, with the average price falling to $0.523 and the median to $0.518, indicating a loss of momentum.

Possible increase in volatility could trigger XRP rally

This data suggests a general pattern of stability, with XRP managing to hold above crucial support levels. However, if the pattern repeats itself, there could be a shift in this stability in the last quarter of 2024.

Historical data supports this prediction and shows that if XRP In the past, there have been periods of increased volatility followed by significant price movements. For example, in Q3 2023, XRP experienced an increase in both the average and median price, which was preceded by a significant increase in volatility.

Data from Santiment Neck rolls this sentiment. Notably, a rise in XRP’s 4-week volatility has historically been accompanied by a rise in price. In December 2017, this value rose to 0.62, which led to a huge rise in XRP. In April 2021, it rose to 0.47, which coincided with an XRP price increase to $1.96.

XRP weekly chart and historical volatility

Further evidence of the potential for a price increase is XRP’s weekly historical volatility (HV). The HV indicator measures how much the price of XRP fluctuates over time. The chart shows that XRP’s HV remains at a low level. However, historical data shows that when this volatility increases, it often precedes a price increase.

For example, in September 2022, a sharp increase in XRP’s HV led to a 37% price jump in just one week. A similar pattern occurred in July 2023, when XRP rose 59% within a week after a further increase in HV.

Meanwhile, the Chande Kroll Stop also shows that XRP is currently in a neutral position, however, any significant market movement could trigger a new trend, consistent with predictions for increased volatility later this year.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. The views expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are advised to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial loss.

-Advertising-