Bitcoin, the original and largest cryptocurrency by market capitalization, has seen its price decline since the halving in 2024. This was the first time such a decline followed the programmed cut in reward emissions.

Bitcoin miners’ BTC rewards for securing the network were halved in April 2024, making their profitability more dependent on an increase in the BTC dollar value.

(Shutterstock)

Posted on August 19, 2024 at 11:49 am EST.

Monday, August 19, marks the fourth anniversary of the 2024 Bitcoin halving, an automated event that halves mining rewards every four years. However, unlike previous halvings, the latest halving has not yet been followed by a rise in Bitcoin’s dollar value.

Each halving makes it harder for miners to stay afloat because the BTC rewards for validating and securing the blockchain are halved. But the price of BTC in dollars has generally increased after a halving, with analysts often attributing the price increases to a lower supply of new coins.

However, Bitcoin’s price performance after the recent halving was worse than all previous halving events, which also occurred in 2020, 2016, and 2012.

According to data from blockchain analytics firm CryptoQuant, the BTC price has fallen by over 8.2% following the halving, from $63,825.87 on April 19, 2024, to $58,530.13 at the time of writing.

In all previous halving years, Bitcoin’s dollar value increased in the following four months. In 2020, the BTC price increased by about 21.4% in the four months following the halving, from $8,566.77 to $10,402.66. In 2016, the BTC price increased by 11.12% in the same period, from $638.19 to $720.97. Similarly, the BTC price in 2012 was trading at $12.35 on the day of the halving, and four months later, its price had increased by almost 600% to $86.18, according to CryptoQuant.

Read more: The Bitcoin Halving 2024 – What the miners are doing differently now compared to 2020

One reason for BTC’s weak performance after the halving in 2024 is the net reduction in outstanding Treasury bills, according to Arthur Hayes, co-founder and former CEO of crypto exchange BitMEX.

“As a result of a net reduction in outstanding Treasury bills, liquidity was removed from the system,” Hayes wrote in a Blog post last week. “From April to July, when T-bills were net withdrawn from the market … bitcoin traded sideways, punctuated by some sharp declines.”

As the BTC price drops after the recent halving, miners are “in a difficult position,” wrote the team behind Alkimiya, a blockspace marketplace protocol that enables Users to trade BTC transaction fees.

“The price of $BTC has dropped, mining difficulty has increased, and they are selling coins to cover costs,” Alkimiya wrote on X on Wednesday. “Miners are the backbone of the Bitcoin network, they process transactions and secure the blockchain. They are rewarded in BTC, but with lower prices they have to sell more to remain profitable.”

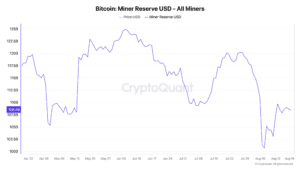

According to CryptoQuant, the amount of bitcoins held in connected miners’ dollar-denominated wallets has fallen by nearly $9.1 billion since the 2024 halving day.

This underperformance is due to Wall Street heavyweights launching spot Bitcoin exchange-traded funds, allowing traditional investors to gain exposure to BTC through mainstream financial markets.

Read more: There are now 11 spot Bitcoin ETFs. Here’s the one that’s best for you

The BTC movement after the 2024 halving also comes in a heated election year, with both Democrats and Republicans actively courting Bitcoin owners. Political circumstances, particularly changes in the US White House, are expected to significantly impact BTC’s price action.