- EUR/USD rose to a new 2024 high at around 1.1080 on Monday.

- The dollar continued to weaken, falling to a multi-month low.

- Next comes the final EMU inflation rate, ahead of the FOMC minutes.

EUR/USD extended its gains for the second day in a row at the start of the week, reaching new 2024 highs of around 1.1080, due to continued weakness in the US dollar (USD).

As a result, the greenback accelerated its correction and fell below the important support level of 102.00, reaching new multi-month lows as measured by the US dollar index (DXY). And this at a time when investors still expected the Federal Reserve (Fed) to begin its easing cycle in September.

Following the release of the consumer price index, expectations for a half-percentage-point Fed rate cut next month declined, with a smaller rate cut now seen as more likely. This view was also supported by better-than-expected results from other major US rates. Basics.

As for rate cuts, the probability of a 25 basis point rate cut is almost 77%, according to CME Group’s FedWatch tool.

While the European Central Bank (ECB) has remained silent so far, Fed policymakers are expected to announce their views ahead of the September meeting. Minneapolis Fed President Neel Kashkari suggested that it would be appropriate to consider the possibility of a Fed rate cut in September, citing the increasing likelihood of a labor market slowdown.

If the Fed decides to cut interest rates more sharply, the policy gap between the Fed and the ECB could narrow in the medium to long term, potentially supporting a further rise in the EUR/USD pair, especially as market participants expect two more ECB rate cuts this year.

However, the US economy is expected to outperform the European economy over the long term, suggesting that any sustained weakness in the greenback could be short-lived.

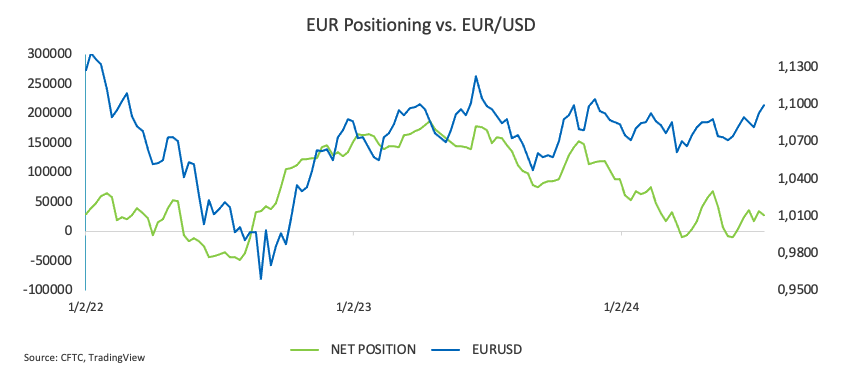

Data from the CFTC Positioning Report showed that non-commercial (speculator) net EUR long positions fell to a two-week low in the week ending August 13.

Looking ahead, the FOMC minutes will be the key data release this week, although investors are expected to closely monitor Chairman Jerome Powell’s speech at Jackson Hole as well as BoJ Governor Kazuo Ueda’s testimony before parliament.

EUR/USD daily chart

EUR/USD short-term technical outlook

Further north, EUR/USD is likely to test its 2024 high of 1.1083 (August 19) before reaching its December 2023 high of 1.1139 (December 28).

On the downside, the pair’s next target is the 200-day SMA at 1.0842, then the weekly low of 1.0777 (August 1) and the June low of 1.0666 (June 26), both of which are ahead of the May low of 1.0649 (May 1).

Overall, the pair’s uptrend should continue provided it stays above the crucial 200-day SMA.

So far, the four-hour chart shows a clear increase in the positive trend. The first resistance is at 1.1083, ahead of 1.1132. On the other hand, there is immediate support at 1.0949, ahead of 1.0881 and the 200-SMA of 1.0888. The Relative Strength Index (RSI) rose above 77.