The market for Alpen Co.,Ltd.’s (TSE:3028) was little moved following its recent weak earnings release. We believe the weaker headlines could be offset by some positive underlying factors.

Check out our latest analysis for AlpenLtd

How do unusual items affect profits?

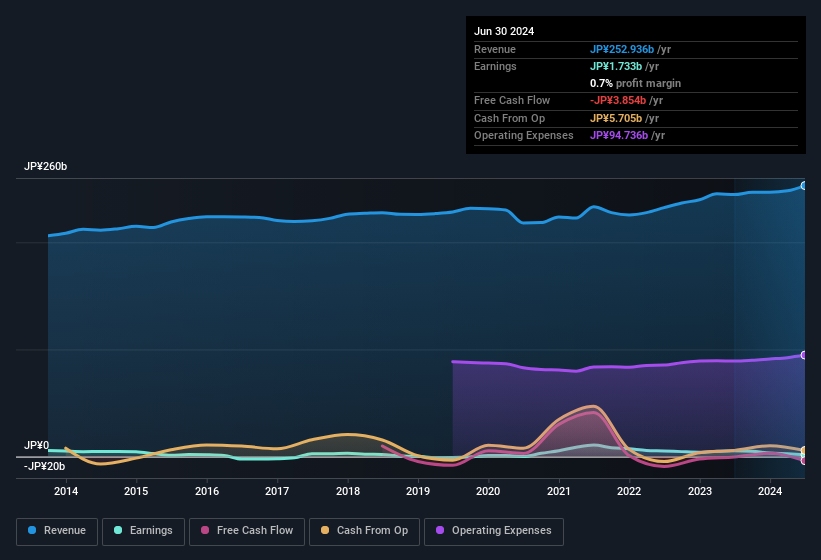

Importantly, our data indicates that AlpenLtd’s profit was shaved by JP¥2.6bn last year due to unusual items. While deductions due to unusual items are disappointing to begin with, there is one bright spot. When we analyzed the vast majority of listed companies globally, we found that significant unusual items are often not repeated. And that’s exactly what the accounting terminology implies. AlpenLtd took a pretty significant hit from unusual items in the year to June 2024. Therefore, we can assume that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: We always recommend that investors check the strength of the balance sheet. Click here to access our balance sheet analysis of Alpen AG.

Our assessment of AlpenLtd’s earnings development

As mentioned, AlpenLtd’s earnings were impacted by unusual items over the last year. Because of this, we believe AlpenLtd’s underlying earnings potential is as good, or possibly even better, than its statutory profit would suggest! Unfortunately, however, earnings per share have actually declined over the last year. Ultimately, it’s important to consider more than just the factors mentioned above if you want to properly understand the company. If you want to dive deeper into AlpenLtd, you should also investigate what risks the company is currently facing. For example: AlpenLtd has 3 warning signs In our opinion, you should be aware of this.

Today we’ve focused on a single data point to better understand the nature of AlpenLtd’s earnings. But there’s always more to discover if you’re able to dig deeper. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You might want to check it out here. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.