David Iben put it well when he said, “Volatility is not a risk we care about. What we care about is avoiding permanent loss of capital.” So it should be obvious that you have to take debt into account when thinking about how risky a particular stock is, because too much debt can ruin a company. AxoGen, Inc. (NASDAQ:AXGN) has a lot of debt. But should shareholders be concerned about its use of debt?

What risks are associated with debt?

Debt is a means of helping businesses grow, but if a company is unable to repay its lenders, it is at their mercy. A key part of capitalism is the process of “creative destruction,” in which failed companies are mercilessly liquidated by their bankers. A more common (but still costly) situation, however, is that a company must dilute its shareholders at a cheap share price just to get its debt under control. Of course, the advantage of debt is that it often represents cheap capital, particularly when it replaces a company’s dilution with the ability to reinvest at a high rate of return. When we think about a company’s use of debt, we first consider cash and debt together.

Check out our latest analysis for AxoGen

What is AxoGen’s net debt?

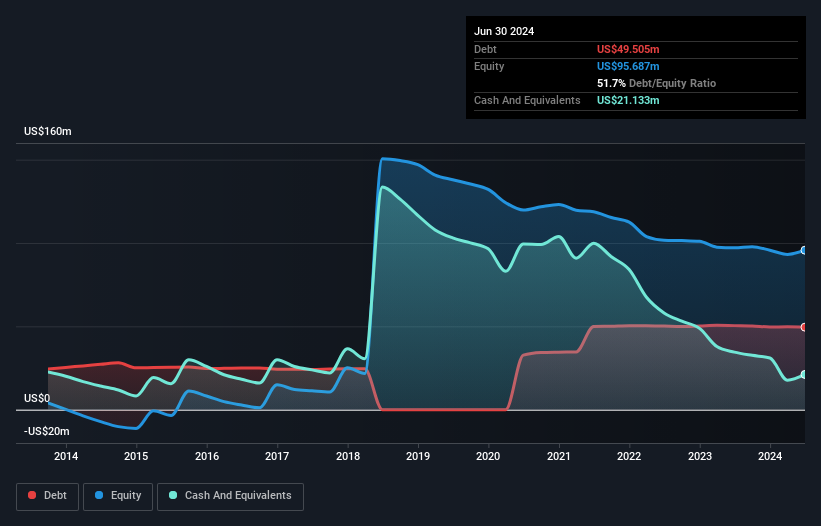

The chart below, which you can click on for more details, shows that AxoGen had $49.5 million in debt in June 2024; about the same as the year before. However, the company also had $21.1 million in cash, so its net debt is $28.4 million.

How healthy is AxoGen’s balance sheet?

From the most recent balance sheet, AxoGen had liabilities of US$23.4 million due within a year and liabilities of US$69.8 million due beyond that, offsetting US$21.1 million in cash and US$25.2 million in receivables due within 12 months. So the company’s liabilities total US$47.0 million more than its cash and short-term receivables combined.

Since AxoGen’s listed shares are worth a total of $514.1 million, this level of liabilities is unlikely to pose a major threat. Still, it’s clear that we should continue to monitor the balance sheet lest it change for the worse. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the company’s future profitability will determine whether AxoGen can strengthen its balance sheet over time. So, if you’re focused on the future, you might want to look at free Report with analysts’ profit forecasts.

Last year, AxoGen was not profitable at the EBIT level, but managed to grow its revenue by 17% to $173 million. That growth rate is a bit slow for our liking, but it takes all kinds of people to create a world.

Reservation by the buyer

Importantly, AxoGen posted a loss before interest and tax (EBIT) last year. More specifically, the EBIT loss was US$12 million. Taking that into account, along with the liabilities mentioned above, we are not very confident that the company should take on so much debt. Therefore, we think the balance sheet is a bit stretched, but not beyond repair. Another reason for caution is that the company lost US$15 million in negative free cash flow over the last twelve months. So suffice it to say that we think the stock is risky. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, any company can contain risks that exist off the balance sheet. We have identified 1 warning signal with AxoGen, and understanding them should be part of your investment process.

If you are interested in investing in companies that can grow profits without the burden of debt, check this out free List of growing companies that have net cash on their balance sheet.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.