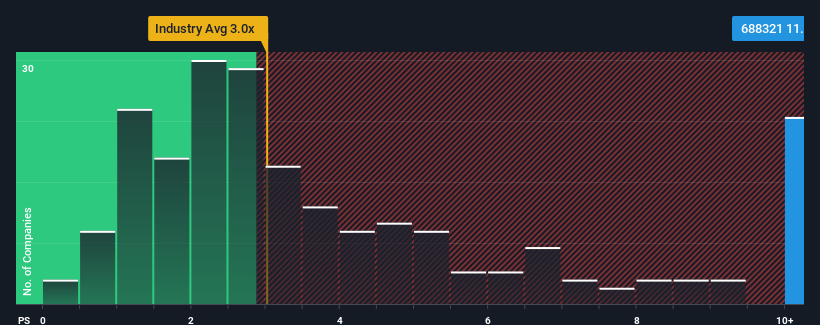

Considering that almost half of the pharmaceutical companies in China have a price-to-sales ratio (P/E) of less than 3x, Shenzhen Chipscreen Biosciences Co., Ltd. (SHSE:688321) appears to be sending strong sell signals with its 11.7x P/S ratio. Still, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/S.

Check out our latest analysis for Shenzhen Chipscreen Biosciences

How has Shenzhen Chipscreen Biosciences developed recently?

Shenzhen Chipscreen Biosciences could be doing better, as its revenue growth has been slower than most companies recently. Many may be expecting a significant rebound from the uninspiring revenue trend that has prevented the P/S ratio from collapsing. That’s what you’d really hope, otherwise you’re paying a pretty high price for no particular reason.

Do you want to know how analysts assess the future of Shenzhen Chipscreen Biosciences compared to the industry? In this case free Report is a good starting point.

How is Shenzhen Chipscreen Biosciences’ sales growth developing?

A P/S ratio as high as Shenzhen Chipscreen Biosciences’ would only be truly comfortable if the company’s growth is on track to significantly outpace the industry.

Looking back, last year saw a decent increase in sales of 5.2% for the company. Over the last three-year period, total sales also increased by an excellent 71%, partly thanks to short-term developments. So, first of all, we can say that the company has done an excellent job of increasing its sales during this time.

According to the only analyst covering the company, revenue is expected to grow 40% next year, well above the 17% growth forecast for the industry as a whole.

With this in mind, it’s not hard to understand why Shenzhen Chipscreen Biosciences’ P/S ratio is high compared to its industry peers. Apparently, shareholders aren’t interested in offloading something that potentially has a better future ahead of it.

What can we learn from Shenzhen Chipscreen Biosciences’ P/S?

It’s not a good idea to use the price-to-sales ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

Our look at Shenzhen Chipscreen Biosciences shows that the price-to-earnings ratio remains high due to strong future sales. It seems that shareholders have confidence in the company’s future sales, which supports the price-to-earnings ratio. Under these circumstances, it is difficult to imagine the share price falling much in the near future.

Many other significant risk factors can be found in the company’s balance sheet. Our free Using the balance sheet analysis for Shenzhen Chipscreen Biosciences, you can identify all possible risks through six simple checks.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.