The price of Ethereum (ETH) could benefit from a change in investor attitude as they move from selling to potentially buying.

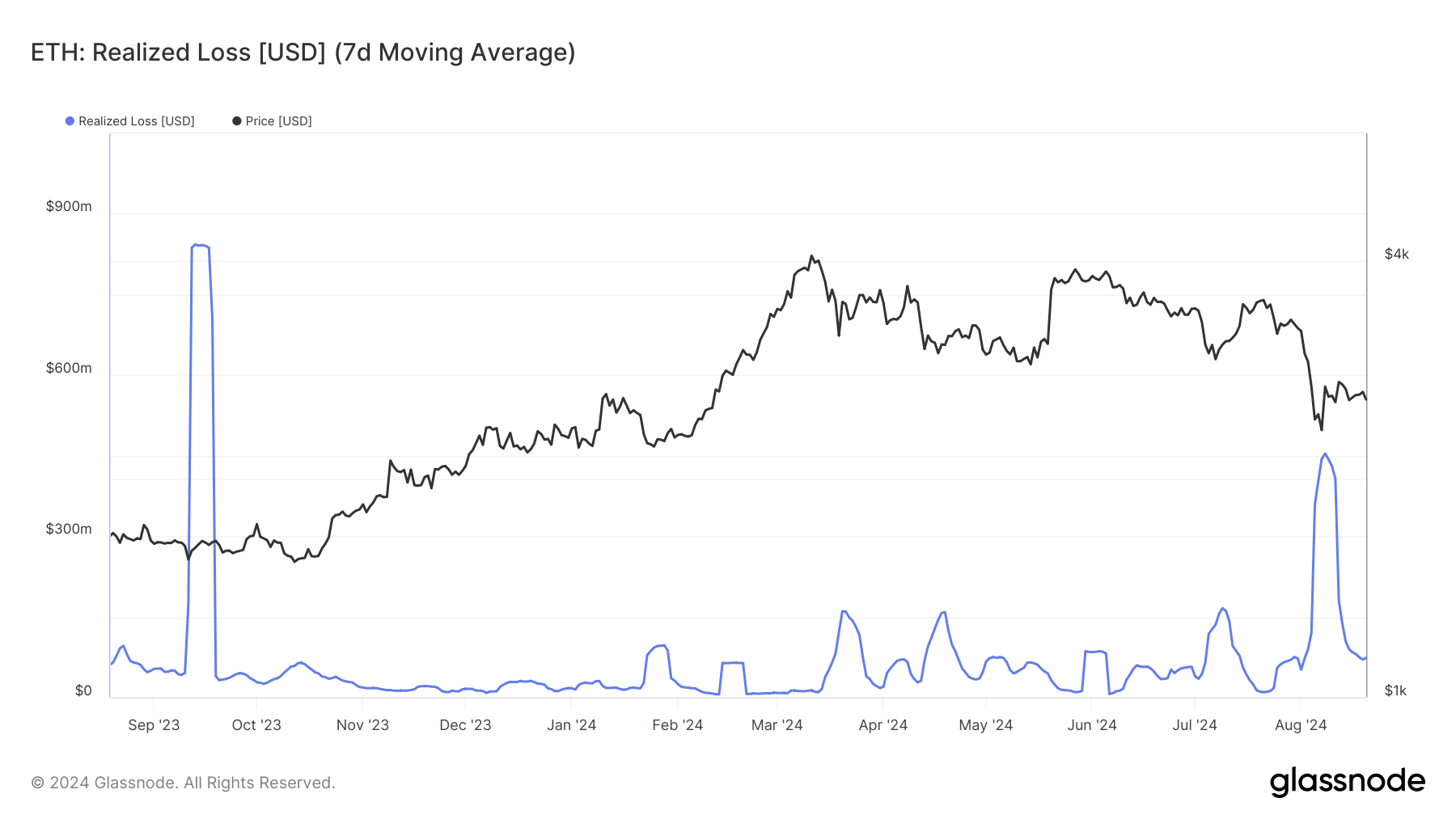

These clues come from the decline in realized losses, which reached an 11-month high less than two weeks ago.

Ethereum investors’ confidence could increase

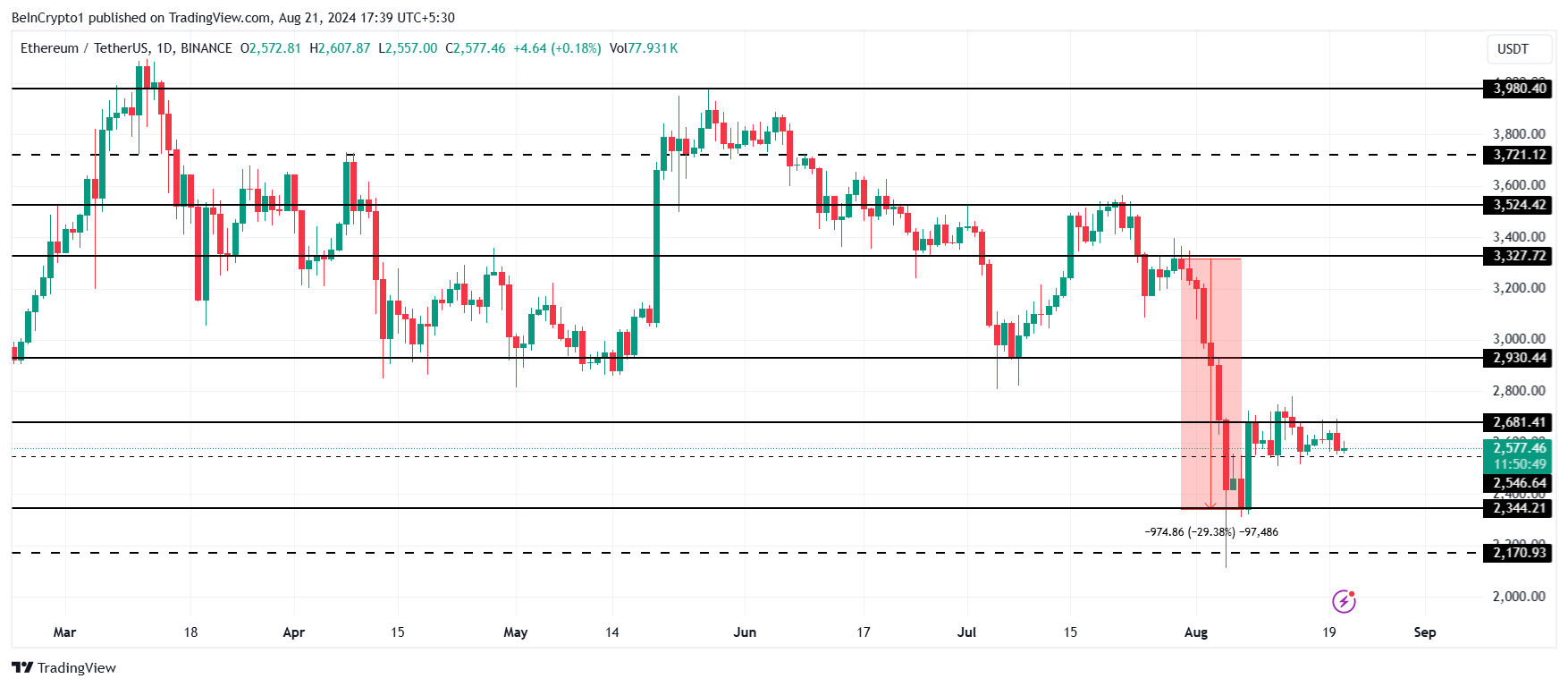

The price of Ethereum could Come back from lows of $2,500 it is currently fluctuating around the $2,681 mark and the altcoin king is waiting for a breakout that could come soon.

The reason for this is the sell-off. Looking at the realized losses incurred by ETH holders over the past three weeks, one can see that the July crash triggered panic. This led to sudden selling, resulting in heavy losses.

Read more: How to invest in Ethereum ETFs?

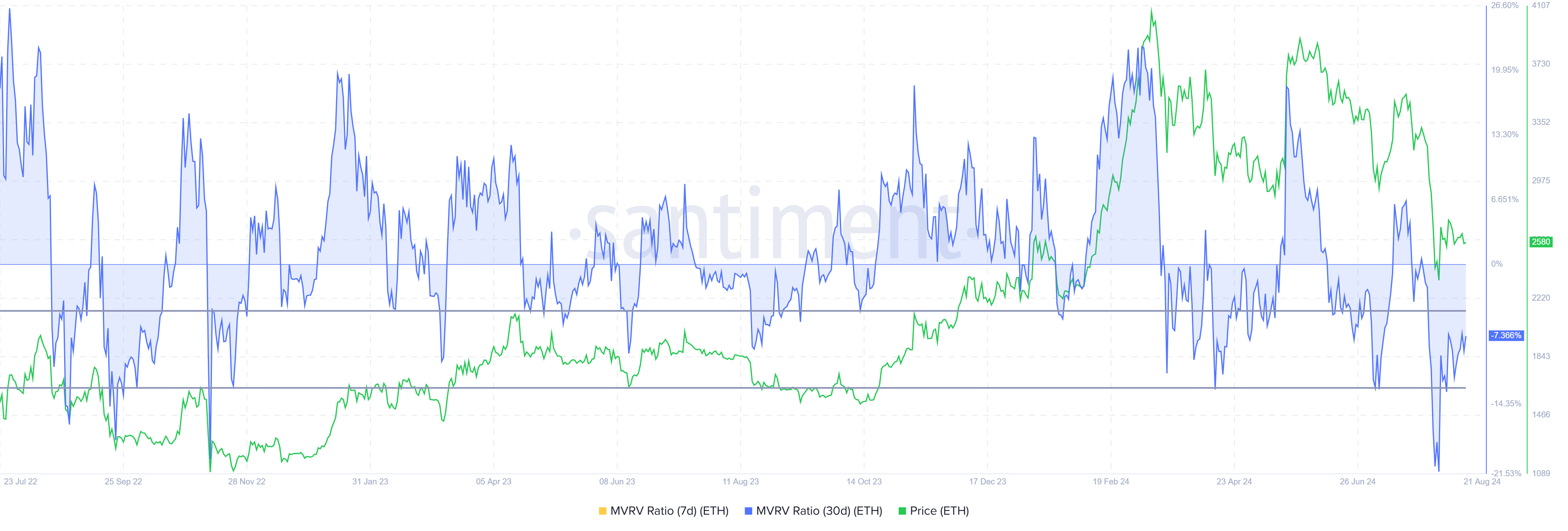

However, this has changed significantly in the last ten days as the price recovered slightly and hopes of a rise have resurfaced. This is a bullish sign and the market value to realized value (MVRV) ratio reinforces this signal even further.

If ETH holders start accumulating from here, Ethereum’s price recovery could strengthen.

ETH price prediction: Close to breakout

Ethereum price at $2,577 is currently trading sideways between $2,681 and $2,546. This short-term consolidation has kept ETH stuck for two weeks.

However, the above factors point to a possible breakout from this consolidation. This break could push ETH towards the next resistance at $2,930, and a rise above it would push ETH to $3,000. A bounce off this resistance could push Ethereum’s price to $3,300, and reaching this point would be a sign of a full recovery from the July crash.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if Ethereum price fails to break above $2,930, it could see further consolidation above $2,681. A sustained sideways movement could invalidate the short-term bullish thesis.

Disclaimer

Per the Trust Project’s guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions can change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.