- Ethereum traded in a key resistance zone.

- An impulsive upward move is expected, but traders should be wary of a breakout.

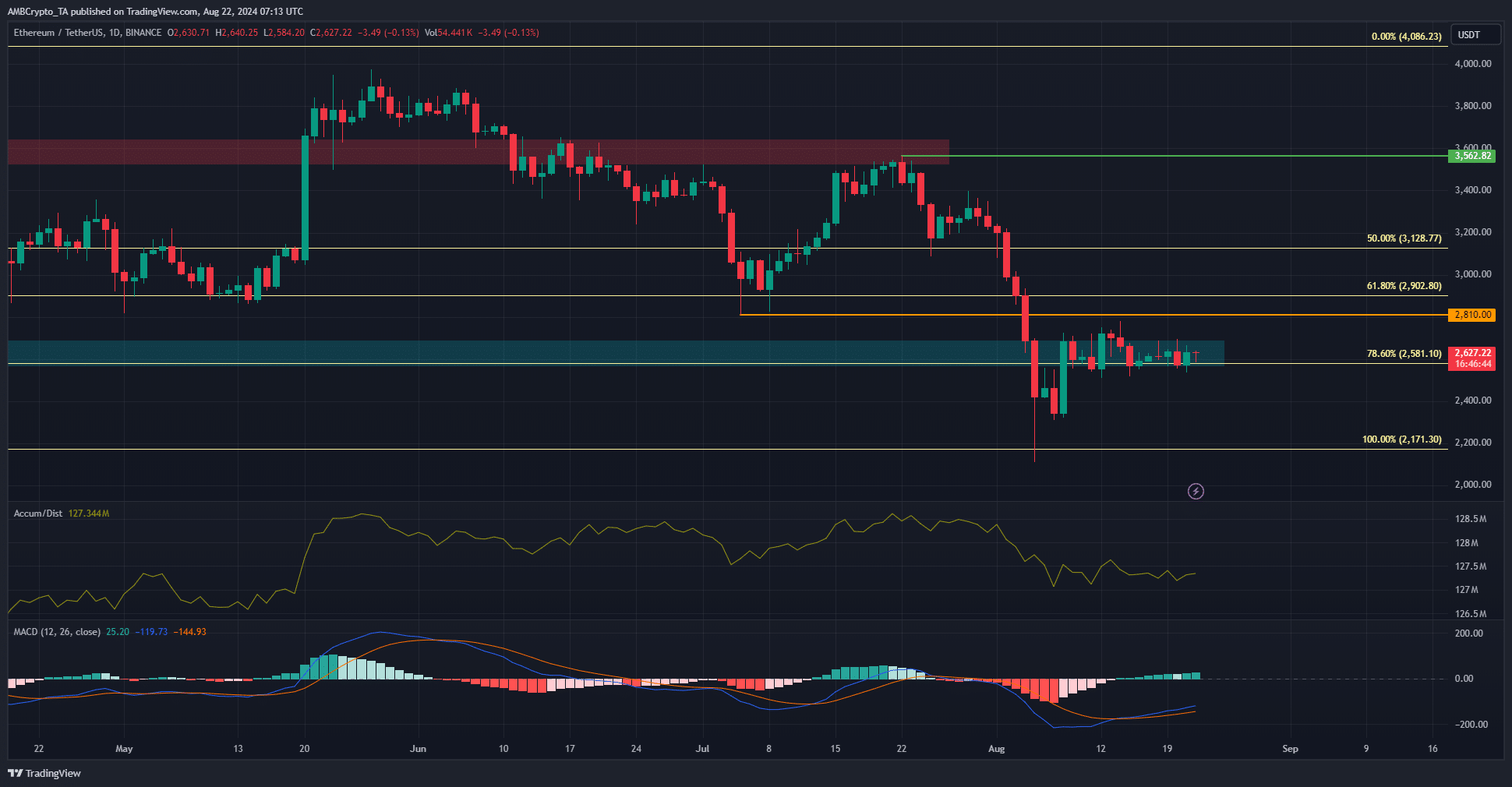

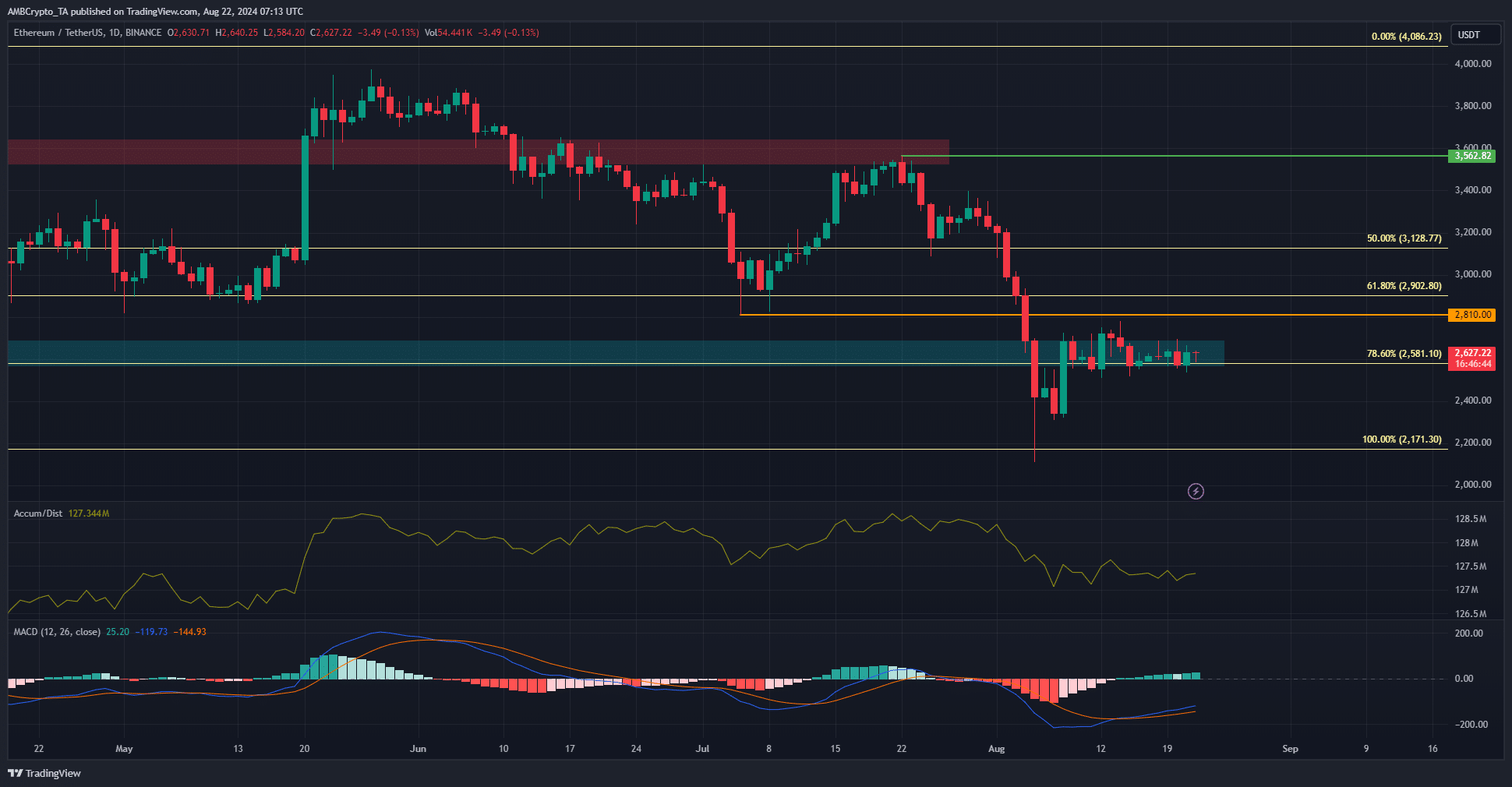

Ethereum (ETH) has been in a long-term downtrend. The price has been stuck in the $2550-$2730 zone for almost two weeks. The long-term downtrend and bull vs. bear scenario were examined in detail in a recent AMBCrypto report.

An investigation found that Ethereum users are increasingly opting for private transactions that consume more gas. This increases the volatility of the base fee and could disadvantage network users.

Is this an accumulation phase before the next bullish expansion?

Source: ETH/USDT on TradingView

The market structure on the daily time frame was still bearish. The price restriction around $2.6k over the past two weeks could pave the way for a strong upward move. This is because the early August crash left some imbalances on the chart.

However, even if ETH rises to $3,000, it may not be enough to initiate a breakout. The A/D indicator showed that bulls were indifferent during the recent consolidation and did not have the strength to push prices higher.

An upward movement would therefore be driven by liquidity rather than demand and could reverse afterwards.

Spot demand supports a pessimistic short-term ETH price forecast

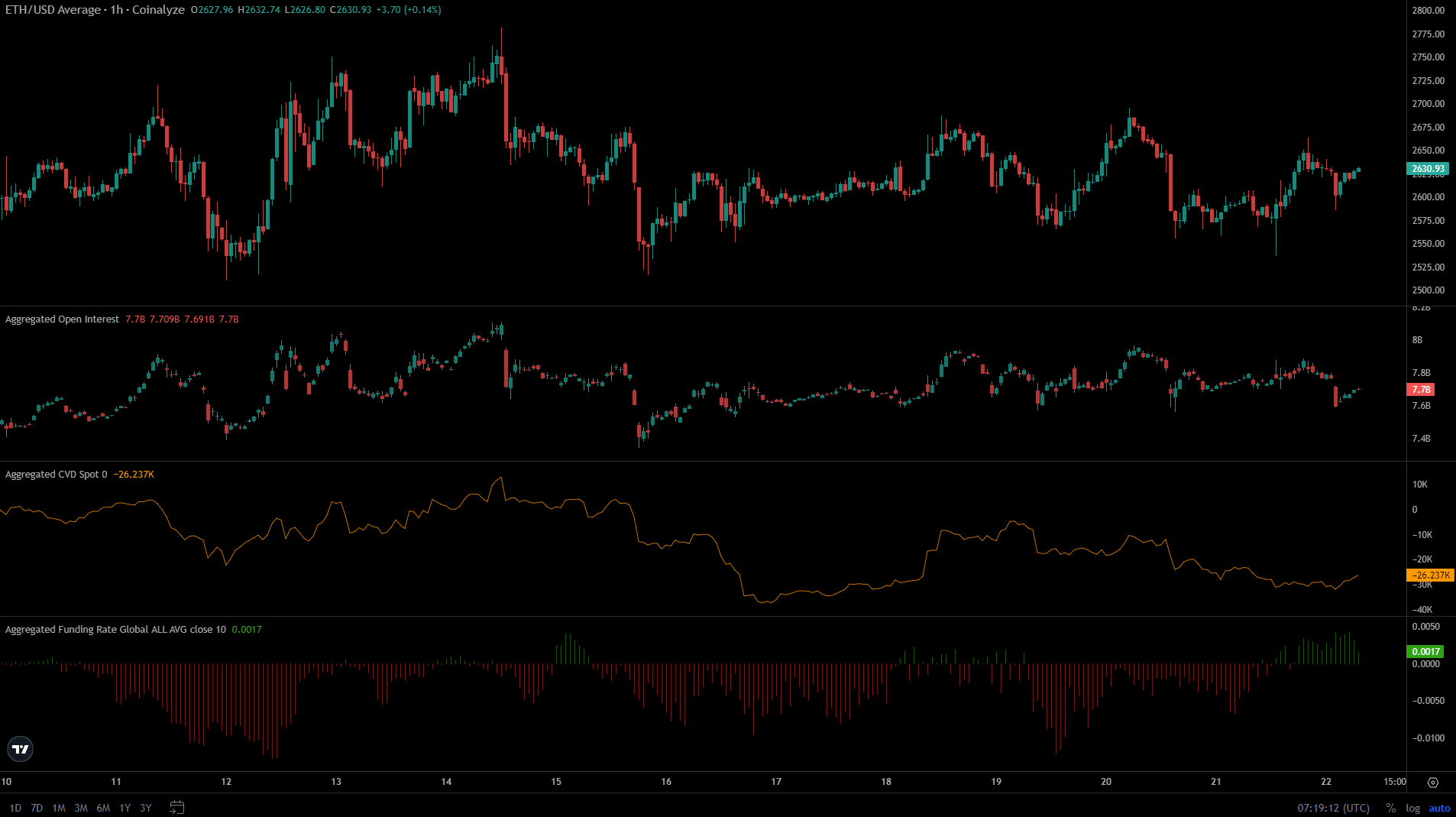

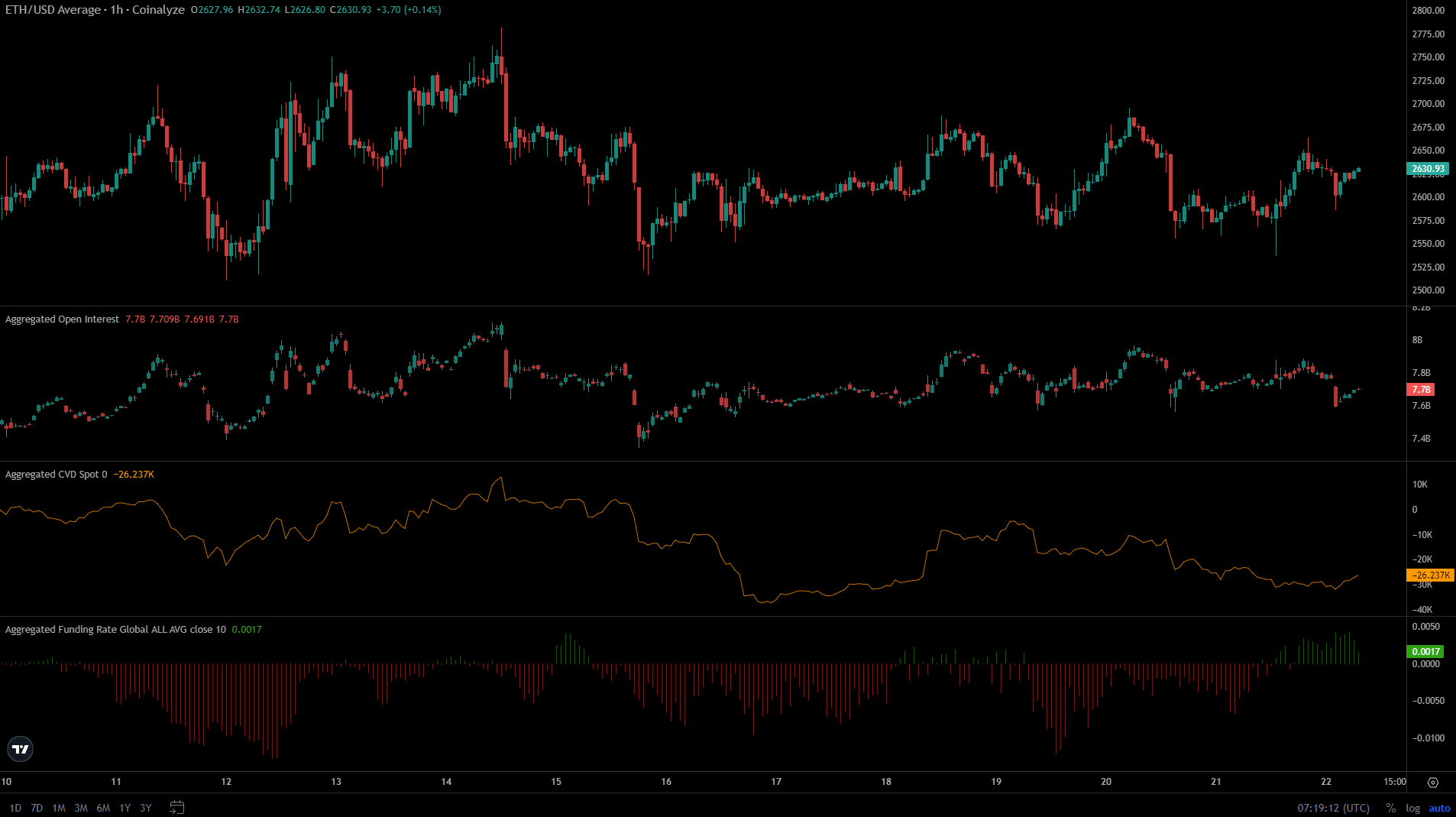

Source: Coinalyze

On the lower time frames, the open interest behind Ethereum has been fluctuating in parallel with the price since August 18, indicating a lack of conviction in the futures market.

The previously negative funding rate moved into positive territory, a sign that speculators were taking long positions, but not a clear sign of an uptrend.

On the other hand, the decline in spot CVD was a bearish signal, reinforcing the lack of demand behind ETH.

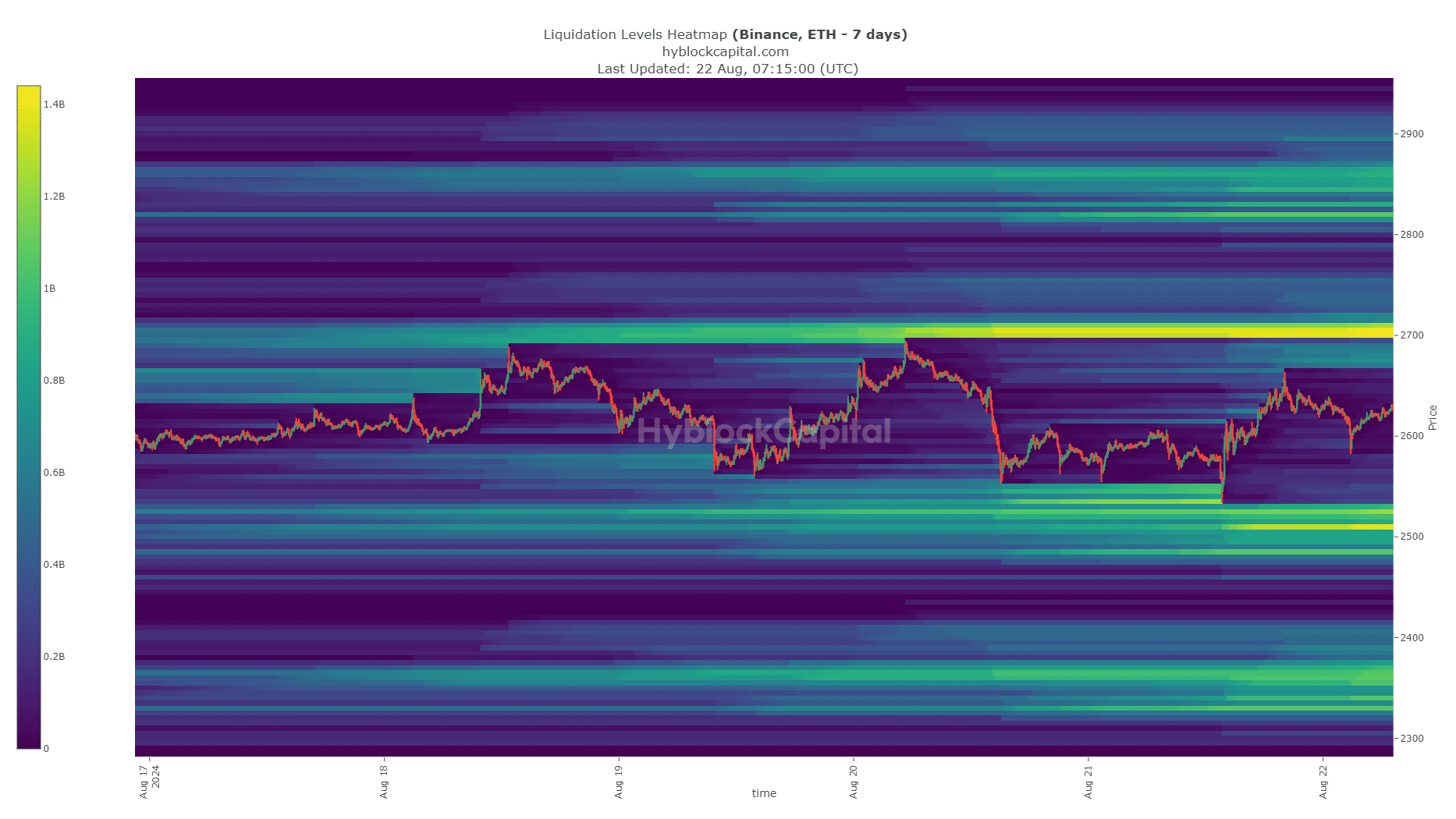

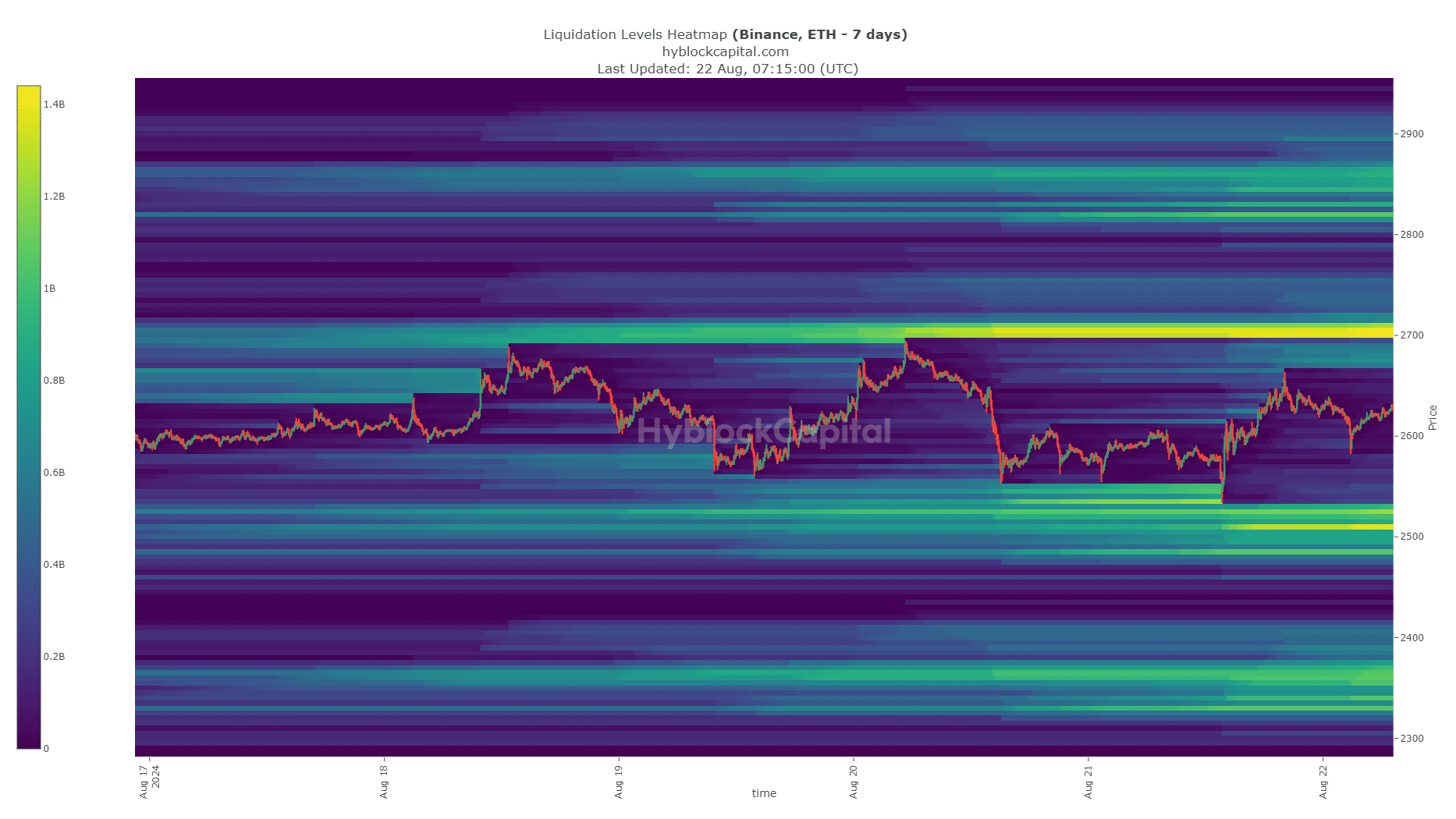

Source: Hyblock

The liquidation heatmap highlighted $2.7k and $2.5k as short-term price targets. As things stand, a move towards $2.7k in the coming days seems very likely.

Therefore, the short-term Ethereum price prediction is optimistic and a move towards $2,850 would also be possible.

Is your portfolio in the black? Check the Ethereum profit calculator

Such a move would be driven by the magnetic zone and would likely reverse, so traders can wait for opportunities to sell the upside rather than buying ETH near the $2.9k-$3k resistance zone.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and reflects solely the opinion of the author.