Transferring points to travel loyalty programs is the best way to get the most value, but that doesn’t mean it’s easy. (Getty Images)

By Sam Kemmis | NerdWallet

Remember those old internet ads that promised a “funny trick” that would permanently improve your fitness? I never clicked on them, but I wonder if the trick was to “exercise frequently.” Because that would work.

Likewise, I’m constantly asked how to best use credit card rewards points—more specifically, points issued by banks to cover a variety of travel expenses. According to the Consumer Financial Protection Bureau, three-quarters of credit card accounts offered rewards in 2022, and many of those offer flexible redemption options. The answer is surprisingly simple: Learn how to transfer those points into travel loyalty programs.

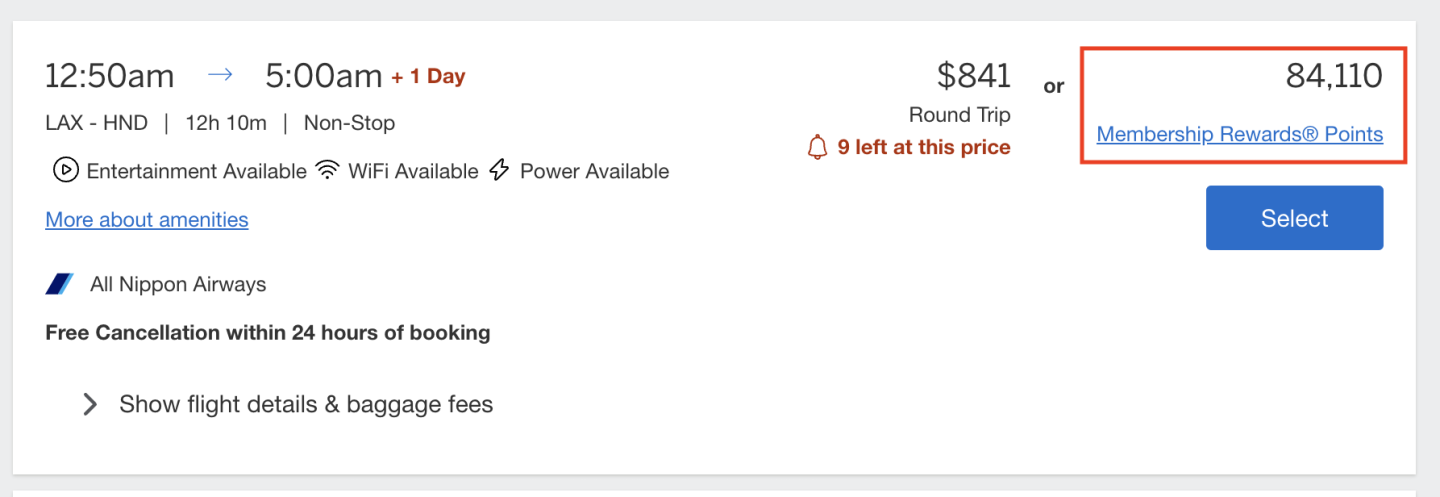

Transferring points isn’t a particularly easy or obvious option. But the value of points from popular carrier loyalty programs — like Chase Ultimate Rewards®, American Express Membership Rewards and Capital One miles — can vary widely depending on how you use them. That’s why NerdWallet offers both a “base value” and a “maximum value” in our points ratings.

The base value represents how much points are worth when used to book travel directly through the issuer’s rewards portal, such as Chase Travel℠ or Capital One Travel. The maximized value refers to how much those points are worth when transferred to the best partner program. For example, American Express Membership Rewards’ base value is 1 cent, while the maximized value (when transferred to the best partners) is 2 cents.

Don’t be put off

Most credit card rewards programs make it easy for you to use your points toward their base value. They usually display the cost of using points right next to the cash price when you search for travel on their booking platforms.

To be clear, there’s nothing wrong with using your points this way. Sometimes it’s even the most valuable redemption option. And you generally get benefits like earning miles for flights you book this way. But there are other ways to do it.

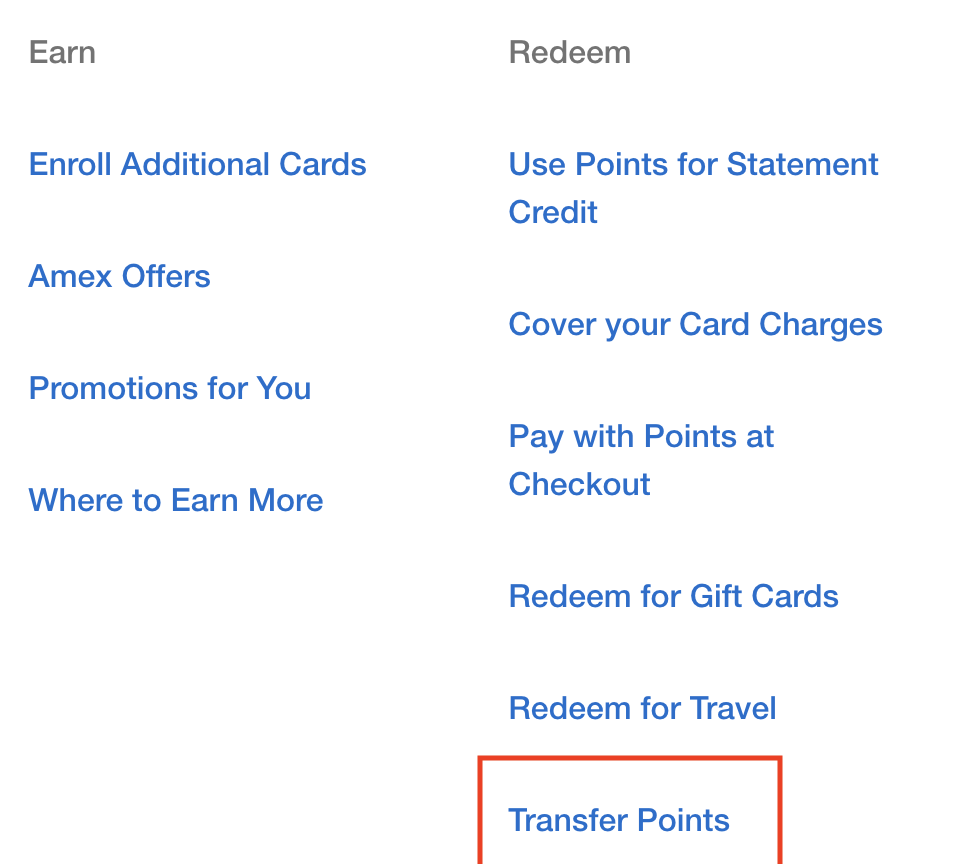

American Express places the “transfer points” option at the bottom of a hard-to-find menu on its account page. Don’t be put off.

Figuring out how to actually transfer your points is one thing. Then comes the real challenge: which affiliate program should you transfer them to?

This is the step that most people – myself included – are most likely to be put off by. Each credit card program has a long list of transfer partnerships, ranging from well-known US brands like Delta Air Lines to international airlines like EVA Air. Which transfer partner is the “best”?

Be clear about your goals

Many articles on maximizing points focus on redemptions that offer the best dollar-per-point value, and that’s almost always business and first class awards. But it’s worth asking: Is that what you want?

If you’re already planning to fly in a premium cabin, these articles may be helpful. However, there are many problems with booking these awards, including limited availability, complex booking processes, high fuel surcharges, and other fees.

If you fly economy, your dollar-per-point value may be worse than if you were flying first class, but you may be able to get more travel out of your points. And if you transfer points into loyalty programs for economy flights, you may still have an advantage over booking directly through an issuer. Don’t suddenly become a champagne-swilling points maximizer just because an article told you to.

Also important: Do not transfer your points until you are sure that the redemption you want is actually available. Otherwise, you will be stuck with a bunch of points in random programs and this trick will become a major nuisance.

Stay tuned

The problem with this strange trick is that, just like with sports, it requires endurance. It is not a cure-all.

According to a 2022 report from the Consumer Financial Protection Bureau, credit card holders receive $40 billion in rewards each year. And most of those rewards aren’t put to optimal use.

Simply considering transfer partnerships as an option when using your credit card points puts you ten steps ahead of most people.

Sam Kemmis writes for NerdWallet. Email: [email protected]. Twitter: @samsambutdif.

The article “Maximize Your Credit Card Points With Just One (Major) Skill” originally appeared on NerdWallet.