Penny stocks can be known to be exciting investments. And not necessarily in a positive sense.

These small-cap stocks are often young companies with significant growth potential. If all goes well, they can experience tremendous earnings growth, driving up their share prices.

However, penny stocks can also often experience significant price fluctuations due to weak liquidity and a high level of speculative trading. They can fall particularly sharply when economic conditions worsen and concerns about their balance sheet strength increase.

Shop cheaply

For this reason, buying low-value penny stocks can be a good idea. The risk of a sharp decline in the price may be limited because the market is already pessimistic about the company’s prospects.

There are other benefits to buying cheap stocks. If the company performs strongly, the share price can explode as investors realize the company’s true value.

With that in mind, here are two top growth stocks that I think are worth a closer look today.

Golden Star

Buying commodity stocks can be a wild affair. Commodity prices are often volatile, meaning the prices of these stocks can rise or fall from one moment to the next.

But given the positive outlook for precious metals, investing in gold producers might be a good idea. Serabi Gold (LSE:SRB), which trades at 66.5p per share and has a market capitalization of £50.4 million, is one such company on my radar.

There is no guarantee that the price of gold will rise above the record high of around $2,450 an ounce reached in May. However, there is a “perfect storm” of factors that could push the metal price significantly higher. These include:

-

Persistent global inflation

-

Major electoral shifts in Europe (and especially in France)

-

High national debt, especially in the USA

-

Continued weakness of the Chinese economy

-

Growing tensions between the West and Russia and China

But why should you buy Serabi Gold shares to profit? First of all, the shares represent good value today. The Brazilian mining company is trading at a price-to-earnings (P/E) ratio of 4, an all-time low.

Gold production is also rising as the company increases production at its Coringa assets. Group production increased 12.5% between January and March, representing the highest quarterly revenue since 2021.

Street festival

Michelmersh Brick Holdings (LSE:MBH) is another good value penny stock to consider today.

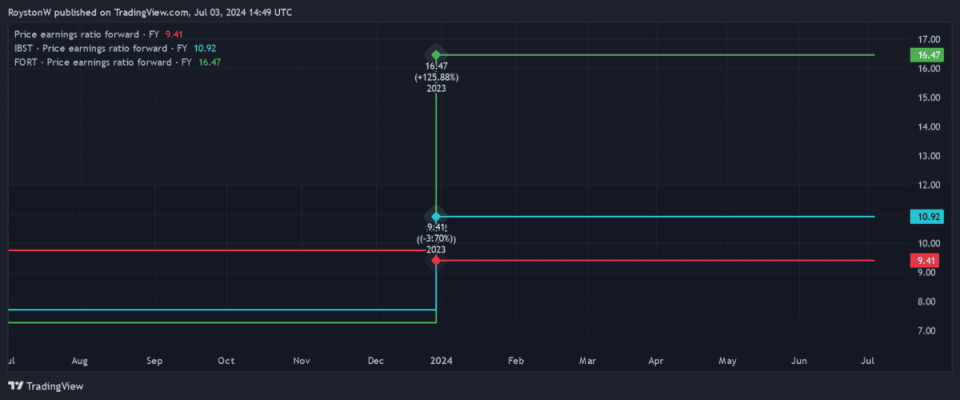

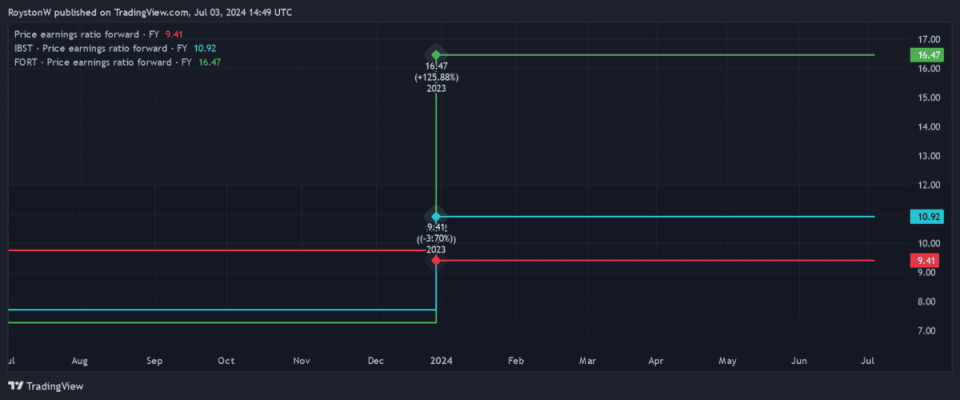

At the current price of 95.4 pence, the company, with a market capitalisation of £93.7 million, appears to be significantly undervalued compared to some of its peers. The gap between its P/E ratio of 9.4 and that of its peers Ibstock (in blue) and Forterra (in green), is shown below.

But what makes brick manufacturers like these such an attractive investment? Admittedly, demand for homes in the UK is currently weak due to higher than average interest rates. This will continue to pose a threat unless inflation remains low.

However, the long-term outlook for the housing market remains robust. The UK will need to significantly increase housebuilding activity in the coming years to meet the housing needs of its growing population, so sales of all types of building products could soar.

Michelmersh also expects demand for bricks to remain robust in the repair, maintenance and improvement (RMI) market. The UK’s stock of old buildings needs constant renewal to survive.

The post “2 dirt-cheap penny stocks investors should consider this July!” appeared first on The Motley Fool UK.

Further reading

Royston Wild has positions in Ibstock Plc. The Motley Fool UK has recommended Ibstock Plc. The views expressed on companies mentioned in this article are those of the author and may therefore differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024