The head of the US Federal Reserve said that “the time has come” for central banks to cut interest rates. However, he gave little indication of how quickly and to what extent borrowing costs could fall.

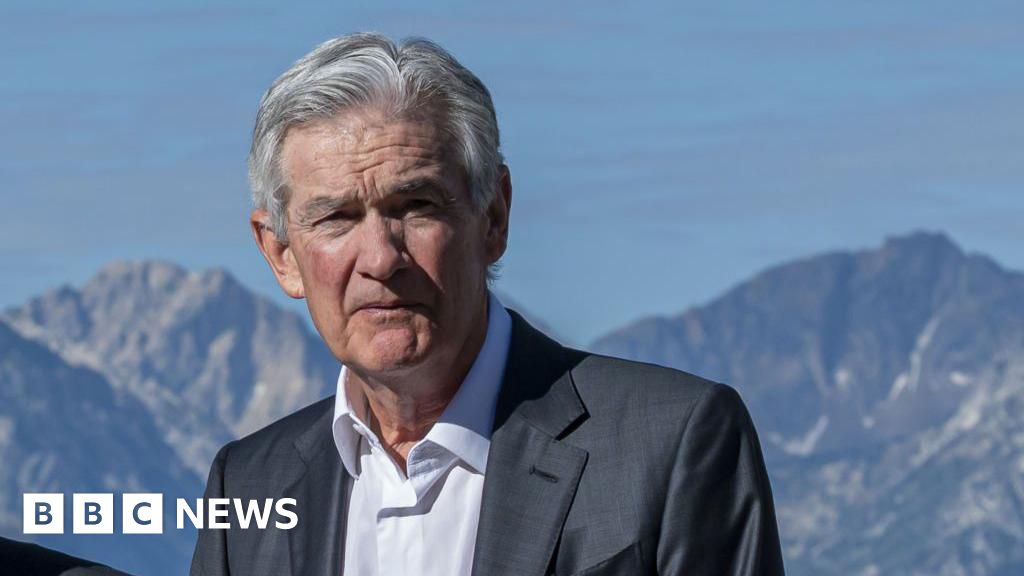

Federal Reserve Chairman Jerome Powell’s speech was closely watched as rising unemployment revived concerns about how the U.S. economy can hold up in the face of higher interest rates.

Mr Powell said the bank was increasingly focusing on the labor market as it became increasingly confident that the U.S. had moved beyond the price increases that began during the pandemic.

Inflation, which measures the pace of price increases, fell to 2.9% in the U.S. last month, the lowest level since March 2021.

“It’s time to adjust policy,” Powell said at a conference in Jackson Hole, Wyoming, adding that the timing and pace of cuts would depend on the data.

These remarks signaled the beginning of a new battle for the Fed after more than two years of focusing on price stabilization.

The Fed has kept its key interest rate at around 5.3% since last July, staying away from the rate cuts sought by central banks in other countries, including the UK.

Powell argued that the U.S. economy was healthy enough to cope with high interest rates, pointing to steady employment growth that had helped households cope with rising prices and higher borrowing costs.

But that growth has slowed significantly since last year, and the unemployment rate has risen to 4.3%, raising renewed fears that Fed policies could derail the recovery and put millions of people out of work.

In the United States, most of the Fed’s previous interest rate hike campaigns resulted in an economic recession.

In his speech, Powell acknowledged a significant slowdown in the labor market and said the Fed was “not seeking or welcoming a further slowdown.”

However, he dismissed concerns that another recession could occur in the near future, arguing that the rise in unemployment was linked to a decline in hiring rather than a sudden increase in layoffs.

“There are good reasons to believe that the economy will return to 2 percent inflation while the labor market remains strong,” he said, later adding that the “pandemic economy” had proven to be “unlike any other.”

Following these comments, stock markets rose, with the Dow, S&P 500 and Nasdaq all climbing more than 0.5 percent.

Analysts said the speech made it all but certain that the bank would cut interest rates by at least 0.25 percentage points, as currently expected – or perhaps even more – at its meeting next month.

“The lack of any guidance suggests that Powell is keeping his options open,” said Stephen Brown, deputy chief North American economist at Capital Economics, after the speech.