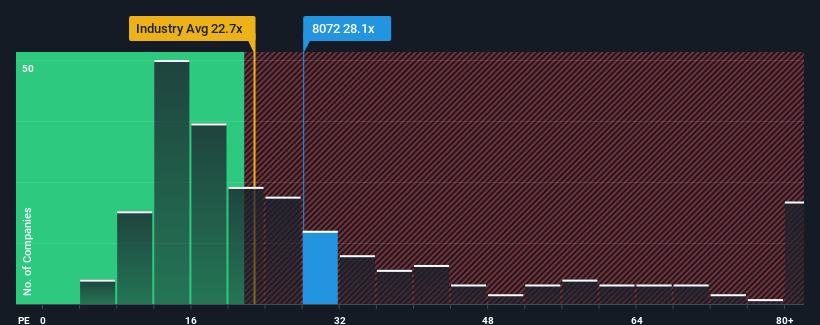

When nearly half of the companies in Taiwan have a price-earnings ratio (P/E) of less than 21, you may consider AVTECH Corporation (TWSE:8072) as a stock that may be worth avoiding with its P/E ratio of 28.1. Still, we would have to dig a little deeper to determine if there is a rational basis for the elevated P/E ratio.

For example, let’s say AV TECH’s financial performance has been poor recently as earnings have been declining. One possibility is that the P/E ratio is high because investors believe the company will still do enough to outperform the broader market in the near future. If not, existing shareholders may be quite nervous about the profitability of the share price.

Check out our latest analysis for AV TECH

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free AV TECH earnings, revenue and cash flow report.

How is AV TECH growing?

AV TECH’s P/E ratio would be typical of a company expected to deliver solid growth and, importantly, outperform the market.

If we look at the earnings over the last year, the company’s earnings have fallen by a disheartening 7.0%. However, since there were some very strong years before that, the company has managed to grow its earnings per share by an impressive 14,398% in total over the last three years. Although it has been a bumpy ride, it is still fair to say that the earnings growth of late has been more than adequate for the company.

Comparing the recent medium-term earnings performance with the broader market’s one-year forecast of 23% growth shows that the company is significantly more attractive on an annual basis.

With this information, we can see why AV TECH is trading at such a high P/E compared to the market. Presumably shareholders aren’t interested in dumping something they believe will continue to outmaneuver the stock market.

The most important things to take away

It is argued that the price-to-earnings ratio is not a good measure of a company’s value in certain industries, but can be a meaningful indicator of business sentiment.

As we suspected, our research into AV TECH found that its three-year earnings trends contribute to its high P/E as they look better than current market expectations. At this point, investors believe that the potential for earnings deterioration is not large enough to justify a lower P/E. Unless recent medium-term conditions change, they will continue to provide strong support to the share price.

Please note, however, AV TECH shows 2 warning signals in our investment analysis what you should know.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.