The Apple Card recently celebrated its five-year anniversary and I’ve been thinking recently about what will happen next with the credit card. Since the Apple Card isn’t particularly profitable and Apple wants to position itself more as a service company, I think it could make a lot of sense for Apple to offer a higher-end credit card.

Apple Card today

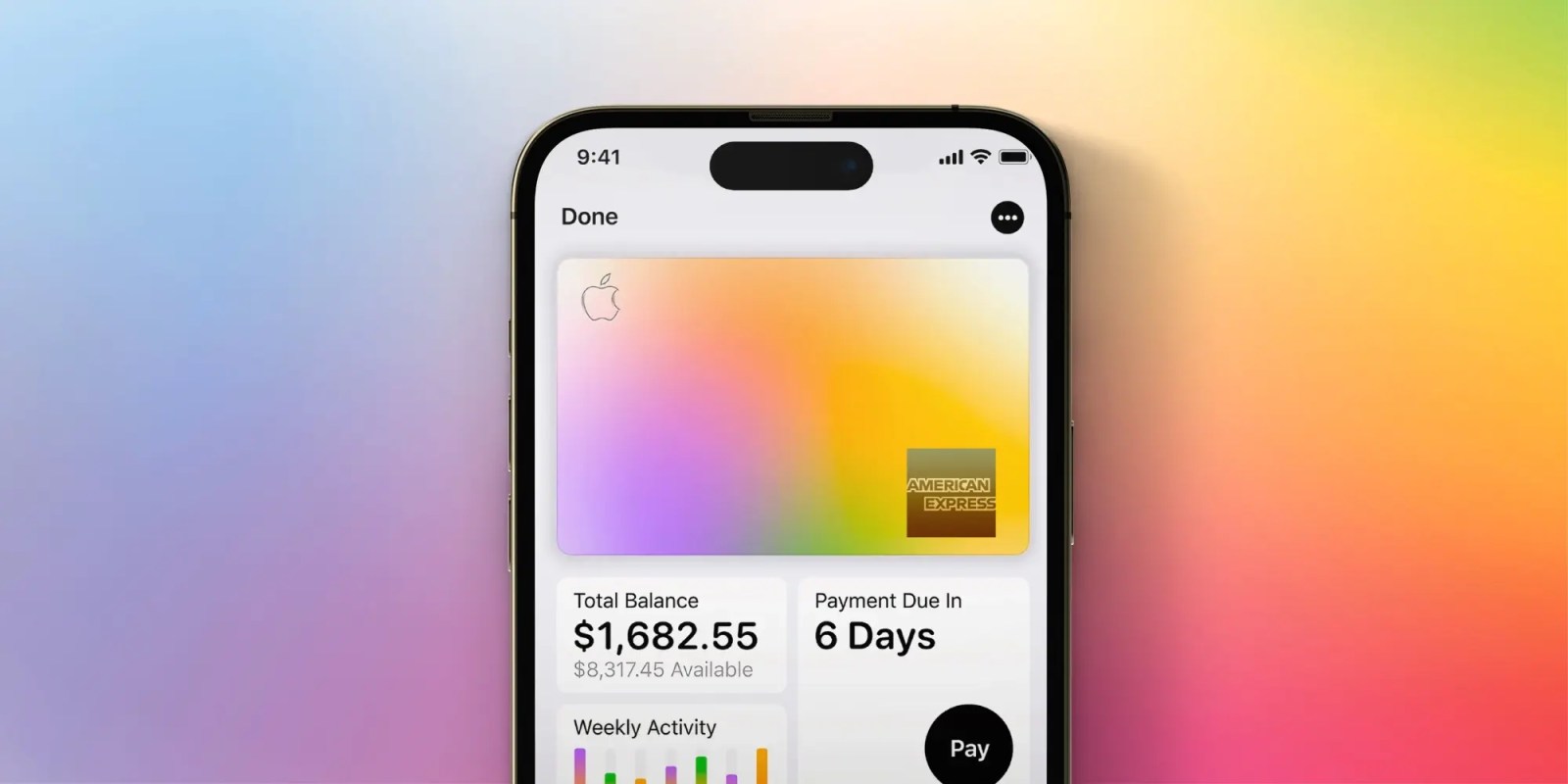

Currently, the Apple Card is a basic credit card with no annual fee that offers 2% cash back when you use Apple Pay. There’s also a boosted 3% bracket for Apple and other partner merchants, which encourages users to spend more money with Apple. It’s not bad, but it’s not a particularly exciting credit card either.

The Apple Card in its current form also cost Goldman Sachs (the issuing bank) over a billion dollars, and Goldman Sachs will be ending its partnership with the Apple Card in the next 3-6 months. Given these two points, I think it could be quite interesting to see a version of the Apple Card with an annual fee that is more geared towards travel…

The competition

There are a number of banks in the general travel credit card space, such as Chase, American Express, Citi, and Capital One. When I say general, I just mean that the cards aren’t directly partnered with an airline or hotel. However, most of these establishments require multiple cards if you want to maximize value. I think Apple could simplify things and make general travel credit cards more appealing to a wider audience.

For example, a popular setup is the Chase Trifecta, which consists of Chase Freedom Unlimited, Chase Freedom Flex, and Chase Sapphire Preferred. The first two cards have no annual fee, while the third costs $95. All three cards earn points in the same ecosystem, so you can pool them all together and transfer them to one of Chase’s travel partners—such as Southwest Airlines, World of Hyatt, or one of many others.

The Chase Freedom Unlimited’s primary purpose is to earn 1.5x points on all purchases, the Freedom Flex offers 5x points on certain rotating categories (gas stations, grocery stores, etc.), and the Sapphire Preferred offers 3x points on dining and 2x points on travel. Sapphire Preferred also offers a range of travel insurance, making it the preferred card for all travel insurance needs.

Revenue from “Apple Card Pro”

I think Apple could develop a really good, single credit card focused on travel, although it wouldn’t be easy. Apple would need to partner with a number of hotels and airlines to make the Apple points ecosystem worthwhile, something banks like Wells Fargo and Capital One struggle with. None of those banks have partnerships with domestic US airlines.

I think that Apple’s travel credit card should keep the structure of earning 1x points with the physical card and 2x points with Apple Pay. That way the card could still serve as a good all-purpose carrier. They can also keep something like 3x with Apple, although they should drop all other partnerships. Instead they should focus on rewarding users with 3x points for every meal or travel.

The annual fee for the card would likely be around $299, similar to the Amex Gold card. Apple could help users justify the card with one major benefit: lounge access.

Travel benefits

Apple could partner with Priority Pass and give Apple Card “Pro” customers access to over 1600 airport lounges worldwide. It would be one of the cheaper credit cards to offer this benefit, so the number of visits would likely be limited, perhaps to 12 per year – which would still be more than enough for most people. Best of all, if users don’t take full advantage of those visits, Apple (and the issuing bank) profits from the annual fee paid.

It would also be pretty neat if Apple worked on a unified travel portal to search for points redemptions across all their different partners, similar to point.me. One of the annoyances of transferring points is having to search through each partner individually to find the best deal, and I think Apple could make that process easier.

Would a travel-focused card make you want to sign up for Apple Card, or would you rather see Apple take a different approach? Let us know in the comments.

FTC: We use income generating auto affiliate links. More.