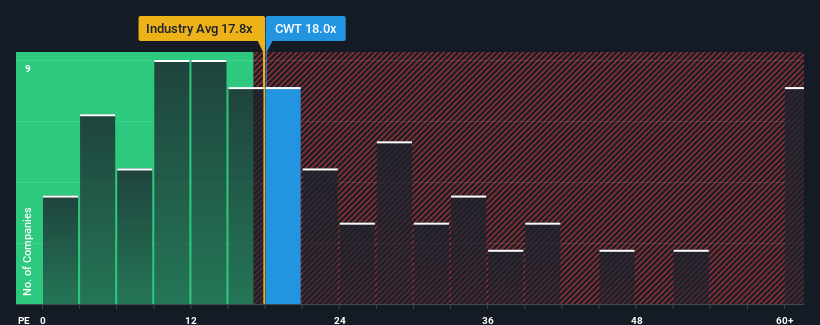

There are not many who think The California Water Service Group (NYSE:CWT) price-to-earnings (or “P/E”) ratio of 18x is worth noting when the median P/E ratio in the United States is similarly high at around 18x. However, it is not wise to simply ignore the P/E ratio without explanation, as investors may miss a special opportunity or a costly mistake.

With earnings growth in positive territory compared to the declining earnings of most other companies, California Water Service Group has done quite well recently. One possibility is that the P/E ratio is modest because investors believe the company’s earnings will be less resilient in the future. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for California Water Service Group

If you want to know what analysts are predicting for the future, you should check out our free Report on the California Water Service Group.

How is California Water Service Group growing?

To justify its P/E ratio, California Water Service Group would need to achieve market-consistent growth.

If we look at the earnings growth over the last year, the company saw a fantastic increase of 167%. However, the long-term performance has not been as strong, with the overall EPS growth over three years being relatively low. Therefore, it is fair to say that the company’s earnings growth has been inconsistent recently.

Looking ahead, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 3.1% annually over the next three years. That’s not good considering the rest of the market is expected to grow 10% annually.

With that in mind, it’s somewhat concerning that California Water Service Group’s P/E ratio is in line with most other companies. It seems that most investors are hoping for a turnaround in the company’s business prospects, but analysts aren’t so confident that will happen. There’s a good chance that these shareholders are setting themselves up for future disappointment if the P/E ratio falls to a level more in line with the negative growth outlook.

What can we learn from California Water Service Group’s P/E ratio?

It’s not a good idea to use the price-to-earnings ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

Our study of analyst forecasts for California Water Service Group found that the prospect of falling earnings does not affect the P/E ratio as much as we would have expected. When we see a poor forecast with falling earnings, we suspect the share price could decline, driving the modest P/E ratio lower. This puts shareholders’ investments at risk and potential investors risk paying an unnecessary premium.

We don’t want to spoil the fun too much, but we also found 2 warning signs for California Water Service Group that you need to consider.

If this Risks make you reconsider your opinion of California Water Service Groupexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.