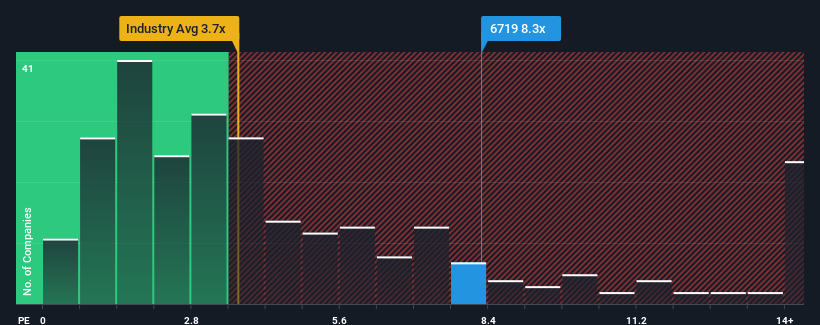

When nearly half of the semiconductor companies in Taiwan have a price-to-sales ratio (or “P/S”) below 3.7x, you may consider uPI Semiconductor Corp. (TWSE:6719) is a stock to avoid entirely with its 8.3x P/S ratio. Still, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/S.

Check out our latest analysis for uPI Semiconductor

What is uPI Semiconductor’s recent performance?

uPI Semiconductor could be doing better as its revenue has been declining recently while most other companies have been reporting positive revenue growth. It could be that many are expecting the weak revenue performance to rebound significantly, which has prevented the price-to-earnings ratio collapse. However, if it doesn’t, investors could fall into the trap of overpaying for the stock.

Do you want to know how analysts assess the future of uPI Semiconductor compared to the industry? In this case, our free Report is a good starting point.

Is sufficient sales growth forecast for uPI Semiconductor?

uPI Semiconductor’s P/S ratio would be typical of a company expected to have very strong growth and, importantly, significantly outperform the industry.

Looking back, last year saw a frustrating 18% drop in sales. The last three years don’t look good either, with the company’s sales falling by a total of 36%. So we’re sorry to admit that the company hasn’t seen much growth in sales during that time.

As for the outlook, next year is expected to bring 27% growth according to the estimates of the six analysts covering the company. With the industry forecast to grow by 26%, the company is positioned for comparable sales performance.

With this in mind, we find it interesting that uPI Semiconductor’s P/S ratio is higher than its industry peers. It seems that most investors are ignoring the rather average growth expectations and are willing to pay more to own the stock. However, additional gains will be hard to come by as this revenue growth will likely weigh on the share price eventually.

The last word

It is argued that the price-to-sales ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

Analysts forecast uPI Semiconductor’s revenues to grow only in line with the rest of the industry, which has resulted in a higher-than-expected P/S ratio. When we see revenue growth that is just in line with the industry average, we don’t expect P/S numbers to remain inflated in the long term. This puts shareholders’ investments at risk and potential investors risk paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for uPI Semiconductor that we uncovered.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

Valuation is complex, but we are here to simplify it.

Find out if uPI Semiconductor could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.