An easy way to profit from the stock market is to buy an index fund. But if you choose the right individual stocks, you can earn more. For example, the Open Up Group Inc. (TSE:2154) The share price has increased by 60% over the last three years, significantly exceeding the market return of around 31% (excluding dividends).

After last week’s strong gains, it is worth examining whether longer-term returns are due to improving fundamentals.

Check out our latest analysis for Open Up Group

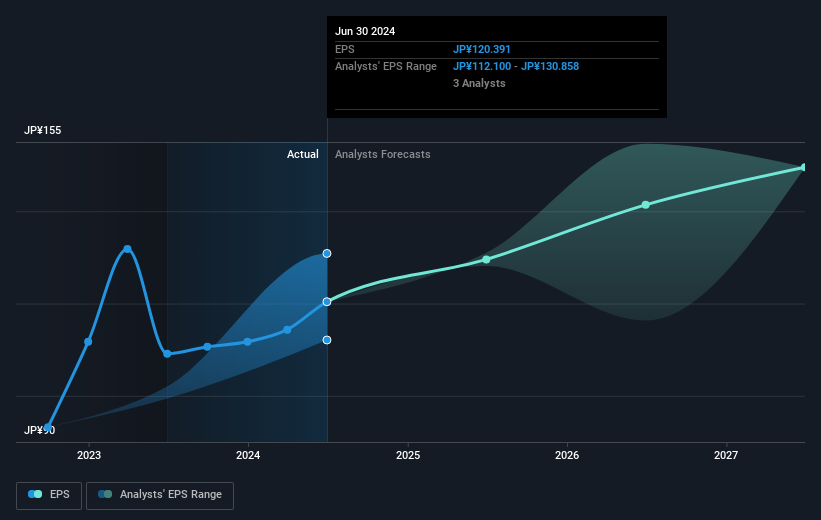

In his essay The super investors of Graham and Doddsville Warren Buffett described how stock prices do not always rationally reflect the value of a company. An imperfect but simple way to examine the changing market perception of a company is to compare the change in earnings per share (EPS) to the stock price movement.

Open Up Group has managed to grow its earnings per share by 36% per year over three years, which has driven up the share price. The average annual share price increase of 17% is actually lower than the EPS growth, so the market seems to have tempered its growth expectations somewhat.

The following graph shows how EPS has changed over time (the exact values can be viewed by clicking on the image).

We know that Open Up Group has improved its results over the past three years, but what does the future hold? If you’re thinking about buying or selling Open Up Group shares, here’s what you should look at: FREE detailed report on its balance sheet.

What about dividends?

In addition to measuring the share price return, investors should also consider the total shareholder return (TSR). While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It could be argued that the TSR gives a more comprehensive picture of the return generated by a stock. We note that the TSR for Open Up Group over the last three years was 74%, which is better than the share price return mentioned above. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A different perspective

Open Up Group shareholders are down 3.2% for the year (even including dividends), but the market itself is up 17%. Even the share prices of good stocks fall sometimes, but we like to see improvements in a company’s fundamental metrics before getting too interested. On the positive side, long term shareholders have made money, with a gain of 13% per year over half a decade. It could be that the recent sell-off is an opportunity, so it might be worth checking the fundamental data for signs of a long term growth trend. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we’ve identified: 1 warning sign for Open Up Group that you should know.

If you like buying stocks along with management, you might like this free List of companies. (Note: many of them go unnoticed AND have an attractive valuation).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.