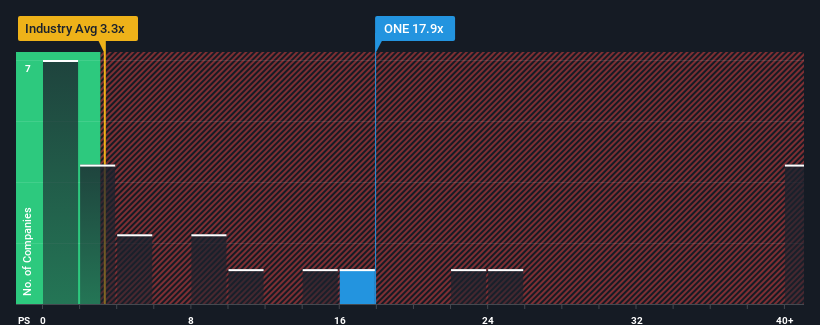

Oneview Healthcare PLCs (ASX:ONE) price-to-sales ratio (or “P/S”) of 17.9x might make it seem like a strong sell at the moment, compared to the healthcare services industry in Australia, where around half of the companies have P/S ratios below 5.4x, and even P/S below 2x are quite common. Still, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/S.

Check out our latest analysis for Oneview Healthcare

What does Oneview Healthcare’s P/S mean for shareholders?

Oneview Healthcare has seen revenue growth that has lagged most other companies recently, and has been relatively sluggish as a result. Perhaps the market is expecting future revenue trends to reverse, which has pushed up the P/S ratio. You would really hope so, otherwise you’re paying a pretty high price for no particular reason.

Would you like to know how analysts assess the future of Oneview Healthcare compared to the industry? In this case, our free Report is a good starting point.

Is sufficient revenue growth forecast for Oneview Healthcare?

Oneview Healthcare’s P/S ratio is typical of a company that is expected to deliver very strong growth and, importantly, significantly outperform the industry.

If we look at last year’s revenue growth, the company saw a remarkable increase of 5.3%. This was backed up by an excellent period prior to that, where revenue had grown by a total of 32% over the last three years. So, first of all, we can say that the company has done a great job of increasing revenue during this time.

Looking ahead, the two analysts covering the company expect revenue to grow 52% annually over the next three years, while the rest of the industry is forecast to grow by just 25% per year, which is much less attractive.

With that in mind, it’s understandable that Oneview Healthcare’s P/S is performing better than most other companies. It seems shareholders aren’t interested in selling something that potentially has a better future ahead of it.

What does Oneview Healthcare’s P/S mean for investors?

It is argued that the price-to-sales ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

As we suspected, our study of Oneview Healthcare’s analyst forecasts found that its above-average revenue outlook contributes to its high P/S ratio. It seems shareholders have confidence in the company’s future revenues, which supports the P/S. Under these circumstances, it’s hard to imagine the share price falling much in the near future.

Before you form an opinion, we found out 1 warning signal for Oneview Healthcare that you should know.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.