SALT LAKE CITY — Falling mortgage rates have led to a sharp increase in interest in refinancing.

The number of debt restructuring applications has “reached its highest level in two years,” the Mortgage Bankers Association said this week, while interest rates have fallen to their lowest level in over a year.

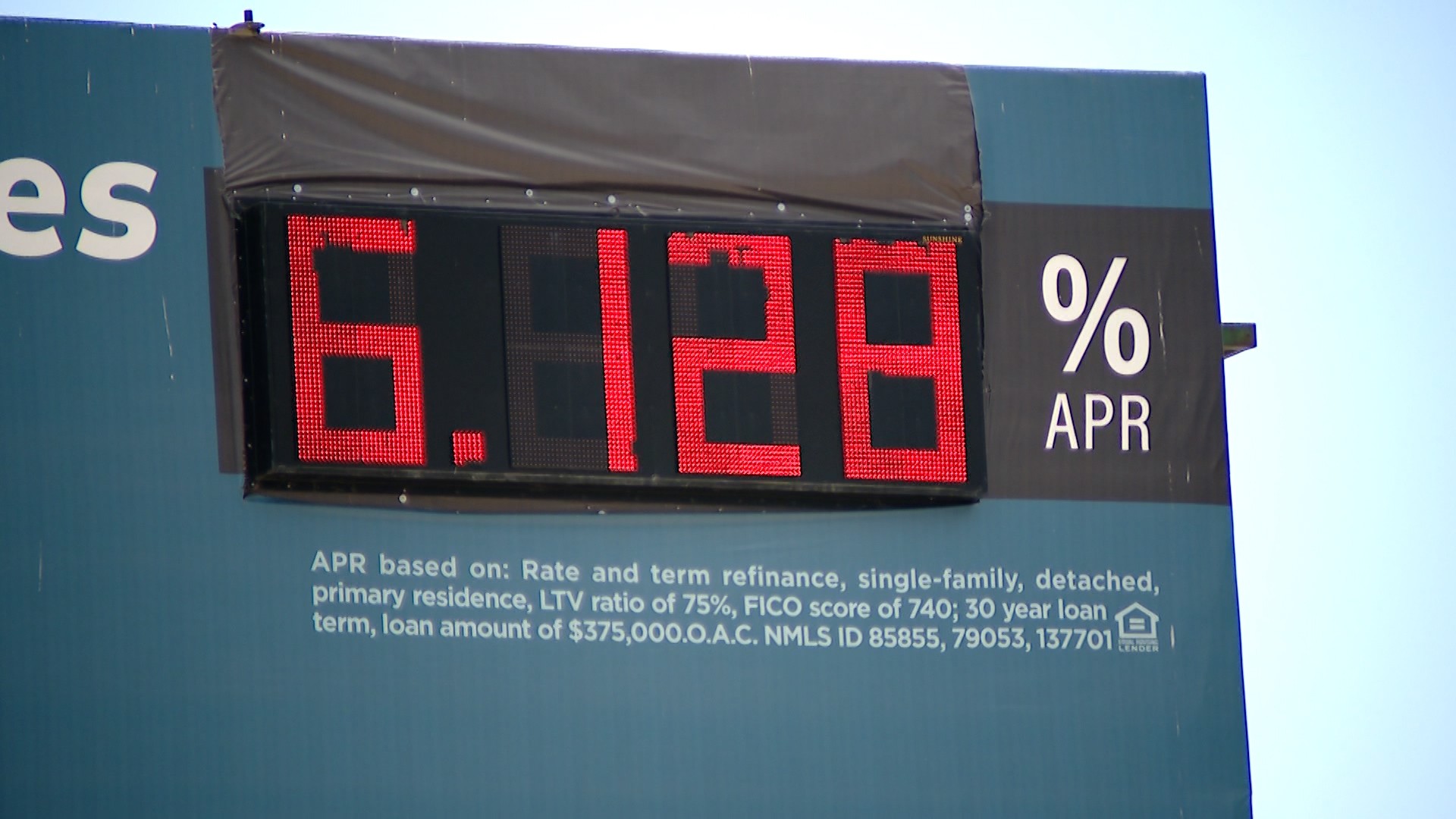

According to Mortgage News Daily, the national average mortgage rates were about 6.5 percent as of Friday afternoon.

Lenders in Utah are seeing an increase in refinancing interest.

“Refinance activity has really picked up recently,” said Josh Kramer, board member of the Utah Association of Mortgage Professionals. “There are a lot of people right now who would absolutely benefit from refinancing.”

Utah’s median home price rises to $500,000 despite high mortgage rates

Leland Schuyler is one of them. In June 2023, he bought a house in Payson at an interest rate of 7.25%.

“We knew from the beginning that we would refinance as quickly as possible,” Schuyler told KSL TV, “and as of the beginning of the week, it looks like now is a good time to do it.”

Schuyler said he plans to take the step soon, and given current interest rates, he expects it will make a big difference in his budget.

“It would ultimately save us several hundred dollars a month,” he said.

“I was frustrated and gave up”: High mortgage rates hold back some Utah homebuyers

However, just because mortgage rates have dropped doesn’t mean refinancing is a no-brainer. Kramer said that for older loans with a lower balance, it may not be very helpful.

“But if I had a loan from last October and could save 1%,” Kramer said, “I would use it in a heartbeat.”

Another thing to consider when refinancing is the amount of upfront costs and how long it would take you to break even.

But for many people, debt restructuring is currently “absolutely worth considering,” says Kramer.