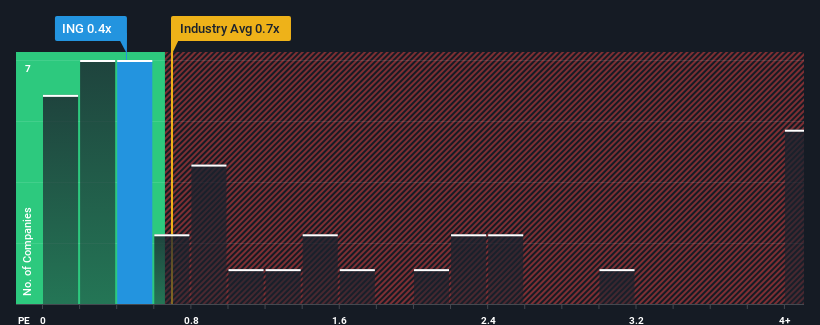

With a median price-to-sales ratio (or “P/S”) of almost 0.7x in the food industry in Australia, you could be forgiven for being indifferent to The (ASX:ING) P/S ratio of 0.4x. However, investors could miss a clear opportunity or potential pullback if there is no rational basis for the P/S.

Check out our latest analysis for Inghams Group

How has the Inghams Group developed recently?

With revenue growth that has been better than most companies recently, Inghams Group has done relatively well. It could be that many are expecting the strong revenue performance to fade, which has prevented the P/S ratio from rising. If you like the company, you’d hope that doesn’t happen so you can potentially buy some shares while it’s not in demand.

Do you want the full picture of analyst estimates for the company? Then our free The Inghams Group report will help you find out what’s on the horizon.

Do the sales forecasts match the P/S ratio?

A P/S like that of the Inghams Group is only safe if the company’s growth corresponds closely to that of the industry.

Looking back, last year saw a solid increase in sales of 12% for the company. The solid development of recent years means that sales have increased by a total of 21% over the last three years. Accordingly, shareholders are likely to have been satisfied with the medium-term sales growth rates.

As for the outlook, the company is expected to grow at a rate of 3.7% per year over the next three years, according to the 11 analysts covering the company. With the industry forecast to grow at a rate of 5.8% per year, the company is likely to see a weaker top-line performance.

Given this information, we find it interesting that Inghams Group trades at a fairly similar price-to-earnings ratio compared to the industry. It seems that most investors ignore the fairly limited growth expectations and are willing to pay more to own the stock. These shareholders could be setting themselves up for future disappointment if the price-to-earnings ratio falls to a level more in line with the growth prospects.

The last word

It is argued that the price-to-sales ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

Considering that Inghams Group’s revenue growth estimates are quite muted compared to the wider industry, it’s easy to see why we think it’s unexpected that the company is trading at its current price-to-sales ratio. We’re not confident about the price-to-sales ratio at this time, as forecast future revenues are unlikely to support a more positive sentiment for long. Positive change is needed to justify the current price-to-sales ratio.

Before you form an opinion, we found out 2 warning signs for the Inghams Group (1 should not be ignored!) that you should know.

It is important, Make sure you are looking for a great company and not just the first idea that comes to mind. So if increasing profitability matches your idea of a great company, take a look at this free List of interesting companies with strong recent earnings growth (and low P/E ratios).

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.