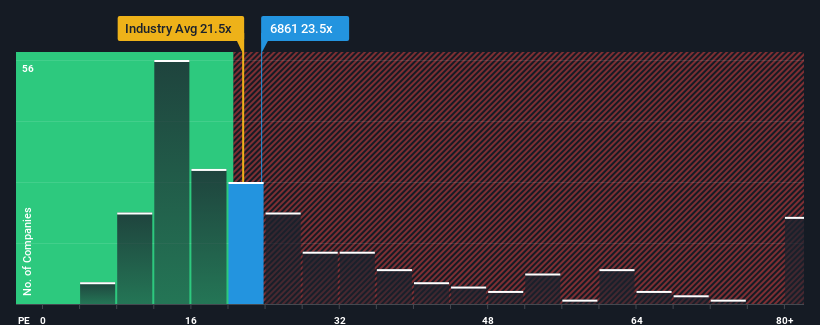

When nearly half of the companies in Taiwan have a price-to-earnings ratio (P/E) of less than 20x, you may consider InnoCare Optoelectronics Corporation (TWSE:6861) is a stock that may be worth avoiding with its P/E ratio of 23.5. However, it is not advisable to simply take the P/E ratio at face value as there may be an explanation as to why it is so high.

For example, InnoCare Optoelectronics’s declining earnings of late should give cause for pause. One possibility is that the P/E ratio is high because investors believe the company will still do enough to outperform the broader market in the near future. You’d really hope so, otherwise you’re paying a pretty high price for no particular reason.

Check out our latest analysis for InnoCare Optoelectronics

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on InnoCare Optoelectronics will help you shed light on the company’s historical performance.

How is InnoCare Optoelectronics growing?

There is a fundamental assumption that a company must outperform the market for P/E ratios like InnoCare Optoelectronics to be considered reasonable.

First, if we look back, the company’s earnings per share growth last year was not exactly exciting as it recorded a disappointing 50% decline. As a result, earnings from three years ago have also declined by a total of 43%. So, we unfortunately have to admit that the company has not done a great job of growing earnings during this time.

When compared to the market, which is forecast to grow by 24 percent over the next twelve months, the company’s downward momentum based on its recent medium-term earnings figures paints a sobering picture.

With this in mind, we find it concerning that InnoCare Optoelectronics is trading at a higher P/E than the market. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. Only the bravest would assume that these prices are sustainable, as a continuation of recent earnings trends will likely weigh heavily on the share price eventually.

The last word

It is argued that the price-to-earnings ratio is not a good measure of a company’s value in certain industries, but can be a meaningful indicator of business sentiment.

Our research into InnoCare Optoelectronics found that declining earnings over the medium term are not impacting the high P/E nearly as much as we would have expected given the likely market growth. When we see earnings declining and falling short of market forecasts, we suspect the share price could decline and the high P/E could fall. Unless medium-term conditions improve significantly, it is very difficult to accept these prices as reasonable.

Don’t forget that there may be other risks as well. For example, we have found 4 warning signals for InnoCare Optoelectronics (1 cannot be ignored) you should know.

Naturally, If you take a closer look at some good candidates, you may come across a fantastic investment. So take a look at the free List of companies with a strong growth track record and a low P/E ratio.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Free test now

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]