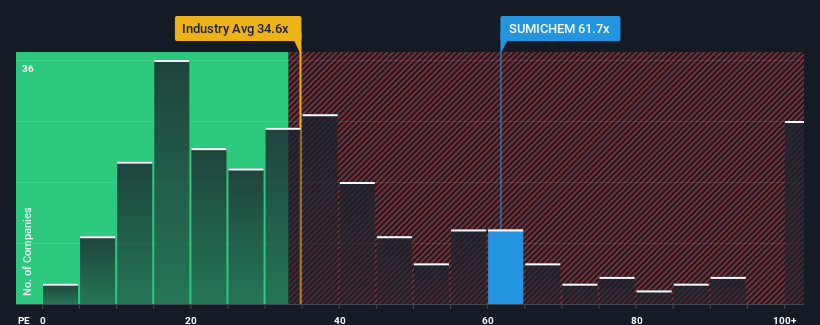

With a price-earnings ratio (P/E) of 61.7x Sumitomo Chemical India Limited (NSE:SUMICHEM) may be sending very bearish signals right now as almost half of all companies in India have a P/E of below 32x and even P/E ratios below 19x are not uncommon. However, it is not advisable to simply take the P/E at face value as there might be an explanation as to why it is so high.

Sumitomo Chemical India may be doing better, as the company’s earnings have risen less than most other companies recently. Many may be expecting a significant rebound from the uninspiring earnings performance that has prevented the P/E ratio from collapsing. That’s what you’d really hope, otherwise you’ll be paying a pretty high price for no particular reason.

Check out our latest analysis for Sumitomo Chemical India

If you want to know what analysts are predicting for the future, you should check out our free Report on Sumitomo Chemical India.

Is the growth appropriate for the high P/E ratio?

Sumitomo Chemical India’s P/E ratio is typical of a company that is expected to deliver very strong growth and, more importantly, significantly outperform the market.

Looking back, last year brought the company virtually the same profits as the year before. However, the last three-year period was better, as it delivered a decent 17% increase in earnings per share overall. Accordingly, shareholders would probably not have been too happy with the unstable medium-term growth rates.

As for the outlook, the company is expected to grow 19% per year over the next three years, according to estimates from the six analysts who cover the company, which is likely to be roughly in line with the 20% per year growth forecast for the overall market.

With this in mind, we find it interesting that Sumitomo Chemical India is trading at a high P/E relative to the market. It seems that most investors are ignoring the rather average growth expectations and are willing to pay more to own the stock. These shareholders could be disappointed if the P/E falls to a level more in line with the growth prospects.

The most important things to take away

It is argued that the price-to-earnings ratio is not a good measure of value in certain industries, but can be a meaningful indicator of business sentiment.

Our study of analyst forecasts for Sumitomo Chemical India found that the market-based earnings outlook is not driving the high P/E ratio as much as we would have expected. At the moment, we are unhappy with the relatively high share price, as forecast future earnings are unlikely to sustain such positive sentiment for long. Unless these conditions improve, it is difficult to accept these prices as reasonable.

Many other significant risk factors can be found in the company’s balance sheet. Our free By conducting a balance sheet analysis for Sumitomo Chemical India with six simple checks, you can identify any risks that could pose a problem.

If this Risks make you rethink your opinion about Sumitomo Chemical Indiaexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.