The Allient Inc. (NASDAQ:ALNT) has performed very poorly over the past month, falling a whopping 27%. Instead of being rewarded, shareholders who have held for the past twelve months are now sitting on a 37% loss.

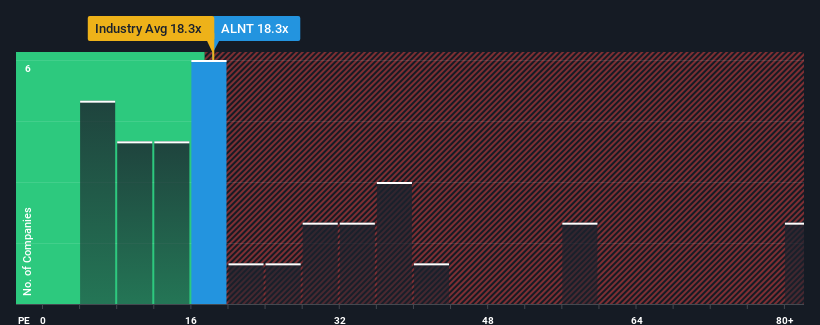

Despite the sharp price decline, one might be indifferent to Allient’s P/E ratio of 18.3, as the median price-to-earnings ratio (or “P/E”) in the United States is also 18. However, it is not wise to simply ignore the P/E ratio without explanation, as investors may miss a special opportunity or a costly mistake.

The recent past has not been favorable for Allient, as its earnings have fallen faster than most other companies. One possibility is that the P/E ratio is modest because investors believe the company’s earnings trend will eventually fall in line with most other companies in the market. If you still believe in the company, you would much rather the company did not suffer an earnings decline. Or at least you would hope that it does not continue to underperform if you plan to buy shares while they are out of demand.

Check out our latest analysis for Allient

Do you want the full picture of analyst estimates for the company? Then our free The Allient report will help you find out what’s on the horizon.

Does the growth correspond to the P/E ratio?

A P/E ratio like Allient’s is only safe if the company’s growth is closely in line with the market.

First, if we look back, the company’s earnings per share growth over the last year hasn’t been particularly exciting as it recorded a disappointing decline of 21%. This means that the company has also experienced a decline in earnings over the long term as earnings per share have declined by a total of 30% over the last three years. Therefore, it’s fair to say that earnings growth has been undesirable for the company lately.

As for the outlook, growth of 10.0% annually is expected over the next three years, as estimated by the three analysts covering the company. With the market expected to deliver growth of 10% per year, the company is positioned for a comparable result.

Given this backdrop, it’s understandable that Allient’s P/E ratio is in line with most other companies. Apparently shareholders are content to hold simple while the company keeps a low profile.

What can we learn from Allient’s P/E ratio?

With the share price slipping into negative territory, Allient’s P/E ratio now looks pretty average. It’s not useful to use the price-to-earnings ratio alone to decide whether you should sell your shares, but it can be a handy guide to the company’s future prospects.

We have noted that Allient maintains its modest P/E ratio because its forecast growth is in line with the overall market, as expected. At this point, investors believe that the potential for earnings improvement or deterioration is not large enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

There are also other important risk factors that need to be considered and we have found 2 warning signs for Allient (1 is a bit worrying!) that you should know before investing here.

If this Risks make you rethink your opinion of Allientexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.