The Cash Advance by Cash Tools app offers fast, interest-free advances of up to $1,000 with flexible repayment options.

Picture: https://www.abnewswire.com/uploads/6fb3472a9cfae1320523530583628e84.png

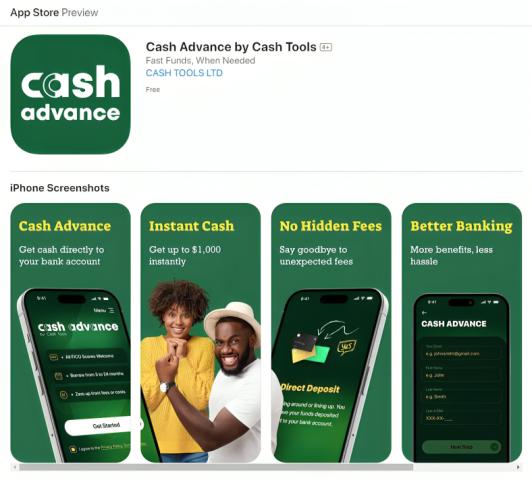

Cash Tools Inc., a financial technology company, has launched its newest service, “Cash Advance by Cash Tools,” which is now available on the App Store (https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395) for iPhone users. This app is designed to provide individuals with a hassle-free and accessible way to meet short-term financial needs by offering instant cash advances without traditional credit checks or interest.

The Cash Advance by Cash Tools app allows users to access up to $1,000 quickly and securely. By connecting directly to a user’s bank account, the app verifies and disburses funds with minimal effort, efficiently handling urgent financial needs. The app is designed to be flexible so that users can repay the advance on their terms without penalties or fees, helping them manage their finances in a way that suits their situation.

One of the key features of the app is its transparent approach. There are no hidden fees and users can repay their advances at a time that suits their cash flow. The app also offers credit building opportunities and helps users improve their credit profile through consistent, on-time repayments.

Ethan Parker, the founder of Cash Tools, spoke about the company’s goals. “Our goal is to provide financial solutions that are both convenient and secure. We want to make it easier for people to access money when they need it, without the complexity of traditional lending systems. As we continue to grow, we remain focused on providing tools that make it easier for individuals to manage their finances.”

The app also includes additional financial management features. Users can access budgeting tools and real-time analytics to better understand and optimize their spending. Additionally, the app offers rewards through surveys and promotions that help users increase their available advance limits.

Cash Tools places great importance on the security of user data. The Cash Advance by Cash Tools app uses strong encryption to protect personal and financial information. This focus on privacy ensures that users can trust the platform with their financial data and know that it will remain safe.

Download the Cash Advance app from the App Store: https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395

About the company:

Cash Tools Inc. was founded in 2024 by a team of finance and technology experts who recognized the need for more accessible financial services. With many people locked out of traditional banking due to strict credit requirements and high interest rates, the company developed a platform that provides quick financial relief on clear terms. Cash Tools Inc. plans to continue to expand its services, focusing on developing solutions that meet the needs of a diverse audience.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results or strategies (including product offerings, regulatory plans and business plans) and are subject to change without notice. We caution you that such statements are subject to a variety of risks and uncertainties that could cause future circumstances, events or results to differ materially from those projected in the forward-looking statements, including the risk that actual results may differ materially from those projected in the forward-looking statements.

Media contact

Company name: Cash Tools Inc.

Contact person: Nathan Brooks

Email: Send email (https://www.abnewswire.com/email_contact_us.php?pr=cash-advance-by-cash-tools-app-launched-for-iphone-users)

City: Kansas City

State: Missouri

Country: United States

Website: http://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395

This press release was published on openPR.