Mobile app advertising platform AppLovin (NASDAQ: APP) reported second-quarter results of calendar year 2024 that were in line with analysts’ expectations. Revenue rose 44% year over year to $1.08 billion. The company expects revenue of around $1.13 billion for the next quarter, which is 1.8% above analysts’ estimates. The company posted GAAP earnings of $0.89 per share, improving from earnings of $0.22 per share in the same quarter last year.

Is now the right time to buy AppLovin? Find out in our full research report.

AppLovin (APP) highlights in Q2 of calendar year 2024:

-

Revenue: $1.08 billion vs. analyst estimates of $1.08 billion (minor miss)

-

EPS: $0.89 versus analyst estimates of $0.73 (22.1%)

-

Sales forecast for the 3rd quarter of the calendar year 2024 is on average 1.13 billion US dollars, above analyst estimates of 1.10 billion US dollars

-

Gross margin (GAAP): 73.8%, compared to 65.5% in the same quarter last year

-

Free Cash Flow of USD 450.6 million, an increase of 14.7% over the previous quarter

-

Market capitalization: 22.7 billion US dollars

AppLovin (NASDAQ:APP) was co-founded by Adam Foroughi, who was frustrated with not being able to find a good solution to market his own dating app. The company is both a mobile game studio and a provider of marketing and monetization tools for mobile app developers.

Advertising software

The digital advertising market is large, growing and increasingly diverse in both audiences and media, so there is a growing need for software that enables advertisers to use data to automate and optimize ad placement.

Sales growth

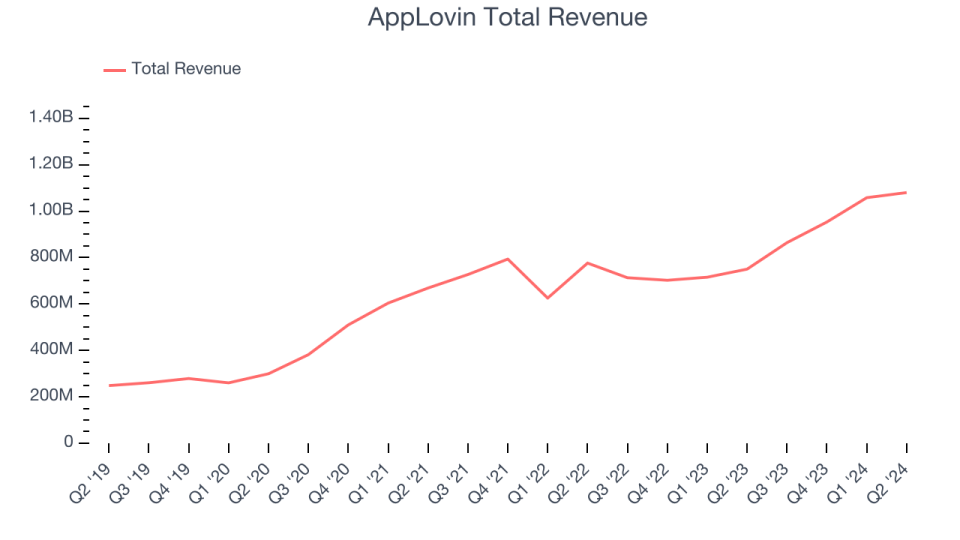

As you can see below, AppLovin’s annual revenue growth over the past three years has been a healthy 22.3%, and revenue this quarter came in at $1.08 billion.

Despite missing analysts’ revenue estimates, this was a high-growth quarter for AppLovin, with quarterly revenue up 44% year over year, above the company’s historical trend. However, growth has slowed compared to last quarter, as the company’s revenue only grew by $22 million in the second quarter, compared to $104.9 million in the first quarter of fiscal 2024. While we would like to see revenue grow more each quarter, a one-time fluctuation is usually not a cause for concern.

The forecast for the next quarter suggests that AppLovin expects revenue to increase 30.2% to $1.13 billion, beating the 21.2% increase in the year-ago quarter. Analysts covering the company had expected revenue to increase 18.2% for the next 12 months before the earnings announcement.

Unless you live in isolation, it should be obvious by now that generative AI will have a huge impact on how major companies do business. While Nvidia and AMD are trading near all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock that is benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Money makes the world go round

While earnings undoubtedly play an important role in assessing a company’s performance, we believe cash is the most important thing because accounting profits cannot pay the bills.

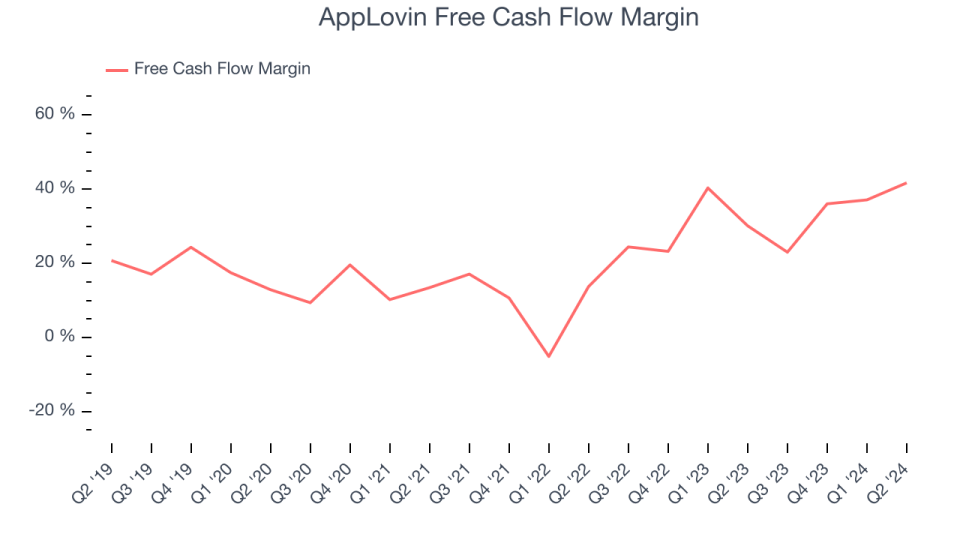

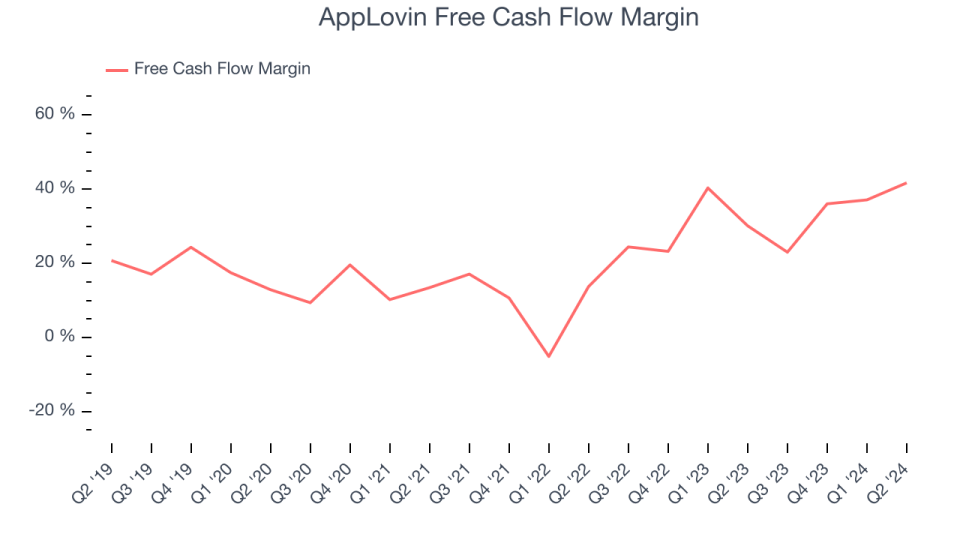

AppLovin has demonstrated excellent cash profitability, driven by its cost-efficient customer acquisition strategy, which allows the company to stay ahead of the competition by investing in new products rather than sales and marketing. The company’s free cash flow margin has been among the best in the software sector, averaging an incredible 35% over the last year.

AppLovin’s free cash flow for the second quarter was $450.6 million, representing a margin of 41.7%. This quarter’s performance was good, as the margin was 11.6 percentage points higher than the same quarter last year. Cash profitability was also above one-year levels, and we hope the company can build on this trend.

Key takeaways from AppLovin’s Q2 results

It was great to see AppLovin improve its gross margin this quarter. We were also happy to see the revenue guidance for next quarter come in higher than Wall Street estimates. On the other hand, unfortunately, revenue fell short of analyst expectations. Looking at the whole thing, we think this was a mixed quarter. The areas below expectations seem to be driving the stock movement, and the stock traded up 7.1% to $62.40 immediately after the release.

So should you invest in AppLovin now? When making this decision, it’s important to consider the valuation, business qualities as well as what happened in the last quarter. We cover this in our actionable full research report, which you can read for free here.