Link: Apply now for the Ink Business Preferred® Credit Card, the Ink Business Cash® Credit Card or the Ink Business Unlimited® Credit Card

The Chase Ink Business card portfolio is among the most lucrative credit cards on the market in terms of their overall value proposition. The cards offer great welcome bonuses, an excellent return on spending, and give you access to the Ultimate Rewards ecosystem.

When applying for a business credit card, you don’t usually have to be a business, as you can apply as a sole proprietorship. In this post, I want to go into this in a little more detail and show you the best way to go about it. This is something that confuses a lot of people, and you might be surprised at how successful you can be with it.

Chase Ink Business Card Basics

To provide a little background, I’d like to quickly go into the details of the three most popular Chase Ink Business cards that earn points:

- The Ink Business Preferred® Credit Card (Review) has a $95 annual fee and is one of the most comprehensive business cards with a huge welcome bonus, generous rewards structure, cell phone protection, rental car insurance, and more

- The Ink Business Cash® credit card (review) has no annual fee and offers 5x points bonus categories, so points accumulate quickly, especially with the welcome bonus

- The Ink Business Unlimited® credit card (review) has no annual fee and is one of the best Chase business cards for everyday spending

The Chase Ink Business cards are not mutually exclusive—you can apply for any of them and get the bonuses (you can even apply for the same card for multiple businesses if you have more than one), and they complement each other well, too.

Although I’m focusing primarily on the Chase Ink Business card portfolio now, other cards, such as the Southwest® Rapid Rewards® Performance Business Credit Card (review), World of Hyatt Business Credit Card (review), IHG One Rewards Premier Business Credit Card (review), etc., follow the same general principles as applying for a card as a sole proprietor.

Chase Ink Business Card Application for Sole Proprietorship

You don’t have to be a business to get a business credit card, a sole proprietorship usually qualifies as well. So let’s talk a little more about that – what is a sole proprietorship, what do you need to qualify for it, and how should you apply for a business credit card using this method?

What is a sole proprietorship and who is eligible?

A sole proprietorship is the simplest form of business. It is unincorporated and is run by one person. The owner has unlimited liability and the business has no legal personality separate from him. The owner reports the business’s income on his personal tax return and pays federal and state income taxes on the profits.

Of course, I’m not here to give advice on what type of business someone should start (you should talk to a tax advisor about that), but in most places there are literally no barriers to starting a sole proprietorship, as it doesn’t even require official registration.

For many people, a side hustle is very much a sole proprietorship, whether you rent out a property, work as a consultant, do freelance writing, or whatever. Being able to separate business expenses from personal expenses is valuable, and of course the very lucrative business cards we see don’t hurt either. 😉

How do I fill out the application for a sole proprietorship?

What should you do if you’re a sole proprietor applying for a business card? For example, I recently applied for the Ink Business Preferred® credit card as a sole proprietor because I already have the card for my business.

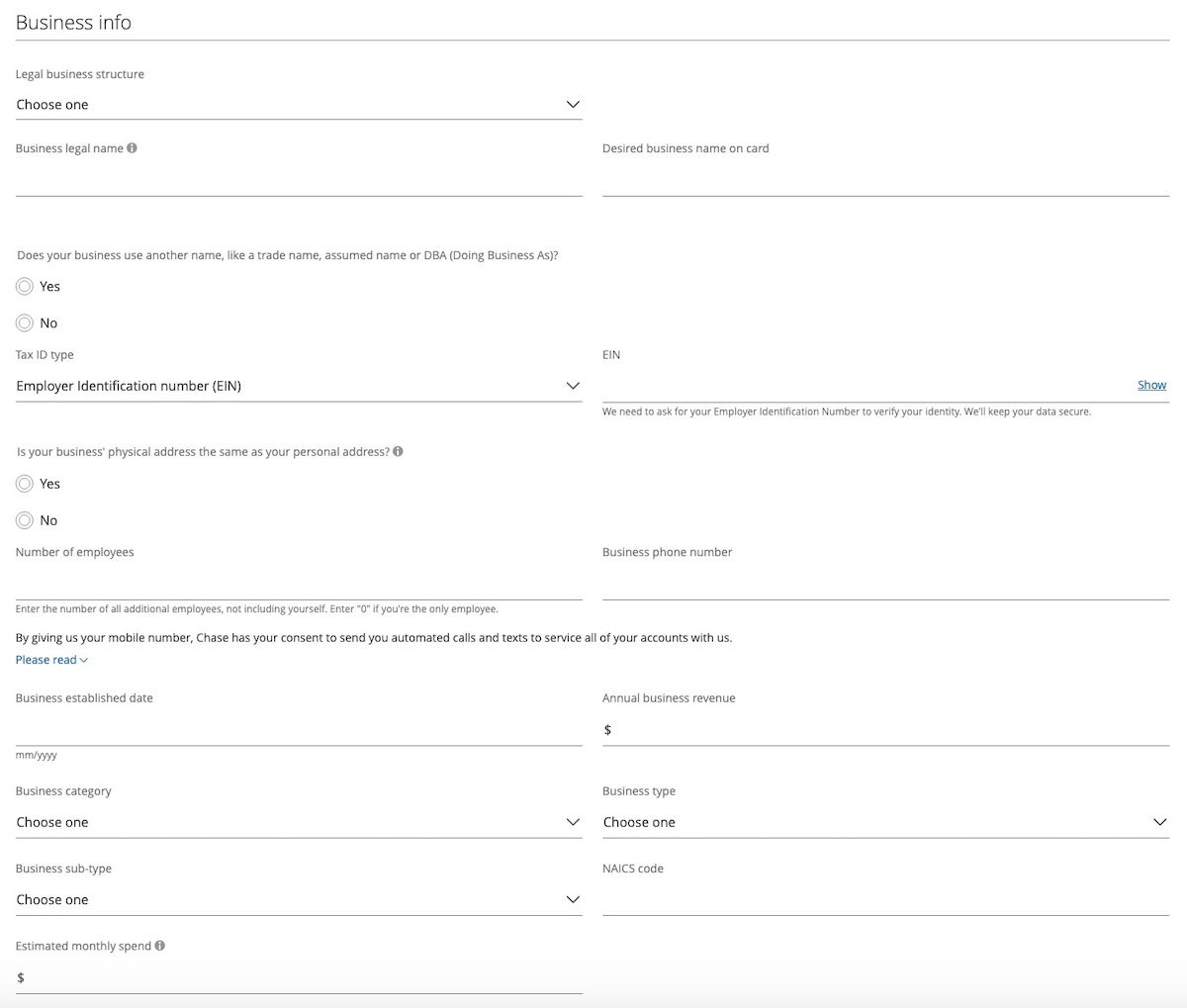

While Chase card applications always require you to provide basic personal information, let’s take a look at the section that asks for business information and how to fill it out for a sole proprietorship:

- You can choose “sole proprietorship” as your legal form.

- You can simply use your name as the company name.

- You can select “Social Security Number” as your tax number and then enter your personal number.

- For the number of employees, you can select “one” and your business phone number can be your personal number if you use it.

- Simply enter the requested information for the company’s founding date and turnover.

- For the business category, select the one that best suits the activity of your sole proprietorship.

For more details, I recently wrote about the eligibility requirements for the Chase Ink Business card and my experience getting approved as a sole proprietor. Also, keep in mind that because of the Chase 5/24 rule, it generally makes sense to apply for a business card first and then a personal card.

What are your chances of being approved as a sole proprietorship?

You should always fill out credit card applications truthfully. To get a business credit card, your company does not have to make a million dollars in annual sales and employ a dozen people. Many people get a business card as a sole proprietorship with one employee, limited business sales, and limited history.

Are your application likely to be approved if you say you have no income and the company is brand new? Well, it’s possible, but the odds are probably not great. The more history and the more income you have, the more likely your application is to be approved. This is especially true if you have excellent credit.

Everyone should use their own judgment when applying for a credit card based on their own situation. Assuming you have excellent credit, the benefits of applying are great, while the disadvantages are minimal.

Typically, your credit application score will be temporarily lowered by a few points, but there are no major consequences if your application is denied. Business credit cards also generally have a limited impact on your personal credit score.

Conclusion

Chase has an excellent portfolio of business cards, most notably the Ink Business Preferred® Credit Card, the Ink Business Cash® Credit Card and the Ink Business Unlimited® Credit Card. Although it’s often businesses that apply for business cards, you don’t actually need one to get approved.

You can also apply as a sole proprietorship. Hopefully the above provides a basic overview of how you can do this. I know applying for business cards can be intimidating, but many people are also pleasantly surprised by the results.

If you have applied for a business card as a sole proprietor, what was your experience?