Key findings

- The significant number of private companies owned by Better Collective suggests that key decisions are influenced by shareholders from the larger public sector.

- A total of 6 investors own the majority of the company with 52%

- Institutions own 25% of Better Collective

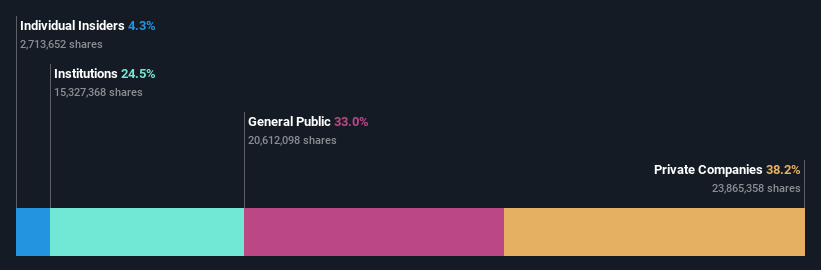

To get a sense of who really has control over Better Collective A/S (STO:BETCO), it’s important to understand the company’s ownership structure. And the group that holds the largest piece of the pie is Private Companies, with 38%. In other words, the group stands to gain (or lose) the most from their investment in the company.

Apparently, private companies benefited the most after the company’s market capitalization increased by 625 million crowns last week.

In the table below we zoom in on the different ownership groups of Better Collective.

Check out our latest analysis for Better Collective

What does institutional ownership tell us about Better Collective?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it’s included in a major index. We would expect most companies to have some institutions on their registry, especially if they’re growing.

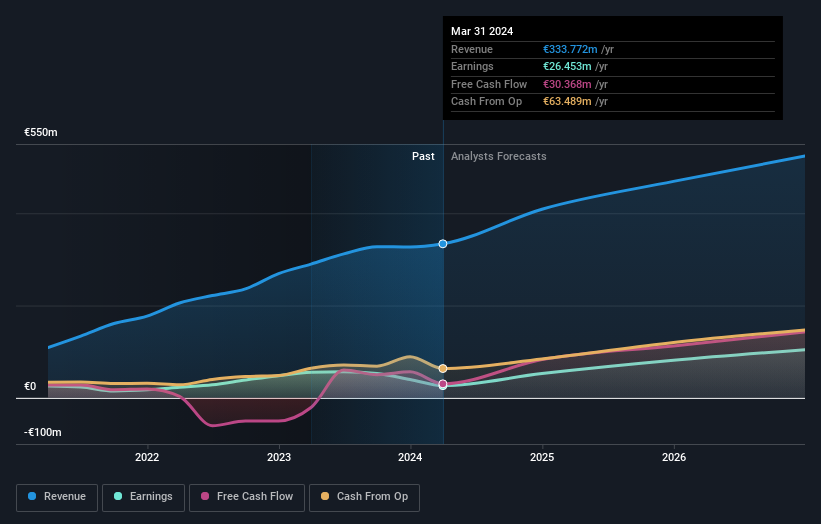

We can see that Better Collective has institutional investors; and they hold a good portion of the company’s shares. This may indicate that the company enjoys a certain level of trust in the investment community. However, one should be wary of relying on the supposed validation that institutional investors bring. Even they are sometimes wrong. When multiple institutions own a stock, there is always a risk that they are involved in a “crowd trade.” If such a trade goes wrong, multiple parties may be competing to sell the shares quickly. This risk is higher with a company without a history of growth. You can see Better Collective’s historical earnings and revenue below, but keep in mind there’s always more to the story.

Hedge funds do not own a lot of shares in Better Collective. Our data shows that Bumble Ventures A/S is the largest shareholder with 34% of the shares outstanding. The second and third largest shareholders hold 5.1% and 4.0% of the shares outstanding, respectively.

We dug a little deeper and found that six of the top shareholders together make up about 52% of the register. This means that in addition to the large shareholders, there are also some small shareholders who balance their interests to some extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a significant number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider ownership of Better Collective

The definition of corporate insiders can be subjective and varies by jurisdiction. Our data reflects individual insiders and includes at least board members. Company management is accountable to the board, which should represent the interests of shareholders. Notably, top executives are sometimes on the board themselves.

Most people consider insider ownership to be a positive because it can indicate that the board is well aligned with other shareholders. However, sometimes too much power is concentrated in this group.

We can see that insiders own shares in Better Collective A/S. This is a large company, so it’s good to see this alignment. Insiders own 666m kr worth of shares (at the current price). It’s good to see this level of investment by insiders. You can check here to see if these insiders have been buying recently.

Public property

The general public, usually retail investors, owns a 33 percent stake in Better Collective. While this size of ownership is significant, it may not be enough to change company policy if the decision does not align with that of other major shareholders.

Private company ownership

It appears that private companies own 38% of Better Collective’s shares. It’s difficult to draw any conclusions from this fact alone, so it’s worth investigating who owns these private companies. Sometimes insiders or other related parties have an interest in shares of a public company through a separate private company.

Next Steps:

I find it very interesting to examine who exactly owns a company. But to gain real insights, we need to consider other information as well. Take risk, for example – Better Collective has 2 warning signs In our opinion, you should be aware of this.

If you prefer to know what analysts are predicting regarding future growth, don’t miss this free Report on analyst forecasts.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

Valuation is complex, but we are here to simplify it.

Find out if Better Collective could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.