There has been some decline in artificial intelligence (AI) stocks over the past month, as evidenced by a 13% decline in Nasdaq-100 Technology sector. Concerns about a possible recession triggered a sell-off that was not favorable for technology companies.

However, recent gains from a number of technology giants active in AI suggest that the industry still has a lot to offer in the long term. Market leaders such as Advanced micro deviceS, AmazonAnd alphabet Earnings reported last month beat Wall Street estimates in their respective AI divisions.

This impressive growth is in line with data from Grand View Research, which shows that the AI market is expected to grow at a compound annual growth rate of 37% and reach spending of nearly $2 trillion by 2030. Therefore, it is probably not too late to invest in AI and benefit from its long-term development.

Some attractive and lesser known options are Intel (NASDAQ:INTC) And ASML Holding NV (NASDAQ:ASML)One is investing heavily in building AI chip factories and the other is a semiconductor equipment manufacturer that supplies essential machinery for manufacturing all kinds of chips. Let’s take a closer look at these two chip giants and determine whether Intel or ASML is the better way to invest in AI.

Intel

Intel has been a tough stock to invest in over the past 30 days, with the stock plunging 43%. On August 1, the company released disappointing second-quarter 2024 results, sending shareholders fleeing.

Revenue fell about 1% year-over-year, $150 million below expectations, while earnings per share of $0.02 were $0.08 below forecasts.

Coinciding with the earnings slump came news that Intel would cut 15% of its workforce and halt its dividend for the fourth quarter of 2024 in order to reduce capital spending.

Costly moves such as increasing production of Core Ultra PC chips and moving Intel 4 and 3 chip wafers to a plant in Ireland contributed to the recent declines. Meanwhile, Intel said its contract foundry was performing worse than expected.

To make matters worse, a group of shareholders is suing Intel after some of the company’s worst declines wiped $32 billion off its market value. Shareholders felt blindsided by the latest earnings results and accused Intel of making “materially false or misleading statements about the company and its manufacturing capabilities.”

Intel is in a difficult situation. The company has not yet achieved a return on its high investments in AI and is facing fierce competition from AMD and NVIDIAThe technology giant is playing for the long term and could come back strong in the long term, but investors must be willing to wait.

ASML Holding NV

ASML’s share price has fallen 20% over the past month amid a sell-off in the technology sector. The Dutch technology company is the world’s leading supplier of lithography systems, the equipment needed to produce a range of chips, including those used in artificial intelligence. ASML accounts for more than 80% of the lithography market, making it a major player in chip manufacturing and an attractive investment.

Due to its dominance, the company has attracted the largest foundries in the world. Its customers include Semiconductor manufacturing in TaiwanSamsung and Intel. At the same time, annual revenue and operating profit have increased continuously by 283% and 513% respectively over the past decade.

ASML released its second-quarter 2024 results on July 17. Revenue of €6 billion fell 10% year-on-year. However, the company has assured investors that it sees 2024 as a “transition year with continued investments in capacity expansion and technology.” ASML expects big profits in 2025 as it capitalizes on its work this year.

One weak point for ASML is the increasing tensions between the US and China and their impact on the chip market. However, many of the world’s leading foundries are working to build factories in the US, which could secure ASML’s business in the long term. At the same time, the company’s monopoly in a critical area of chip development is too good to ignore.

Is Intel or ASML the better stock for investing in AI?

Intel and ASML have very different positions in the AI space. One is expanding into chip design and manufacturing, while the other has a monopoly on the equipment needed to make graphics processing units (GPUs) for AI.

However, recent declines in Intel’s share price suggest that ASML stock may be the more reliable buy right now. Intel is under a lot of pressure to improve its financial situation while competing with Nvidia, AMD and TSM.

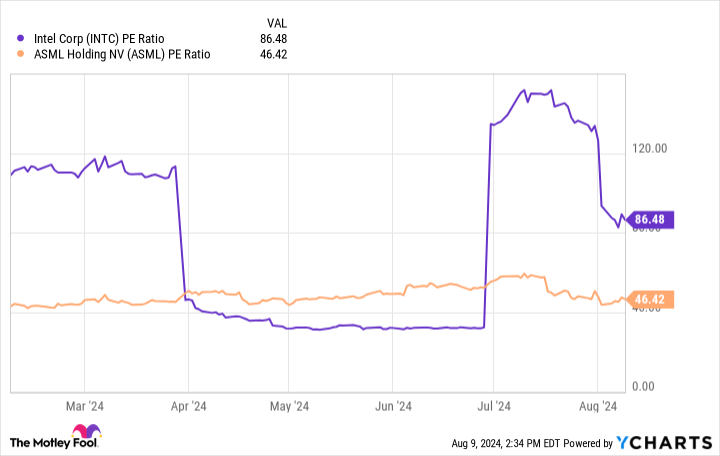

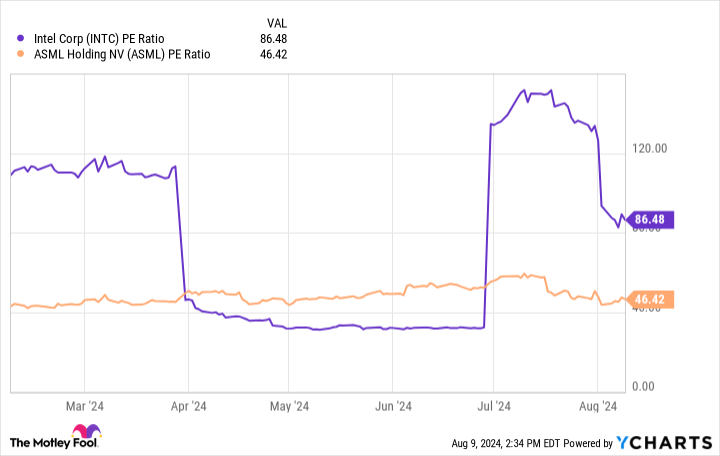

The chart above shows Intel’s volatility over the past six months, with the price-to-earnings (P/E) ratio recently rising above 86. The chart shows that ASML is more consistent and valuable, with a considerably lower P/E ratio.

Furthermore, ASML’s free cash flow of over $3 billion compared to Intel’s negative $12 billion only underscores ASML’s safer position in the market, making it the better AI stock to buy this month.

Should you invest $1,000 in Intel now?

Before you buy Intel stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now…and Intel wasn’t one of them. The 10 stocks that made it through could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $711,657!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

John Mackey, former CEO of Whole Foods Market, a subsidiary of Amazon, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook does not own any of the stocks mentioned. The Motley Fool owns and recommends ASML, Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Better Stock for Artificial Intelligence (AI): Intel vs. ASML was originally published by The Motley Fool