- Saylor believes the world’s largest cryptocurrency is a “digital force”

- MSTR outperformed BTC during its recent recovery

Some TradFi analysts criticized Bitcoin (BTC) recentlywhich discredits its use as a hedge after massive volatility caused its value to fall by 15% on August 5. And yetChairman of MicroStrategy Michael Saylor continues to defend the volatility of the world’s largest digital asset. He calls it “The price you pay” because of its usefulness and liquidity, he said,

“Volatility is the price you pay to make billions of dollars of credit and liquidity available anytime, anywhere, to anyone.”

According to Saylor,

“Nobody who understands Bitcoin is afraid of volatility.”

Saylor’s Bitcoin advice to governments

But that was not all, because Saylor also criticized the inefficiency of traditional finance (TradFi) compared to Bitcoin. He commented,

“There is a revolution in global capital markets and traditional finance is active 19% of the time for 10% of the world. That makes it a 2% solution. #Bitcoin is a 100% solution. It’s not biased; it’s just a good idea.”

To put this into perspective, traditional financial exchanges like the NYSE have halted stock trading in recent weeks after disruptions were reported. In contrast, Bitcoin has been online for over 99% of its existence.

In addition, Saylor reiterated BTC as “digital performance“, which every government should adopt. He equated it with nuclear and space energy.

Bitcoin Strategy Trend

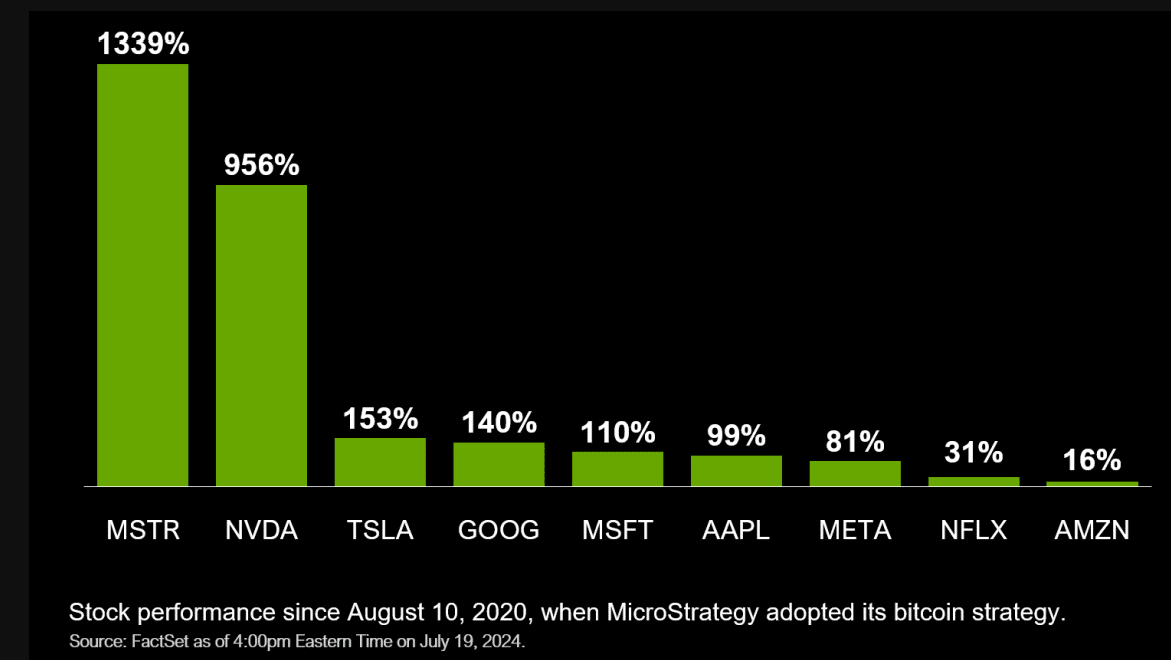

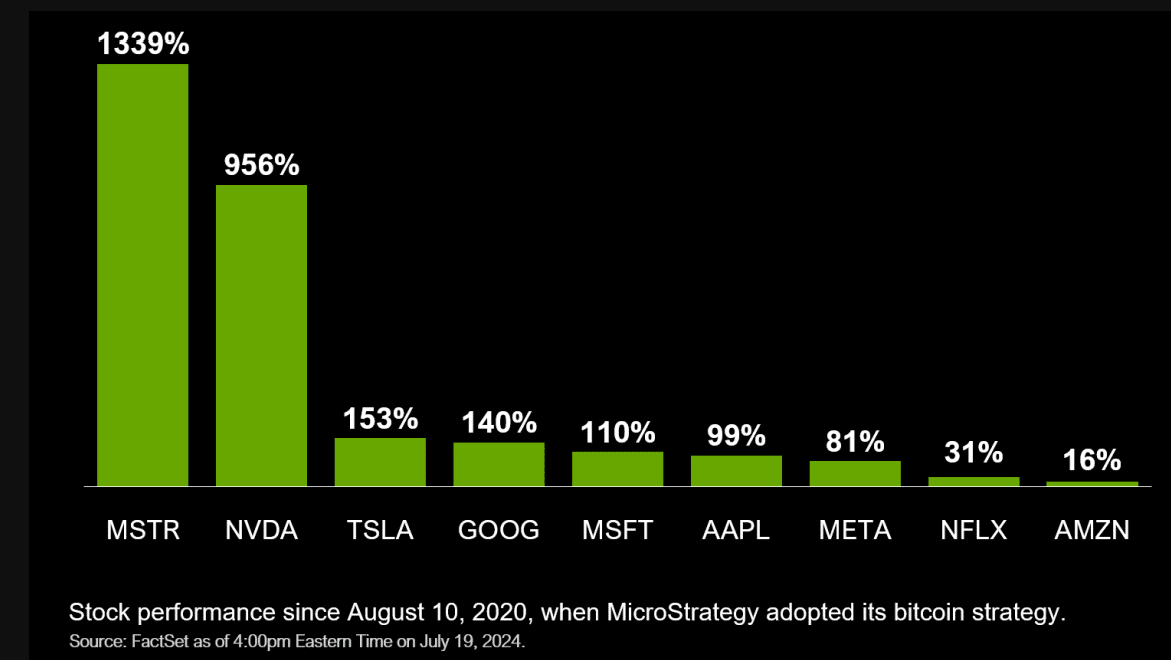

The CEO expressed a similarly optimistic sentiment recently in a Fox Business interviewAccording to the manager, his company’s stock, MicroStrategy (MSTR), outperformed everything else because it followed the Bitcoin strategy.

“MicroStrategy has outperformed everything since they launched #Bitcoin… It has outperformed everything.”

In fact, MSTR has outperformed all of its competitors, gaining over 1000% since the cryptocurrency’s launch in 2020.

Source: Michael Saylor

In August, MicroStrategy held over 226,000 BTC and planned to acquire another $2 billion in BTC. Saylor himself holds He alone has about $1 billion in BTC and is ready to hoard even more.

Interestingly, other companies have also adopted MicroStrategy’s Bitcoin strategy. In the US, for example, Block Inc., founded by Jack Dorsey and parent company of Cash App, is one of the companies pursuing an active BTC strategy.

Overseas, Japanese investment firm Metaplanet is perhaps the most aggressive user of this strategy. The company recently secured 1 billion yen to add more BTC to its portfolio. As a result, the company’s TKO stock is up +600% year-to-date (in Japanese yen).

During the same period, MSTR even outperformed BTC by over 97%, while the digital asset only gained 37%.

Meanwhile, on August 8, MSTR’s 10-for-1 stock split was completed, which was intended to make the stock more affordable. As a result, there would be ten times more MSTR shares at one-tenth of their previous value.

At the time of going to press, MSTR Trade at $135. It recovered 27% in the last five trading days, while BTC rose only 12%.

Source: Google Finance