There is no doubt that NVIDIA(NASDAQ:NVDA)’s financial results last year were something special. Earnings soared as demand for chips powering the artificial intelligence (AI) revolution boomed. But as an investor, I feel like the company’s impressive revenues are now being reflected in its high share price.

With a price-to-earnings ratio (P/E) of $122.60 per share for Nvidia, that’s a massive 45.5x for 2024.

Technology stocks typically command high premiums due to their enormous growth potential. However, compared to almost all of its competitors in the industry, the chipmaker appears massively expensive.

Other tech giants and AI stocks Microsoft And alphabetFor example, they are traded with a P/E ratio of 37.5 and 24 respectively.

This high valuation leaves little room for bad news. A global economic slowdown, problems with product development or problems with order fulfillment are some of the risks that, if they occur, could cause Nvidia’s share price to fall.

Initial period

I have another problem with buying Nvidia shares at the current price.

The microchip manufacturer has been one of the frontrunners in AI so far. But at this early stage of the race, it is difficult to predict who will ultimately emerge as the winner in this new field of technology.

Each of the “Magnificent Seven” stocks – including Nvidia, Microsoft and Meta – as well as Amazon, Apple, alphabetAnd Tesla – are all investing huge sums in generative AI and machine learning. Maybe in a few years we’ll look back and cringe at Nvidia’s enormous valuation.

Better AI stocks?

One way to get around this might be to buy AI-related stocks rather than the technology companies themselves. This approach gives me the opportunity to hedge my bets as well as Avoid the huge premiums these growth companies attract.

With that in mind, here are some ways that I think could be great to capitalize on the AI revolution.

Electric shock

AI applications, especially deep learning and processing large amounts of data, require significant computing power. This in turn leads to a rapid expansion of data centers that house the necessary hardware and thus a sharp increase in electricity demand.

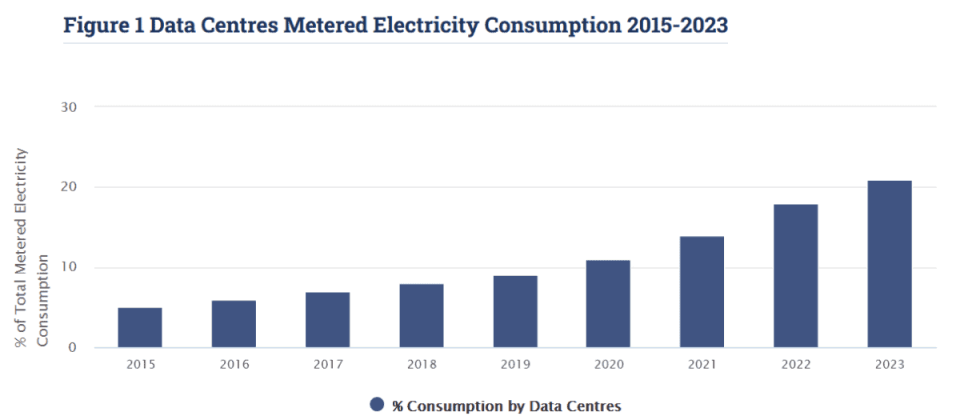

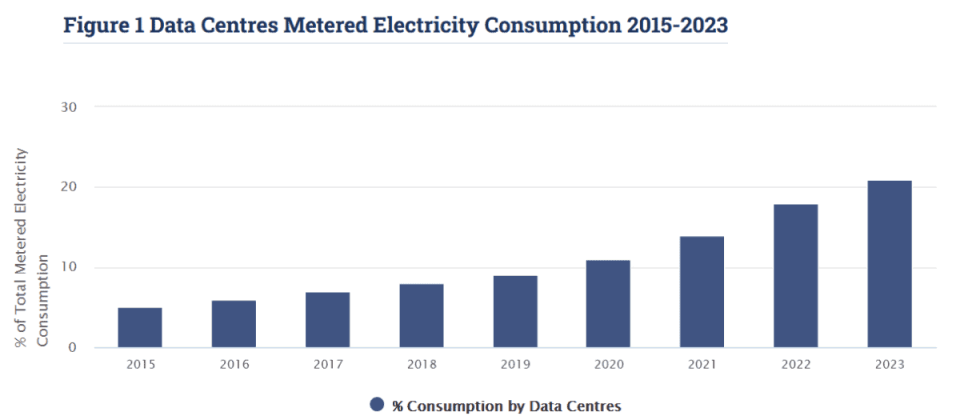

Energy consumption data from Ireland this week underscores just how much power is needed to run these hubs, with electricity consumption by the country’s data centres increasing by a fifth between 2022 and 2023. The sector now accounts for 21% of Ireland’s total electricity, more than all of the country’s urban households combined.

Given the rapid growth of AI, countries are at risk of missing their carbon neutrality targets. The result could be a global increase in renewable energy generation.

Greencoat Renewable Energy is one such company that could benefit from Ireland’s electricity outflow. It primarily owns and operates onshore and offshore wind farms across Europe, most of which are located on the Emerald Isle.

Other strong stocks in the renewable energy sector are The Renewable Infrastructure Group — a stock that I own in my own portfolio — and FTSE100 Wind energy giant SSEIn fact, investors today have dozens of such stocks to choose from.

Periods of adverse weather can severely impact the energy production and profits of such companies. But like Nvidia, they also have significant growth potential as the fight against climate change intensifies.

The post “Should I buy NVIDIA shares? I think these AI-related stocks could be better investments” appeared first on The Motley Fool UK.

Further reading

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Royston Wild holds positions in the Renewables Infrastructure Group. The Motley Fool UK has recommended Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The views expressed about companies mentioned in this article are those of the author and may therefore differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners, and Pro. At The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024