The decline in copper prices since the end of the squeeze is comparable to the trend of jumping on the next big trend and demanding prices of $15,000 per tonne early next year and $40,000 per tonne in the “not too distant future”.

Those who were gripped by copper fever supplemented the often-touted energy transition with demand for data centers with artificial intelligence and military spending.

That’s all well and good, but the next few years are likely to be brutal before the mining industry finally reaches copper nirvana.

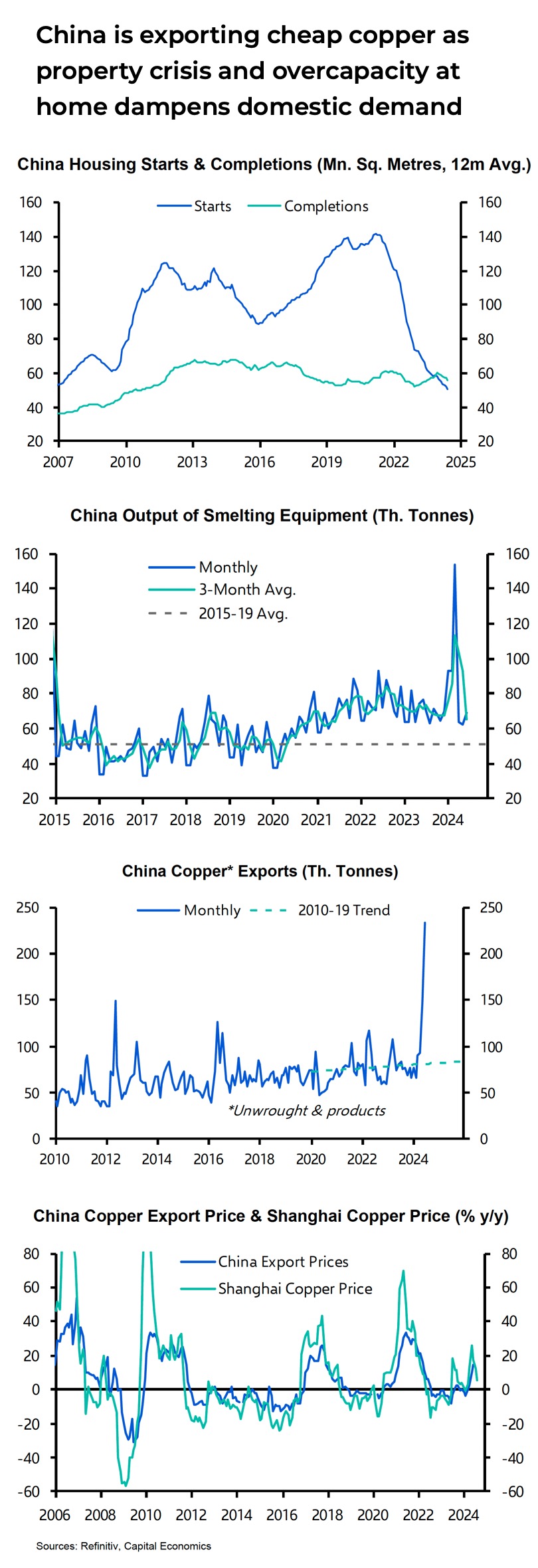

A new note from Capital Economics reminds industry observers that the success of copper prices depends on China.

More specifically, in the country’s construction sector and in the steelworks (the rumours of production cuts were the first spark that set the market ablaze).

The London-based analyst believes that it is not so much a slowdown in the US but rather the “creeping crisis” in the real estate market in China and the ongoing overcapacity that will cause the decline in copper prices.

Production at Chinese smelters, which account for more than half of global production, will remain high and, due to abundant stocks on exchanges, the country’s copper exports will decline, dragging down prices on global exchanges.

While base metals should rise towards the end of the year as China increases its public debt and infrastructure spending in the final months of 2024, copper prices will be back below today’s levels by the end of next year.

So not $15,000 then.