- Ethereum has seen recent gains that are likely not due to organic demand.

- The search for liquidity could lead to a price increase to $2.9k in the coming days.

Ethereum (ETH) made a good case for buyers a few days ago as institutional interest increased and whales began accumulating more of the token.

There have been some gains in the last two days, bringing the price to $2,672 at press time.

In other news, Vitalik Buterin supported a proposal to have multiple block proposers on the network. This proposal was made to counteract the risks of centralization and manipulation.

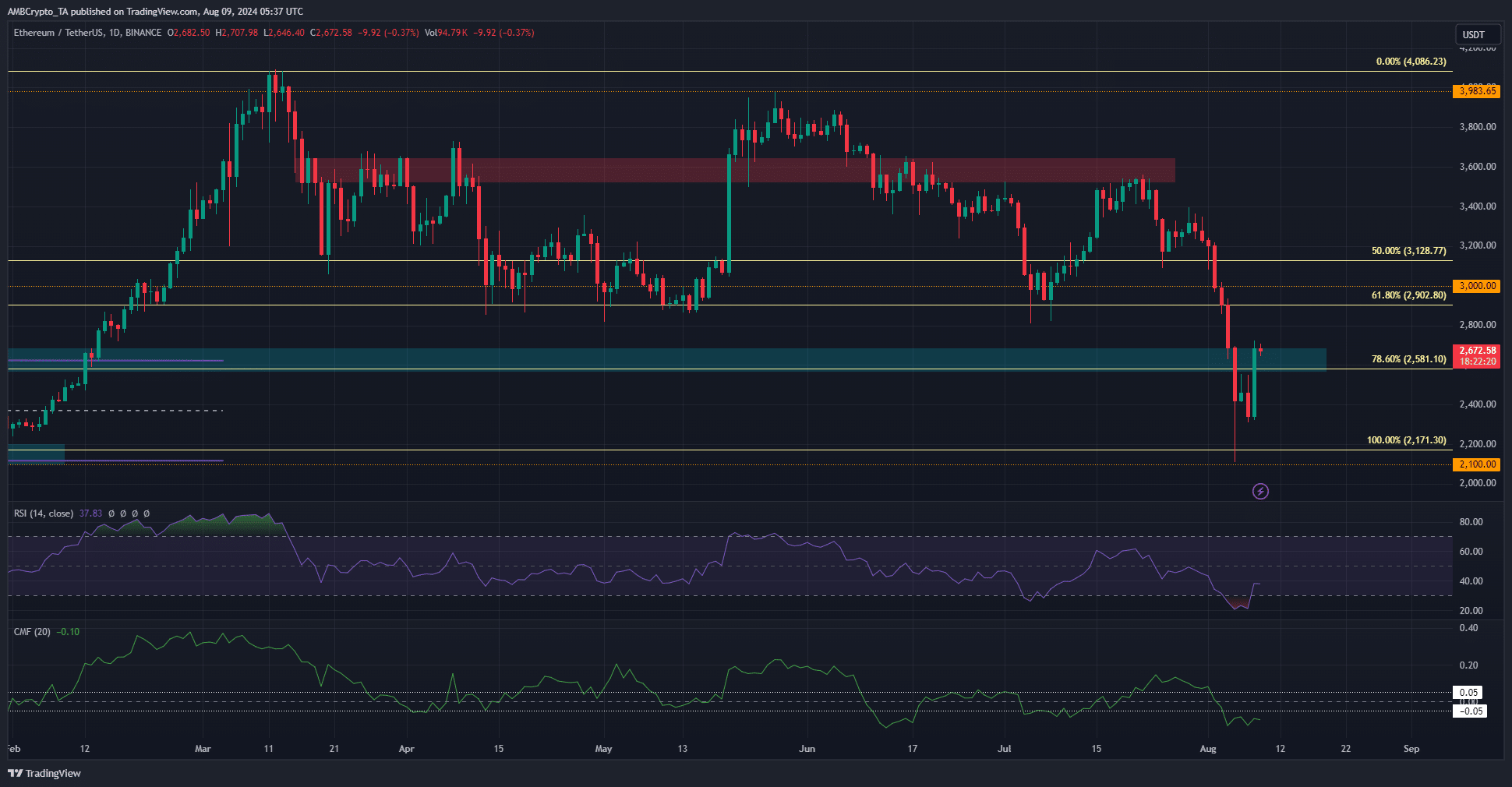

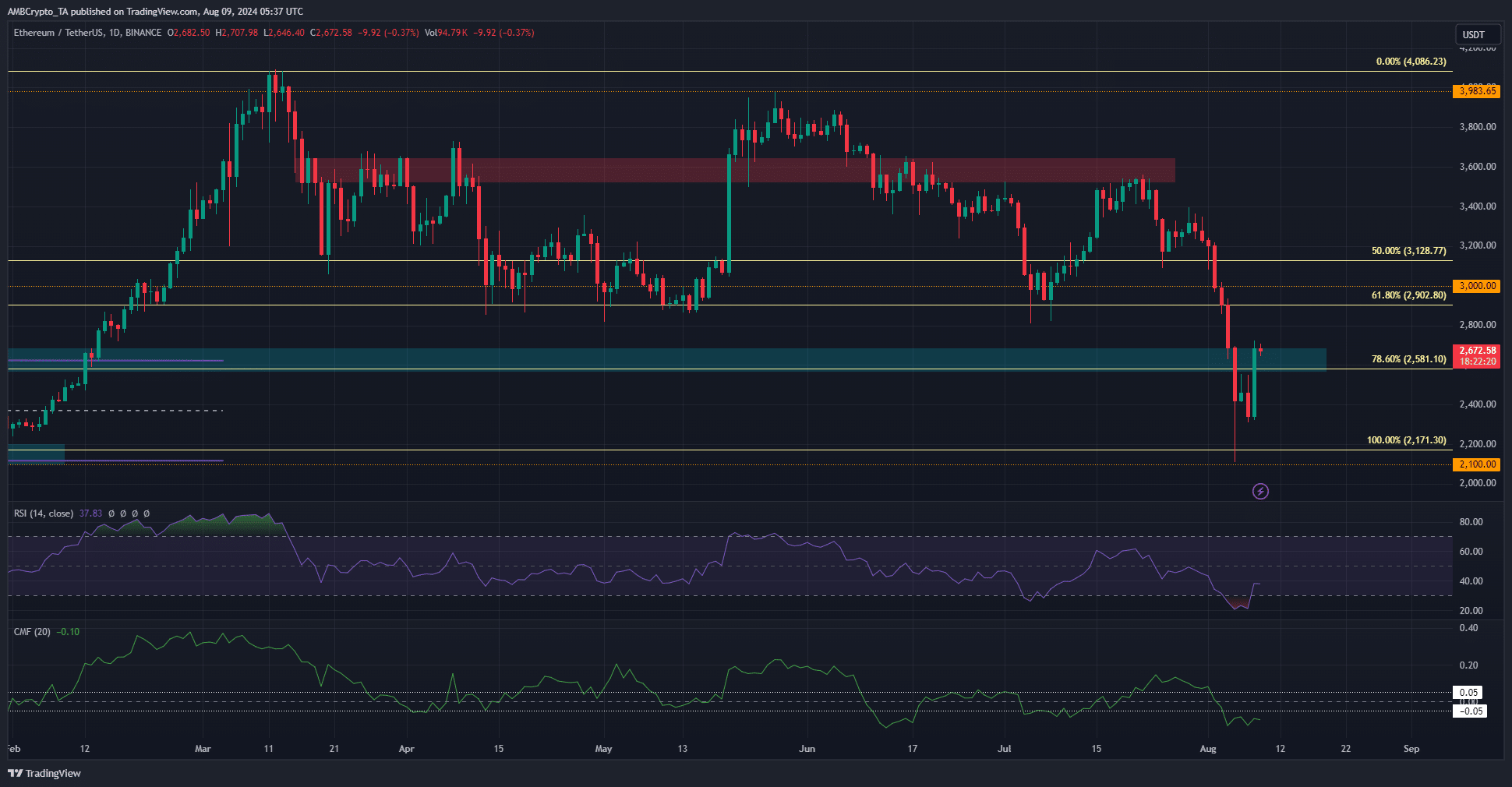

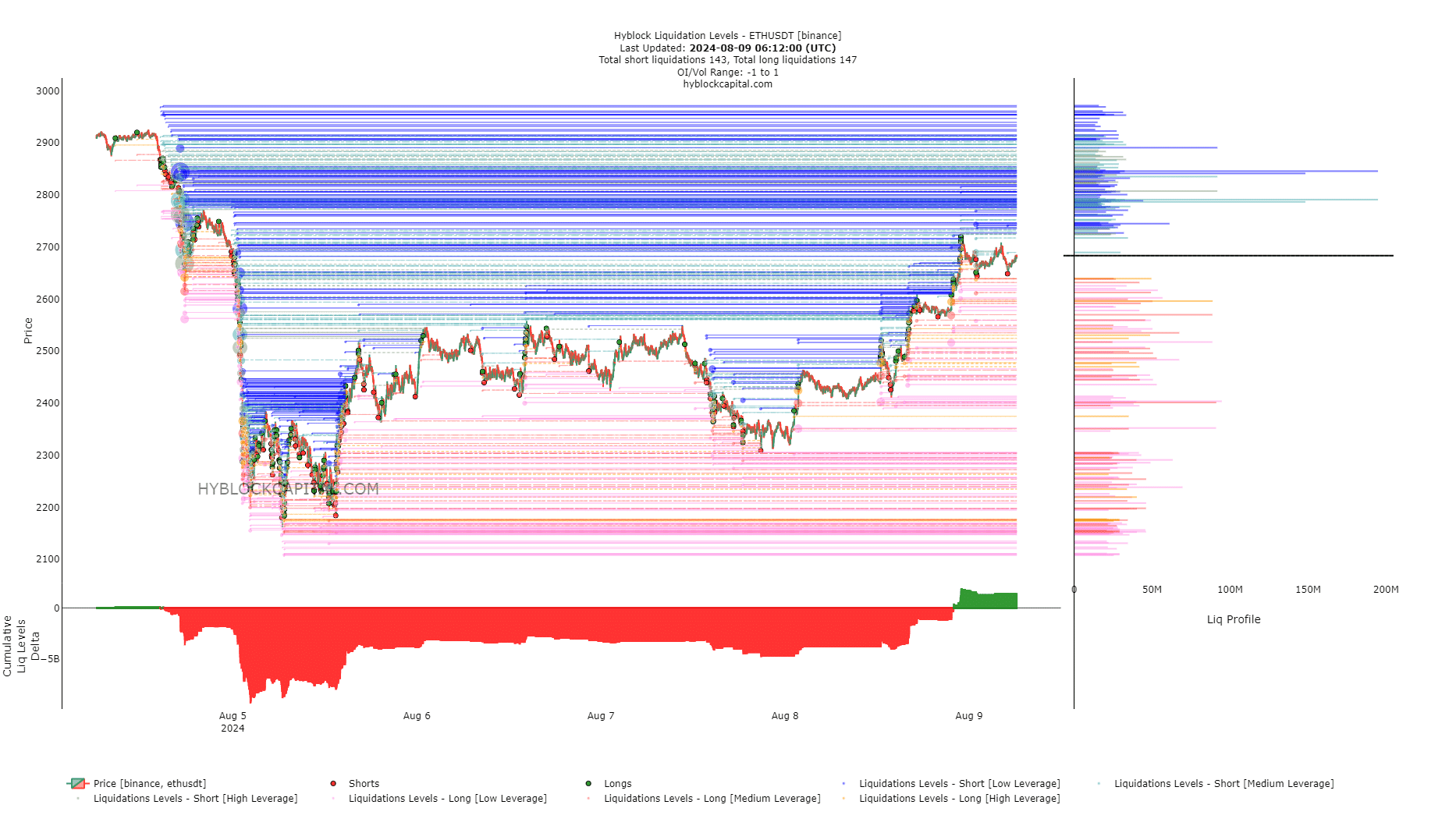

The resistance above the market seemed threatening to Ethereum buyers

Source: ETH/USDT on TradingView

The $2580-$2680 level was a resistance zone that offered resistance to the bulls in January and February this year, so it is imperative that the bulls convert this zone into a support in the coming days.

Technical indicators were not encouraging. The daily RSI was at 37, showing significant downward momentum. The CMF was at -0.1, showing a strong capital outflow from the market, which reduced the recent price gains.

The conclusion was that the price increase from the lows of $2.1k was driven by liquidity from late short sellers rather than strong demand. Therefore, there could be further movement south after this liquidity hunt.

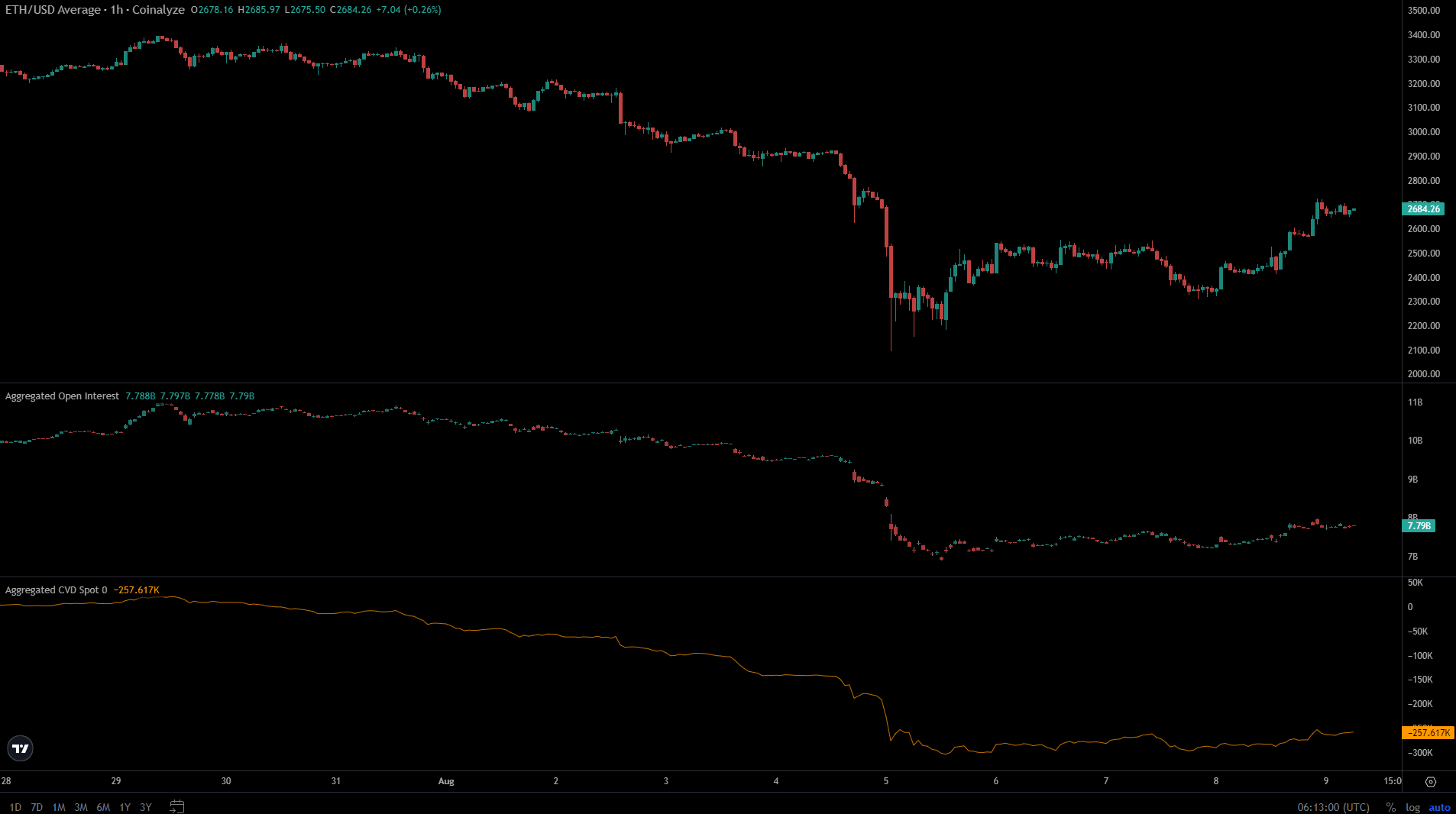

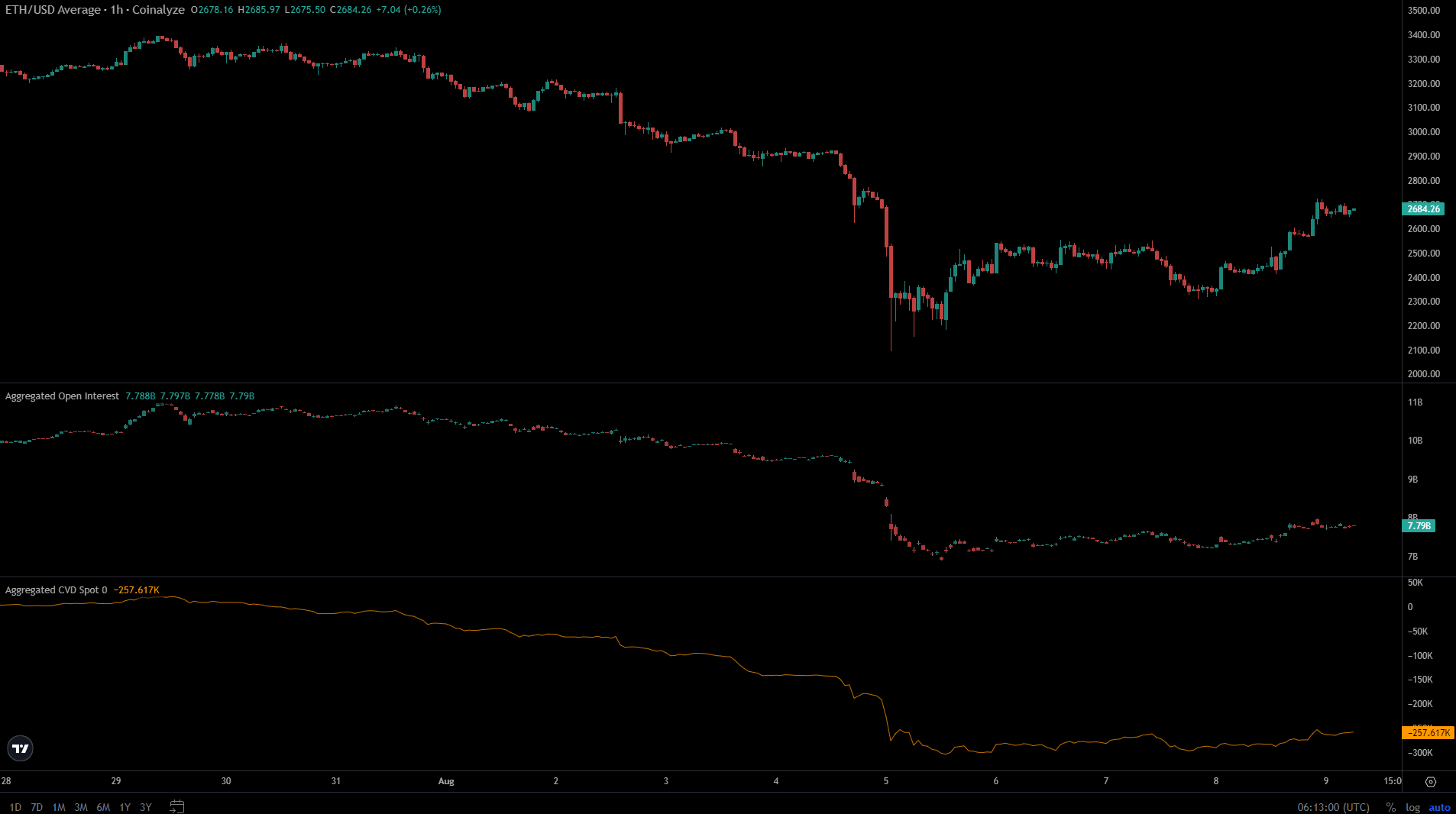

Lack of conviction on the part of speculators

Source: Coinalyze

ETH has gained 27% since Monday’s low. However, open interest rose from $7.07 billion to $7.79 billion, a small increase compared to the price gains.

This showed that the speculators lacked the necessary conviction.

Nevertheless, spot CVD showed a slow uptrend, which was good news for the bulls.

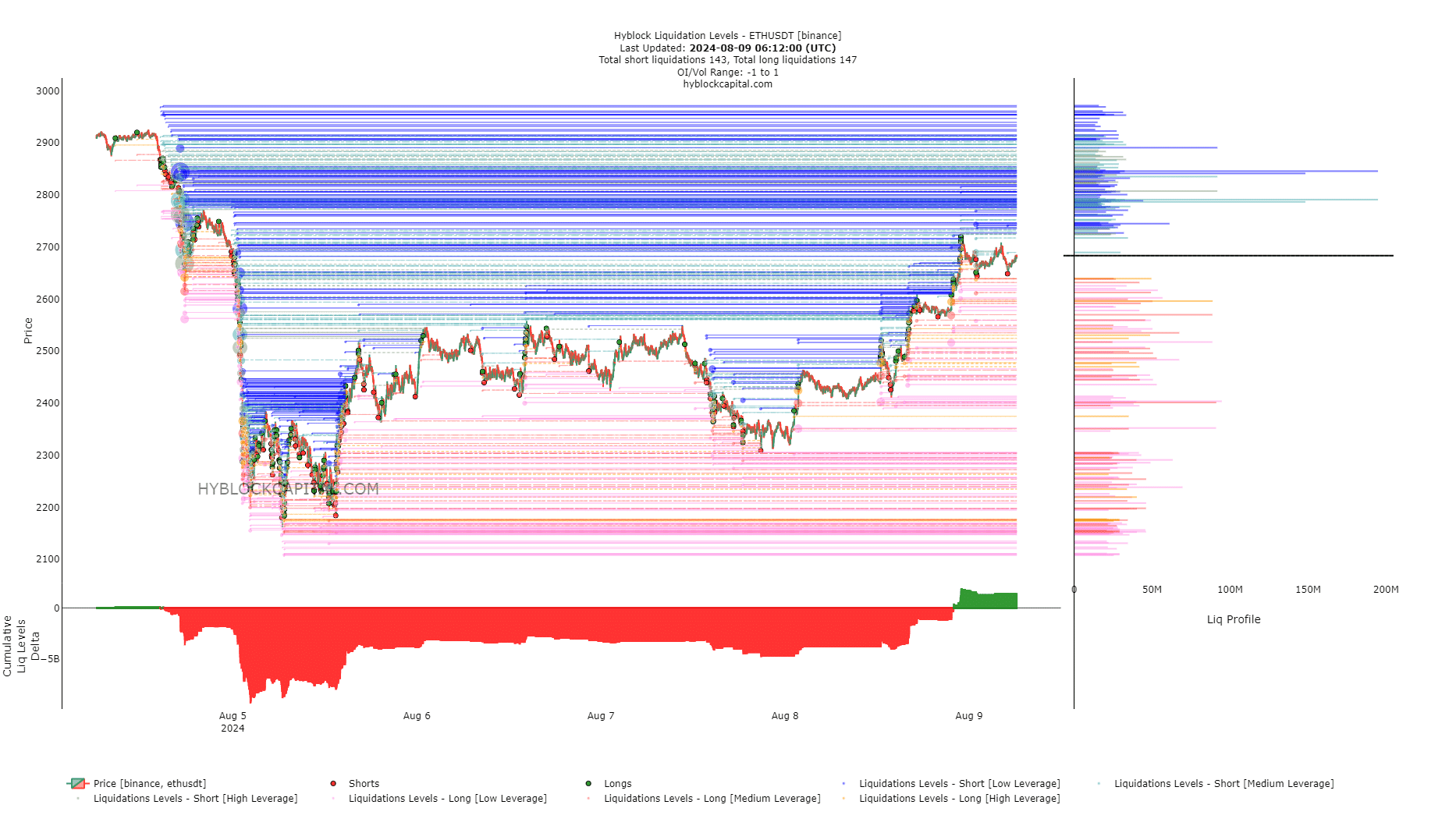

Source: Hyblock

AMBCrypto’s analysis of the liquidation level chart revealed that long positions were gaining dominance. The delta of the cumulative liquidation level was becoming increasingly positive.

Read Ethereum (ETH) price prediction 2024-25

To the north, $2,791 and $2,845 are the largest liquidation levels.

However, since the delta has not been overwhelmingly positive, further price gains are expected in the short term. Above $2845-$2900, bulls are likely to struggle and prices could head lower from there.

Disclaimer: The information provided does not constitute financial, investment, trading or other advice and reflects solely the opinion of the author.