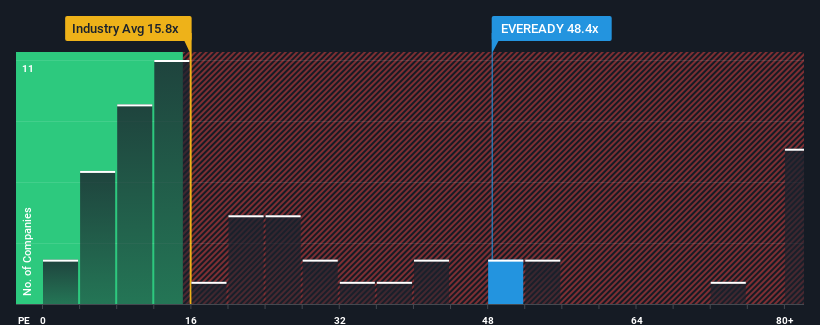

With a price-earnings ratio (P/E) of 48.4x Eveready Industries India Limited (NSE:EVEREADY) may be sending bearish signals at the moment as almost half of all companies in India have a P/E below 33x and even P/E below 19x is not uncommon. However, the P/E could be high for a reason and further research is needed to determine if it is justified.

The last few years have been quite beneficial for Eveready Industries India as earnings have grown very quickly. The P/E ratio is probably so high because investors believe this strong earnings growth will be enough to outperform the broader market in the near future. That’s something you really hope for, otherwise you’re paying quite a high price for no particular reason.

Check out our latest analysis for Eveready Industries India

Although there are no analyst estimates for Eveready Industries India, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

How is Eveready Industries India growing?

There is a fundamental assumption that a company must outperform the market for P/E ratios like Eveready Industries India’s to be considered reasonable.

Looking back, last year saw the company grow its earnings by an exceptional 133%. However, the last three-year period was not so great overall, as it produced no growth at all. Therefore, it seems to us that the company has had a mixed performance in terms of earnings growth during this period.

Compared to the market, which is forecast to grow by 26 percent over the next twelve months, the company’s momentum is weaker based on recent medium-term annualized earnings figures.

Given this information, we find it concerning that Eveready Industries India is trading at a higher P/E than the market. It appears that many investors in the company are much more optimistic than the recent history would suggest and are not willing to offload their shares at any price. There is a good chance that existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The most important things to take away

In our opinion, the price-earnings ratio is not primarily used as a valuation tool, but rather to assess current investor sentiment and future expectations.

We have found that Eveready Industries India is currently trading at a significantly higher P/E than expected, as recent growth over the past three years is below the overall market forecast. If we see weak earnings and slower-than-market growth, we suspect the share price could decline, driving the high P/E down. If recent medium-term earnings trends continue, shareholders’ investments are at significant risk and potential investors are at risk of paying an inflated premium.

And what about other risks? Every company has them, and we have 2 warning signs for Eveready Industries India (of which 1 is important!) that you should know.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Find out if Eveready Industries India could be undervalued or overvalued with our detailed analysis, Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.