Anyone can’t just come in and start damaging the integrity of our institutions. Explain it. Back it up with data and go to court and file a complaint. But using the media to create mass hysteria and mass panic is clearly a crime against the people of India. – Sushil Kedia, Founder and CEO, Kedianomics

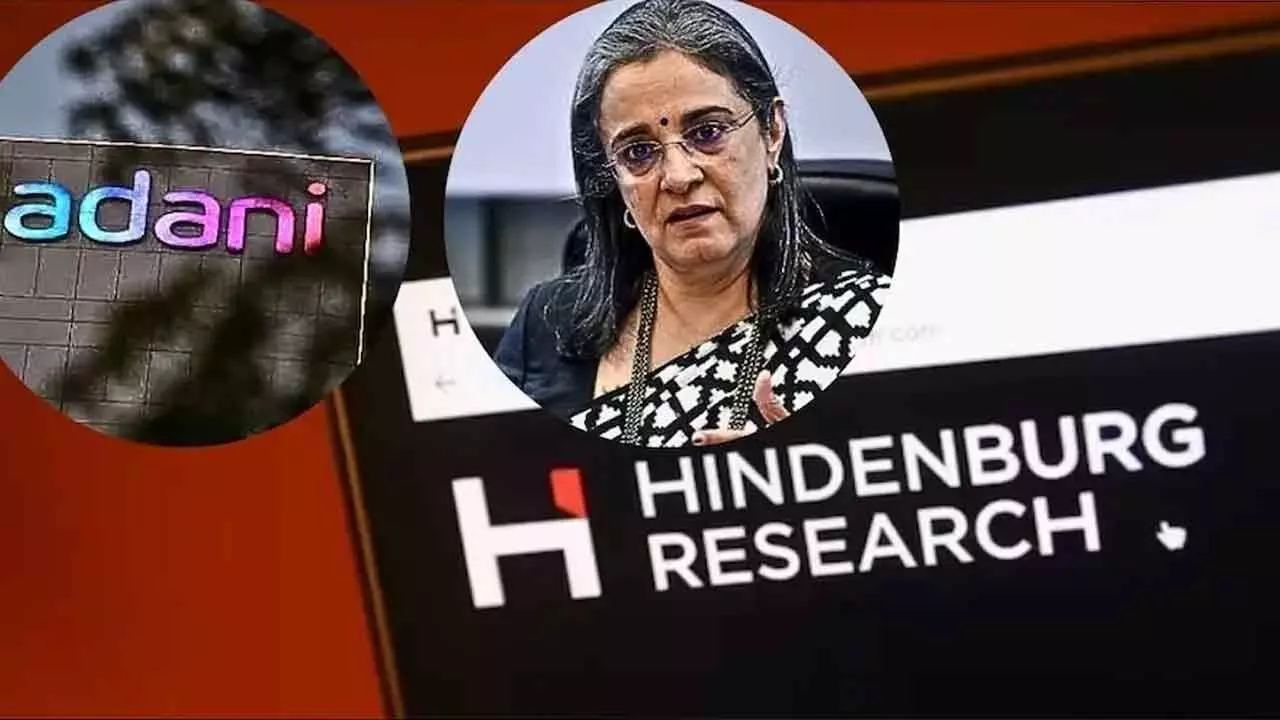

New Delhi: Market experts condemned the latest allegations in the Hindenburg case on Monday as not just a frivolous but a cheap joke, saying that even 18 months later the US short seller had nothing of substance to report.

Sushil Kedia, founder and CEO of Kedianomics, said that short-selling firm Hindenburg was already exposed 18 months ago when it made big claims about the Adani Group and the Supreme Court-monitored investigation found nothing.

Sebi has also issued a notice to the research firm for violating securities market rules. “Now, 18 months later, Hindenburg suddenly comes and claims on social media that they have something big planned for India. The aim was to destroy the Indian stock market by breaking the confidence of retail investors,” Kedia said.

The expert further said that the real intention was to “try to break the sentiment of Indian retail investors” who had invested in the capital markets with great confidence.

Kedia said that just anyone cannot come in and damage the integrity of our institutions. “Explain it. Back it up with data, go to court and file a complaint. But using the media to create mass hysteria and mass panic is clearly a crime against the Indian people,” he said. The fresh Hinderburg allegations against the Sebi chairman had no impact on Indian stock markets on Monday. According to Vikram Kasat, Head-Advisory, PL Capital at Prabhudas Lilladher, Adani shares were resilient and were not significantly affected by the recent Hindenburg allegations.