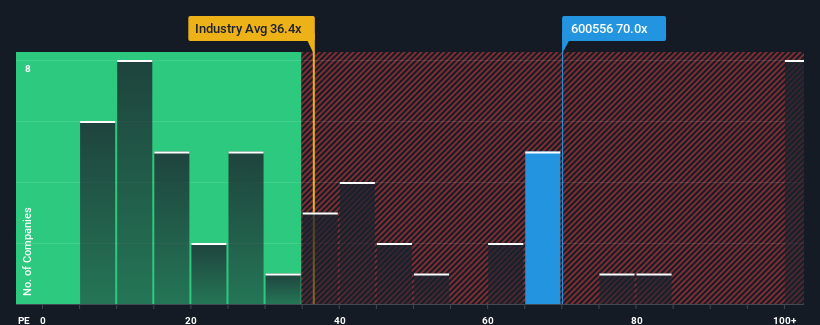

When nearly half of the companies in China have a price-to-earnings (P/E) ratio of less than 26x, you can consider Inmyshow Digital Technology (Group) Co., Ltd. (SHSE:600556) is a stock that should be avoided completely with its P/E ratio of 70. However, the P/E ratio might be quite high for a reason and further research is needed to determine if it is justified.

Inmyshow Digital Technology (Group) Co. Ltd. has not performed well recently as declining earnings compare poorly to other companies that have on average experienced some growth. Many may be expecting a significant rebound in the weak earnings performance that has prevented the P/E ratio from collapsing. If not, existing shareholders may be extremely concerned about the sustainability of the share price.

Check out our latest analysis for Inmyshow Digital Technology(Group)Co.Ltd

Would you like to know how analysts assess the future of Inmyshow Digital Technology (Group) Co. Ltd. compared to the industry? In this case, our free Report is a good starting point.

What do growth metrics tell us about the high P/E ratio?

Inmyshow Digital Technology (Group) Co. Ltd.’s P/E ratio is typical of a company that is expected to have very strong growth and, importantly, significantly outperform the market.

First, if we look back, the company’s earnings per share growth over the last year hasn’t been particularly exciting as it recorded a disappointing 19% decline. The last three years don’t look great either as the company has seen its earnings per share shrink by a total of 74%. Therefore, we’re sad to admit that the company hasn’t done a great job of growing its earnings during this time.

Looking ahead, the two analysts covering the company expect earnings to grow 53% per year over the next three years, compared to just 23% per year for the rest of the market, which is much less attractive.

With this in mind, it is understandable that Inmyshow Digital Technology (Group) Co. Ltd.’s P/E ratio is higher than most other companies. It seems that most investors expect this strong future growth and are willing to pay more for the stock.

The conclusion on the P/E ratio of Inmyshow Digital Technology (Group) Co.Ltd

It’s not a good idea to use the price-to-earnings ratio alone to decide whether to sell your stock, but it can be a useful guide to the company’s future prospects.

As we suspected, our study of analyst forecasts for Inmyshow Digital Technology (Group) Co. Ltd. found that the above-average earnings outlook contributes to the high P/E ratio. At this point, investors believe that the potential for earnings deterioration is not large enough to justify a lower P/E ratio. Under these circumstances, it is difficult to imagine the share price falling much in the near future.

Many other important risk factors can be found in the company’s balance sheet. Many of the main risks can be identified using our free Balance sheet analysis for Inmyshow Digital Technology(Group)Co.Ltd with six simple checks.

Naturally, You may also be able to find a better stock than Inmyshow Digital Technology (Group) Co. Ltd. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.