Gold prices have fallen below their highs from this morning and last week as investors consider some important new factors in their trading decisions.

background

Gold prices closed last week in positive territory as the shiny metal posted some really solid gains, closing above the key 2,500 level. Now, traders are wondering if the rally will continue or if this is a good time for them to take some profits given that geopolitical tensions have largely subsided.

New ingredients for the gold price

Well, most traders will probably take some of their profits, and it is possible that the price will go even lower, purely because the price of gold rose too far and too fast last week. The 2,500 price level is very hot for many traders, and they will not feel very comfortable buying gold above that price level under the current circumstances. This is due to a variety of factors currently in play.

First, risk appetite has risen sharply again as US equity markets enjoyed a decent rally last week, and it seems that equity traders are very comfortable with their position today as well. This confidence is due to the recent release of economic data, which reassured investors that the market is not in a steep downturn, contrary to what many believed after the release of US non-farm payrolls data.

Second, many investors have already considered the possibility of an even deeper rate cut from the Fed. Previously, most market participants expected the Fed to cut rates by 25 basis points, and now the base case for many is 50 basis points. So unless the Fed Chair hints that this is a possibility during this week when he is in the spotlight, it is possible that we will indeed see further sell-offs in the price of gold.

Third, negotiations over Gaza are still in full swing and it seems that Iran will not retaliate due to Israel’s ally’s strong presence in the region. Traders have been paying close attention to headlines and these appear to have toned down, suggesting that any action by Iran could be minimal. However, it is important to remember that in the realm of geopolitics, one should never dismiss anything completely, as any action can be beneficial and situations can change quickly.

What will happen next with the price of gold?

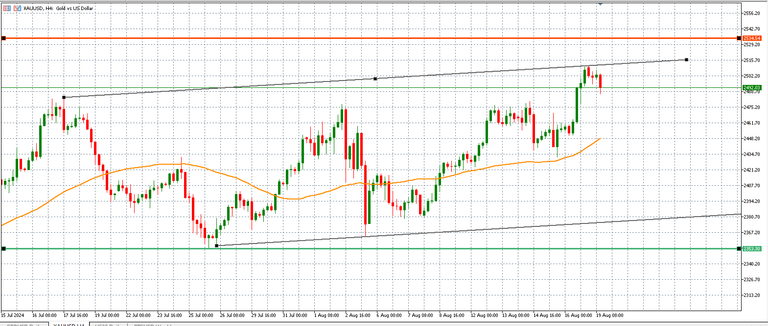

From a technical price perspective, the price is trading very close to the upper line of the up-channel, which means that a correction is very likely. This is what we are witnessing now. However, the bulls will not be worried as the price of the shiny metal is trading above the 50-day SMA on the daily time frame, which confirms that investors are in the driver’s seat and the trend is likely to continue as long as the price continues to trade above this SMA. The chart shows the immediate resistance and support levels through the red and green horizontal lines respectively.

Gold trading chart by CompareBroker

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided, however neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is for informational purposes only. It is not a solicitation for the exchange of commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article assume no responsibility for any loss and/or damage arising from the use of this publication.