Key findings

-

Closing a Capital One credit card account can be done online, by phone, or by mail.

-

Before closing your credit card account, you should pay off the outstanding card balance and use up any rewards remaining in the account.

-

You should consider other options besides cancelling, such as upgrading or downgrading your card or simply blocking it and storing it in a safe place.

Capital One offers a wide range of rewards credit cards for every type of user. Whether you need a travel card, a business card, or even a secured card, there is probably a suitable Capital One credit card option for you.

While there are a variety of Capital One cards to choose from and apply for, what happens when your needs change? Over time, the original credit card account you opened may no longer be a good fit for you. For example, you may start a new career that requires a lot of travel, and you may decide it’s time to cancel your current rewards card and opt for a travel credit card instead.

Closing an account may seem risky or problematic because it could affect your credit score, but generally it depends on your specific credit factors and the account. Being as informed as possible will help you make the right decision. If you think closing your account is the right move, follow these steps:

How to close a Capital One credit card account

Before you take the necessary steps to close your Capital One account, you should first pay off any outstanding balances. This will prevent Capital One from increasing your interest rate or even requiring immediate payment of the balance. You can still close the credit card, but you will still be responsible for all subsequent monthly payments. Once your account is paid off or you have a plan to pay it off, you can close the account either online, by phone, or by mail.

Money tip: You can’t use any credit card rewards currently in your account, so make sure you use them before closing your account. Depending on your card, you can consolidate them with another credit card account or transfer them to a travel partner’s loyalty program. Or you can simply redeem them for account credits or gift cards – either way, don’t let them go to waste.

Close account online

Capital One members can close their accounts online through the website, but not through the Capital One app. You can try closing your account through the app by asking Capital One’s built-in chatbot assistant, Eno, to close your account, but Eno will simply redirect you to a URL in the web browser. To close your account online, you must:

- Sign in to your account. You can do this on a standard computer or through your phone’s browser.

- On your dashboard, click on the card account you want to close. If you have multiple Capital One accounts, you may need to scroll through the dashboard until you find your card.

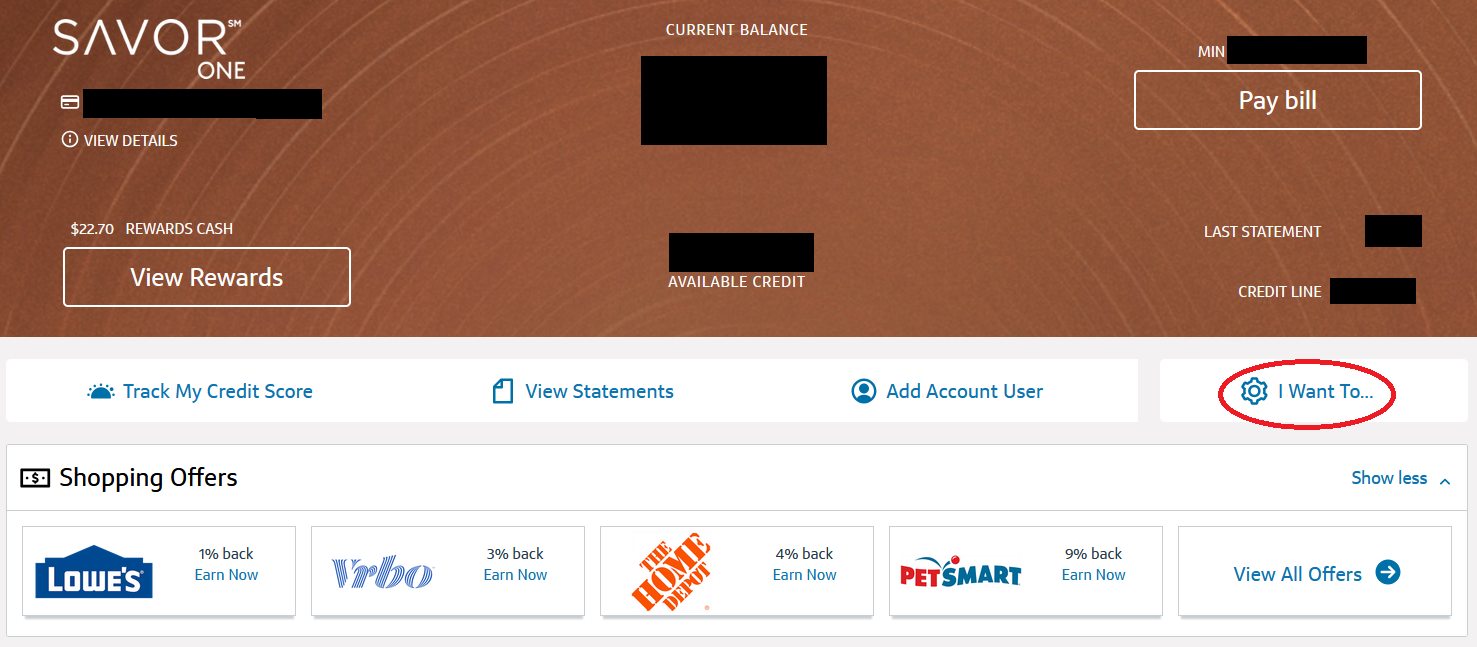

- Click on the “I want to…” link next to the small gear icon. This will open the Account Services menu.

EXPAND

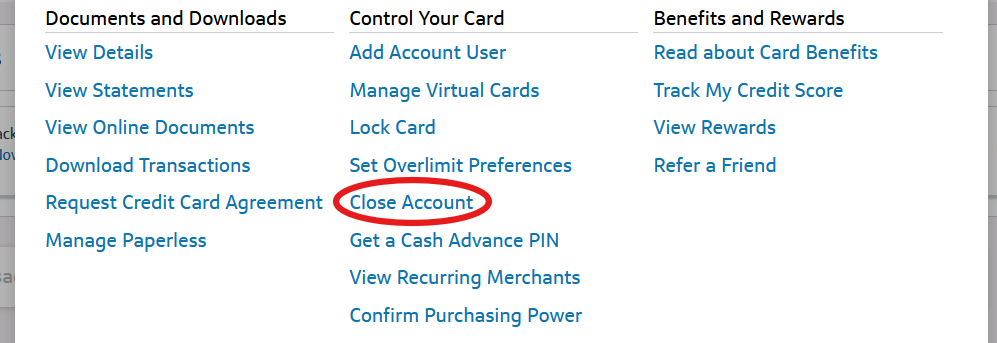

- Select “Close Account”. You will find this option in the “Control your card” section.

EXPAND

- Follow the instructions until the account is closed. These prompts usually include a survey asking you why you want to cancel, as well as information from CreditWise about what closing your card will mean for your credit score.

- Check your email inbox for confirmation of the action. Processing may take several days.

Close the account by phone

If you prefer to cancel over the phone, that’s possible too. A representative on the phone can walk you through the process – but be prepared. They’ll probably try to keep you as a customer, too. Here are the steps you should follow:

- Call 1-800-227-4825. This will take you to credit card customer service. Alternatively, you can call the number on the back of your card if it is different from the one shown here.

- Have ready any information you may need to provide to the Capital One representative. You may need your account number, the full number of the credit card you want to cancel, and the last four digits of your Social Security number.

- Let a staff member guide you through the account closure process. Here, a representative may also offer you certain incentives or perks to keep your account open.

- Make sure you receive an email confirmation that your account has been closed. Processing may take some time.

Close account by email

You can also complete this process by mail. All you need to do is write a letter to Capital One stating that you want to close your account. Include your full credit card number, account number, and your signature. This letter should include a date by which the account is expected to be closed. You can send the letter to the following address:

Attn: General Correspondence

Capital One

PO Box 30285

Salt Lake City, Utah 84130-0287

What to do after closing your Capital One credit card account?

After you close your account, there are a few things you should be prepared for. First, you will still be responsible for the outstanding balance on the card, including any previous charges that have not yet posted to the account. So you will still need to make all of your minimum monthly payments until the balance reaches zero.

In addition, you must cancel any automatic payments or previously authorized recurring charges on that card. Continue to check the account and your statements to make sure you don’t miss any required payments.

Alternatives to closing a Capital One credit card account

You have your reasons for wanting to close a Capital One account, but that may not be the only solution. Depending on what your needs are, there may be another helpful option besides canceling the credit card, such as the following:

Request product change

Many credit card providers offer their customers the option to switch cards without closing the account. Capital One offers a wide range of cards, so a different card may be a better fit for your needs than your current one. Switching products allows you to upgrade or downgrade to a similar card. For example, if you have a Capital One cash-back credit card that charges an annual fee, you can probably downgrade to a version of the card with no annual fee. Contact Capital One to discuss which cards might be right for you.

Block your card

Capital One offers its members the option to “lock” their cards so they can’t be used until they’re “unlocked.” So if you have a credit card with no annual fee, you can pay off the balance, lock the card, and stash it in a drawer for now. If the card will have a positive impact on your credit score by increasing your credit history and lowering your credit utilization ratio, this may be a good option. If you choose to lock your card, you’ll also be notified of any unauthorized account activity.

The conclusion

If you’re thinking about closing a Capital One account, consider what motivates you to do so. Another option, such as changing products, closing the card, or taking advantage of incentives to keep the account, might be a better option.

If you decide to cancel your Capital One account, make sure you follow all the necessary steps and are fully informed. Also, remember that you won’t get a partial refund of the card’s annual fee just because it wasn’t used all year.

After you close the account, you should take a look at the best credit cards currently available to find an option that better suits your needs.

Frequently Asked Questions (FAQs) about closing a Capital One account

-

Yes, you can cancel a Capital One account online, but not through the mobile app. If you try, you’ll simply be redirected to an online login page.

-

Closing a credit card account will affect your credit score, but the magnitude of that impact depends on several factors. For example, your credit utilization ratio, or the amount of credit you use compared to your total credit limit, could increase dramatically if the majority of your unused credit comes from that card. If you had two Capital One cards, each with a $10,000 credit limit, and decided to close one of them, you would lose 50 percent of your total available credit limit. This would cause your credit score to drop.

Closing an account can also cause your credit score to drop temporarily, regardless of the long-term impact, so don’t panic if you weren’t expecting any changes and then see a sudden drop. However, you should also make sure you don’t plan on applying for new credit right away. You should wait until your credit score recovers before applying for a new product.

Be sure to look at your entire credit report to determine the likelihood of a drop in your score.

-

In most cases, you cannot reopen a closed Capital One account. Once an account is closed, it is a final step. It is very rare that Capital One will agree to reopen a closed account.

-

Once you close your account, you will generally no longer be able to use the rewards you have accumulated on it, so please use up any remaining rewards or points beforehand.